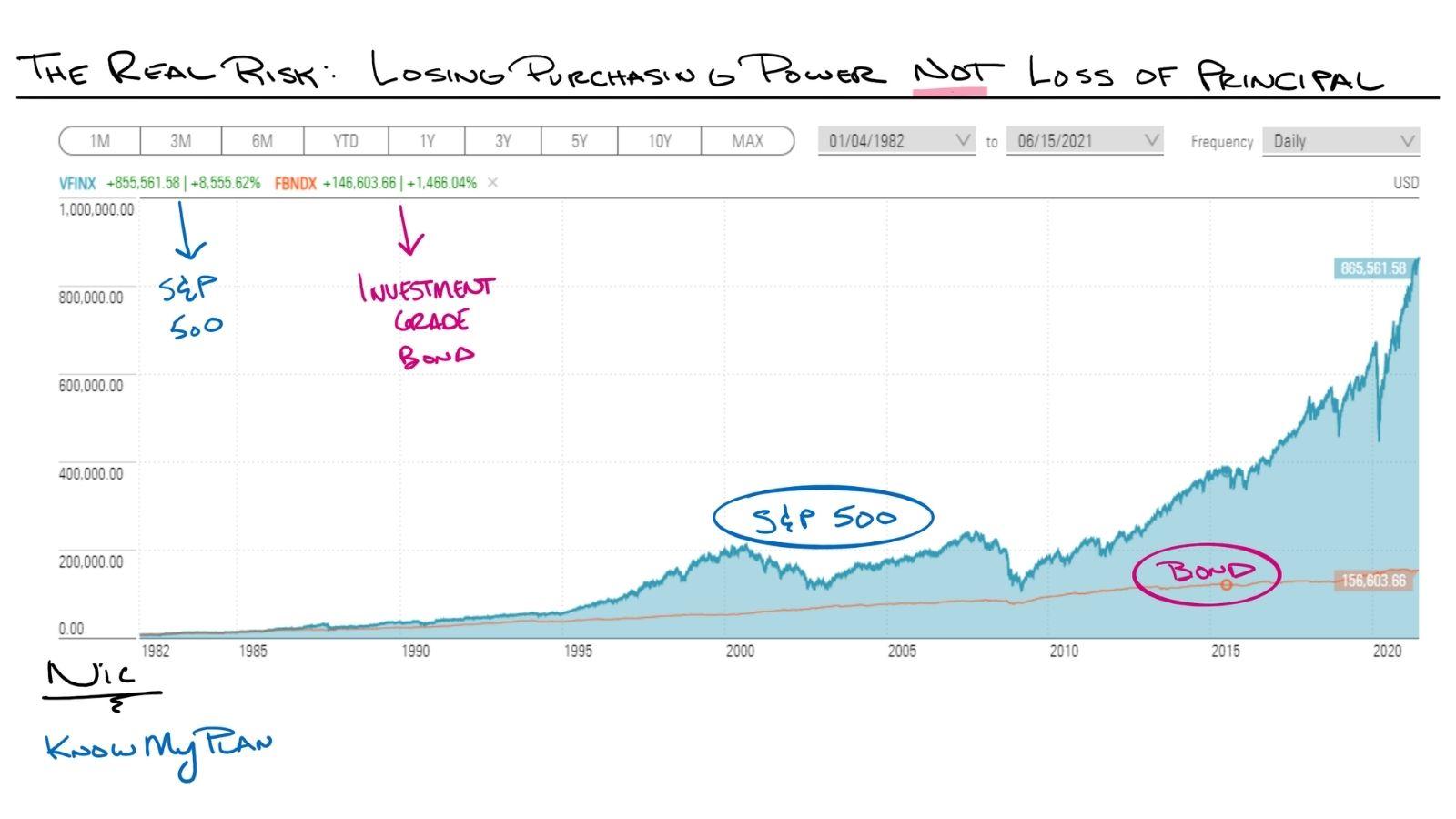

See that choppy blue line that has some big drops? That is the S&P 500 index. Since 1982, it has had only had 6 negative years as well, but 4 years had a 9% annual drop or more (2000, 2001, 2002, 2008).

Both funds started with $10,000 on the same day in 1982.

Both funds had 6 negative years.

The stock fund had 4 years worse than the worst year in the bond fund.

The difference: the stock fund has a current value of $708,957 more than the bond fund.

Let’s say that you want to take a 4% distribution from your portfolio, the stock fund would provide $28,358 more per year.

People do get confused about this. The greatest risk that we will face is not the loss of principal, but the loss of our purchasing power.

Owning the best companies in America & the world with a proven ability to innovate during challenging times gives us a chance to pursue financial independence.