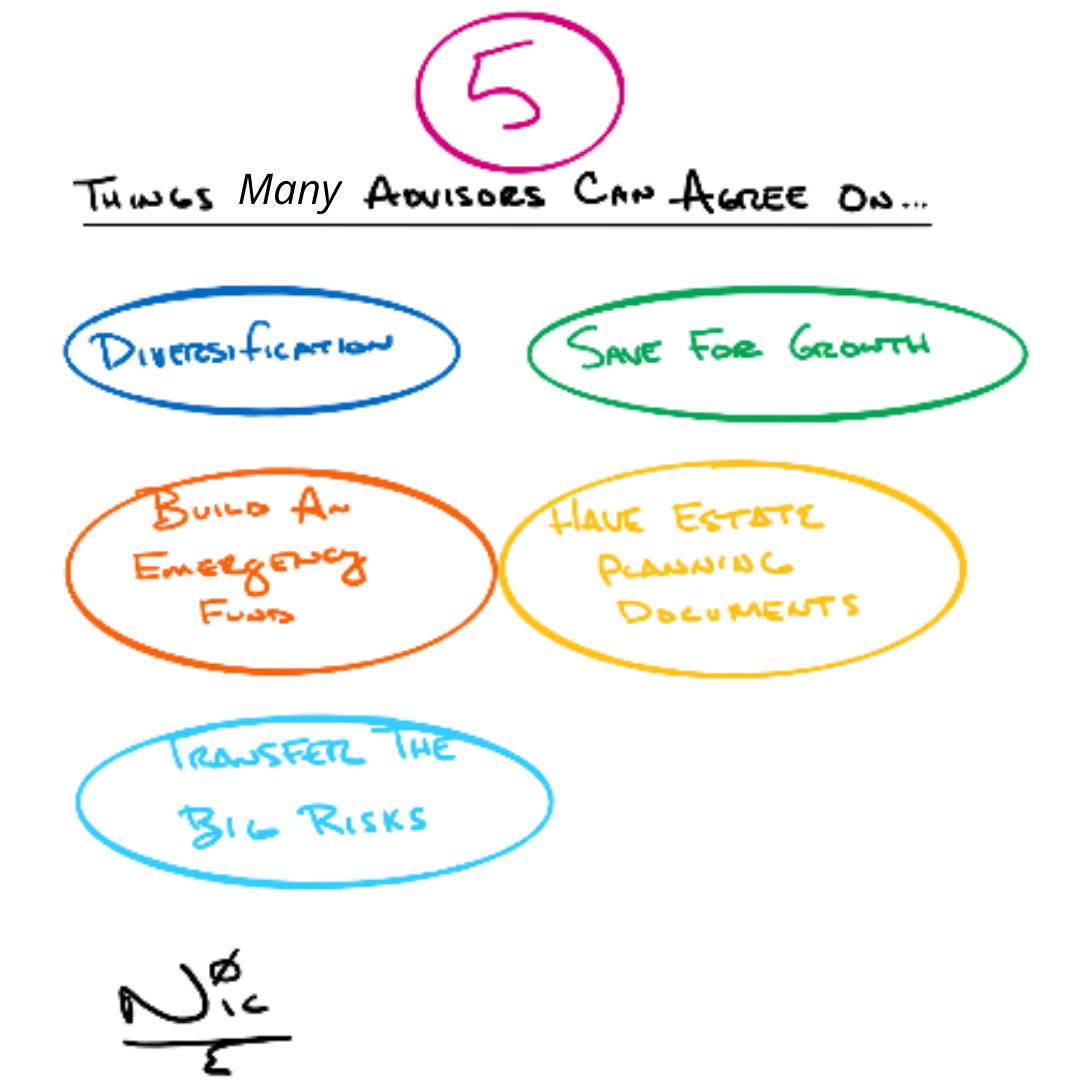

???? Diversification is a good thing. Sage advice has always been not to put all of your eggs in the same basket.

???? Build an emergency fund. Whether it be 3, 6, or 12 months, you have to have access to money. We all know that life happens generally when we least expect it.

???? Have your estate planning documents in order. Will, Durable Power of Attorney, & Medical Directives are a must.

???? Transfer the “BIG” risks. What happens if <insert disastrous scenario>? Life insurance, disability insurance, and long-term care are by and large fantastic risks to transfer to an insurance company and leverage your resources.

???? Save for “Growth.” Many advisors can agree to save in something that can potentially grow at a rate that exceeds inflation.

⏰NIC NOTE: One of my all-time favorite books, “The Richest Man in Babylon” recommends setting aside at least the first 10% of all-earnings for your future.

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision. No strategy assures success or protects against loss. Investing involves risk including loss of principal.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.