I think most people would agree that being diversified is a good thing.

Maybe it was a grandparent that told us not to put all our eggs in one basket. Diversification does not necessarily mean having a lot of mutual funds or ETF’s.

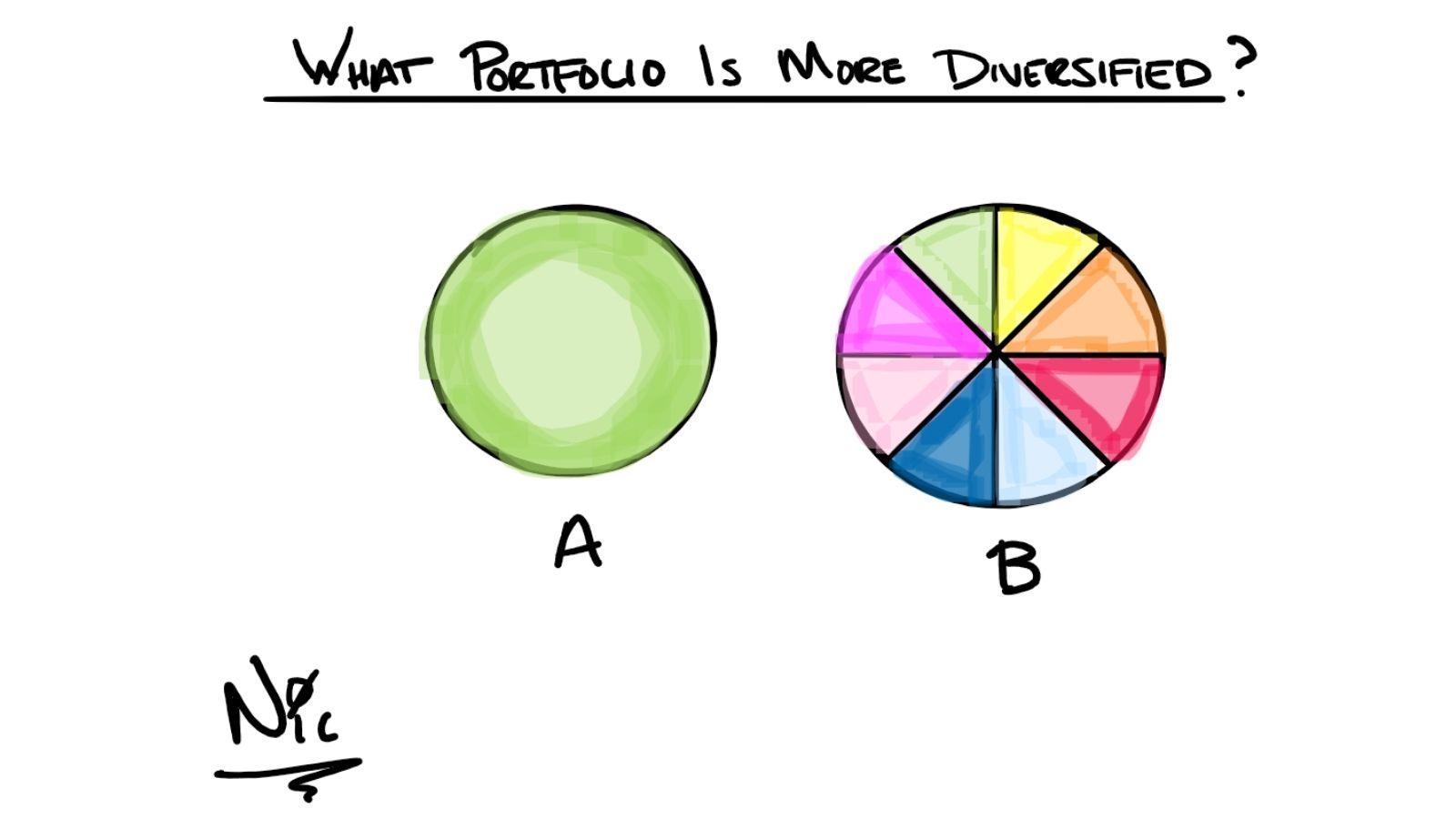

Portfolio A could be a single stock (not diversified) or it could be a Total Stock Market Index fund that owns 1000s of underlying companies (diversified).

Portfolio B could be 8 individual tech stocks (not diversified) or it could be Index Funds of 8 different asset classes (diversified).

The real goal of diversification is to own stuff that zigs when others zag. Not all U.S. stocks react the same. A high growth tech stock is going to react quite differently than a slow dividend growth stock that is a consumer staple.

Stay diversified. Stay invested.

IMPORTANT DISCLOSURES

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

LPL Tracking #1-05132399