Non-mortgage debts are essentially cancerous cells in your financial plan. You want to get rid of them as quickly as possible and have a plan that hopefully they will never return.

Cancer? Really?

The old adage, “if you’re not growing, you’re dying” could not be more true here. Eliminating the debt frees up your cash flow to invest in things with growth potential, which ultimately provides more freedom and options to purchase more of the things you want in the end, you might just have to be a little patient.

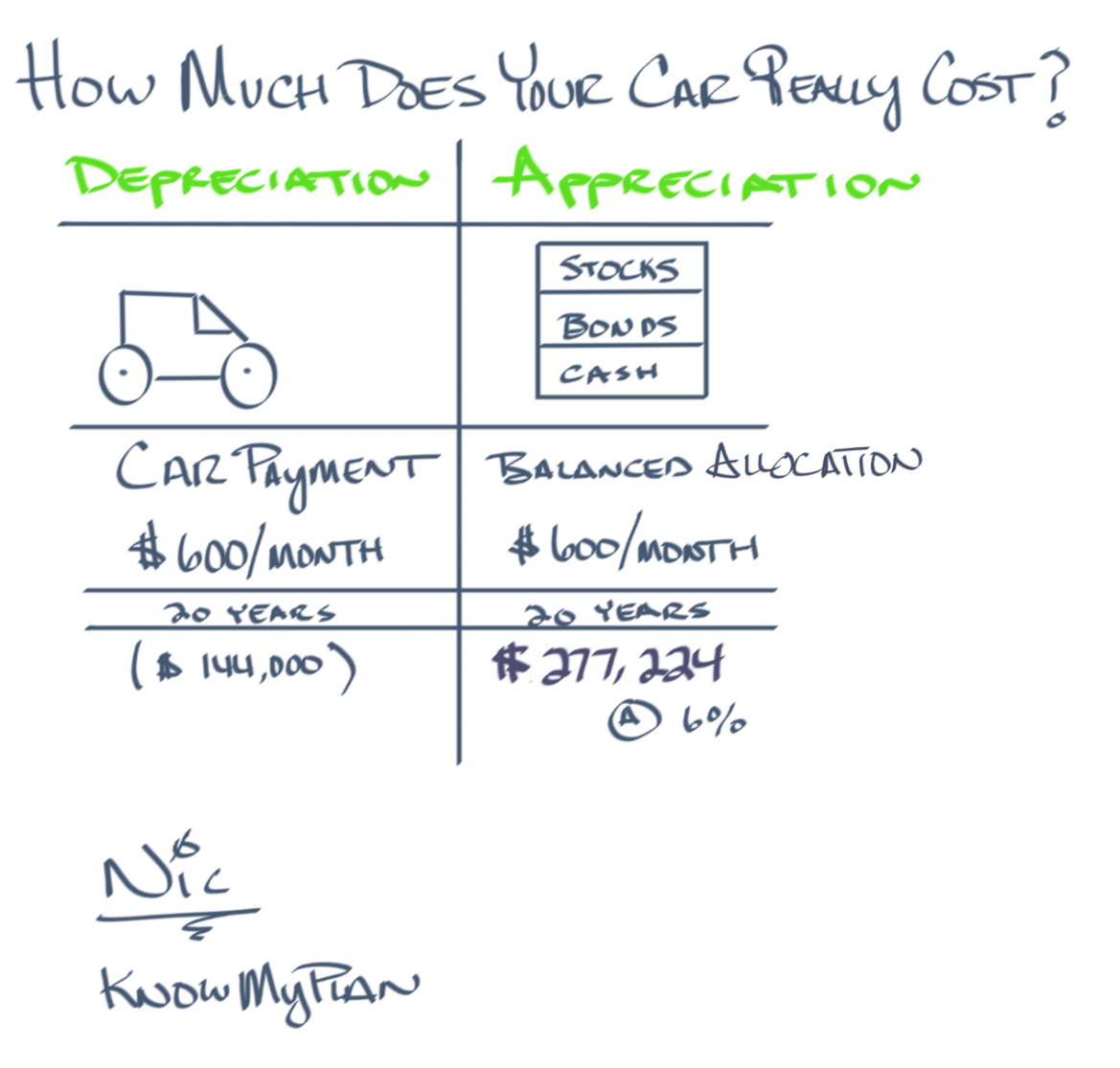

Consider the individual that is constantly on the hamster wheel of having a car payment of $600. They pay the car off just in time to purchase a brand-new vehicle and start the process all over.

Opportunity cost is no joke

Consider the opportunity cost of having a car payment versus investing.

Over a 20-year period, you will pay $144,000 in car payments. Invest those same funds and average a 6% rate of return, you would instead have $277,224. That is over a $400,000 difference! Obviously this is a conservative scenario. For instance, imagine getting a 7%, 8%, 9%+ return and how much more dramatic the numbers become. What if this someone starts the new car hamster wheel at 20 and goes to age 60? You just doubled the scenario.

In conclusion, cars can be the #1 factor for the average person becoming wealthy or just getting by. If you have a car note, get it paid off ASAP. Build a plan to never have a car payment again!