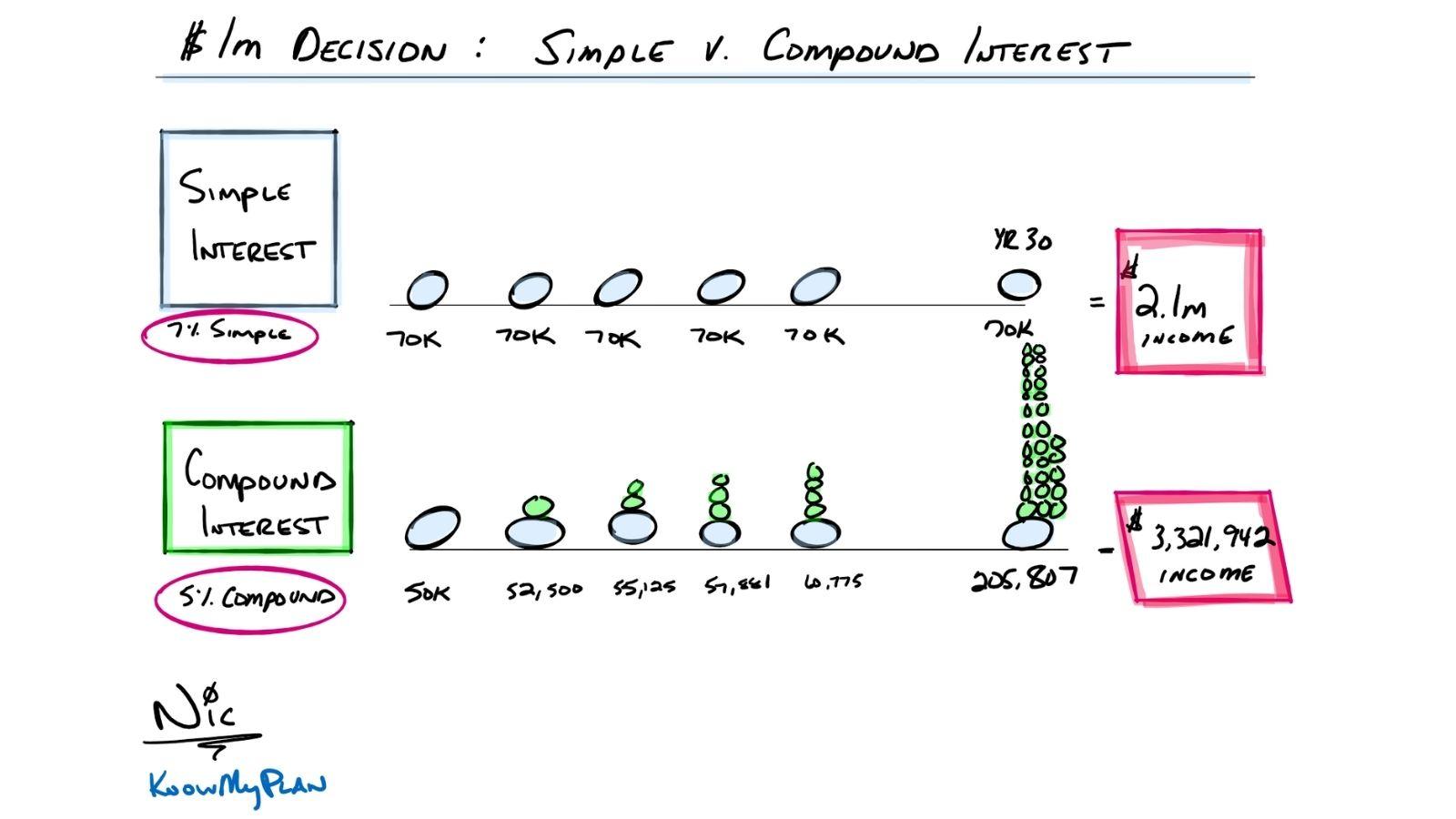

Consider you have $1M and you were given 2 choices:

- 7% simple interest for the next 30 years or

- 5% compound interest for the next 30 years

The beauty of compound interest is that your interest begins to earn interest. Over a 30-year period, the compound interest option would provide over $1.2 million dollars of income.

Let’s apply this to our portfolios…

Most bonds (but not all) pay a fixed rate of interest (simple interest). Stocks have the potential to raise dividends and you can reinvest those dividends (compound interest). With all mutual funds and exchange-traded funds you also have the option to reinvest your dividends and interest as opposed to simply putting the income in your pocket.

Think about ways to increase both cash flow throughout your lifetime!

IMPORTANT INFORMATION

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing.

Dividend payments are not guaranteed and may be reduced or eliminated at any time by the company. Bonds are subject to market and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price. Mutual fund and exchange-traded funds investing include risks, including fluctuating prices and loss of principal.

LPL Tracking #1-05157148