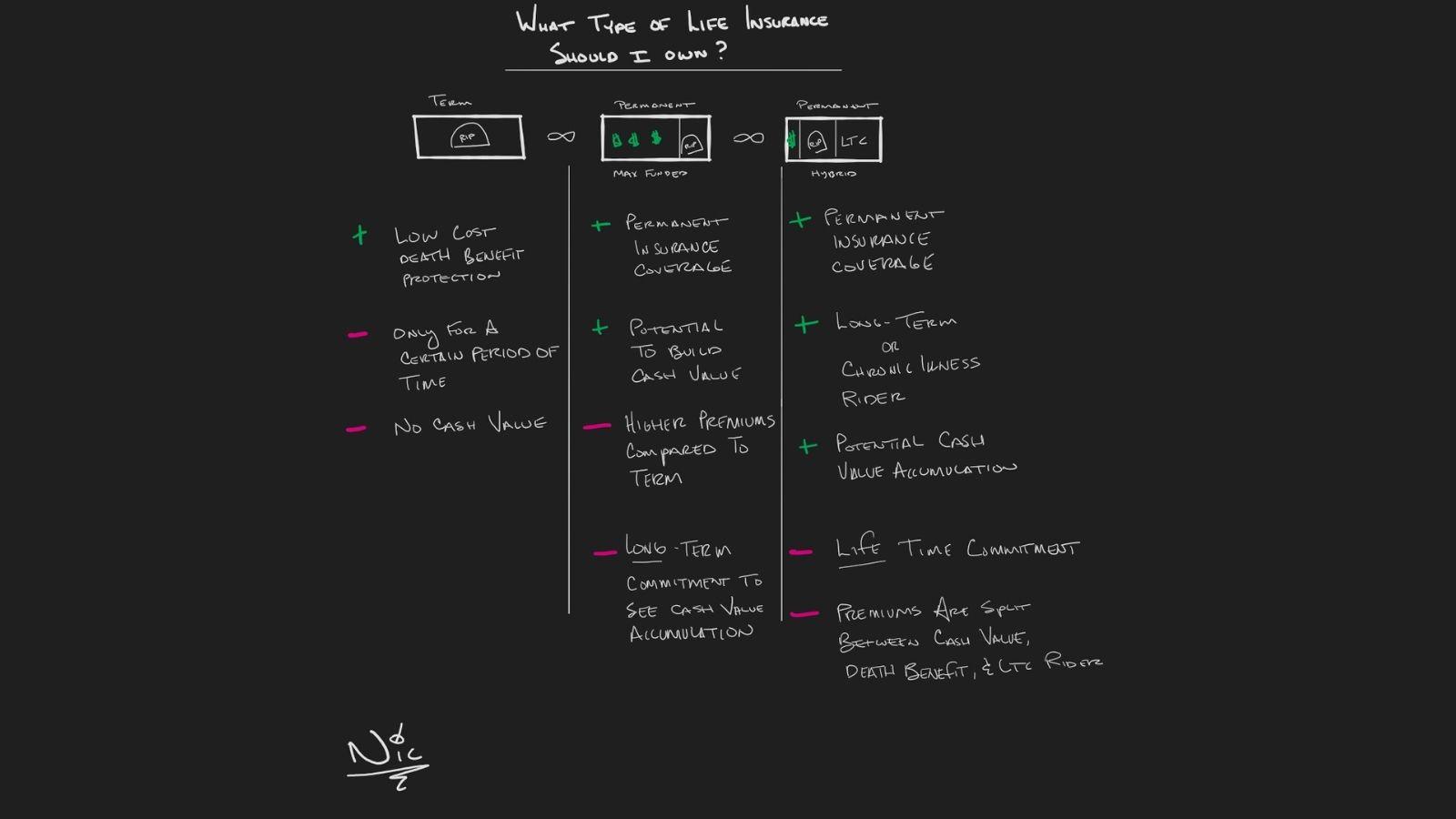

There are a million permutations of life insurance policies. I wanted to highlight 3 that busy executives tend to utilize or ask about.

Term Insurance

A wonderful way to provide death benefit protection for a lower cost. All of your premium payments are going towards the cost of insurance and not building cash value.

Max Funded Permanent Insurance

This could be whole life, universal life, indexed universal life, or variable universal life. The type of policy that you choose ultimately will determine how your cash value will grow. The goal of this type of policy is build cash value. This is a long-term commitment (probably 10-15 years) before you would expect to withdrawal cash. The goal would be to take withdrawals from the policy without creating a taxable event.

Permanent Hybrid Insurance

The goal of this policy could be singular (provide long-term coverage) or a combination of death benefit protection, access to cash value, and long-term care/chronic illness.

With all these policies, the devil is in the details. All of these policies have pro’s and cons. It is important to know what you own and why you own it. Nothing is more important than policy design with life insurance.

ADDITIONAL INFORMATION

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.