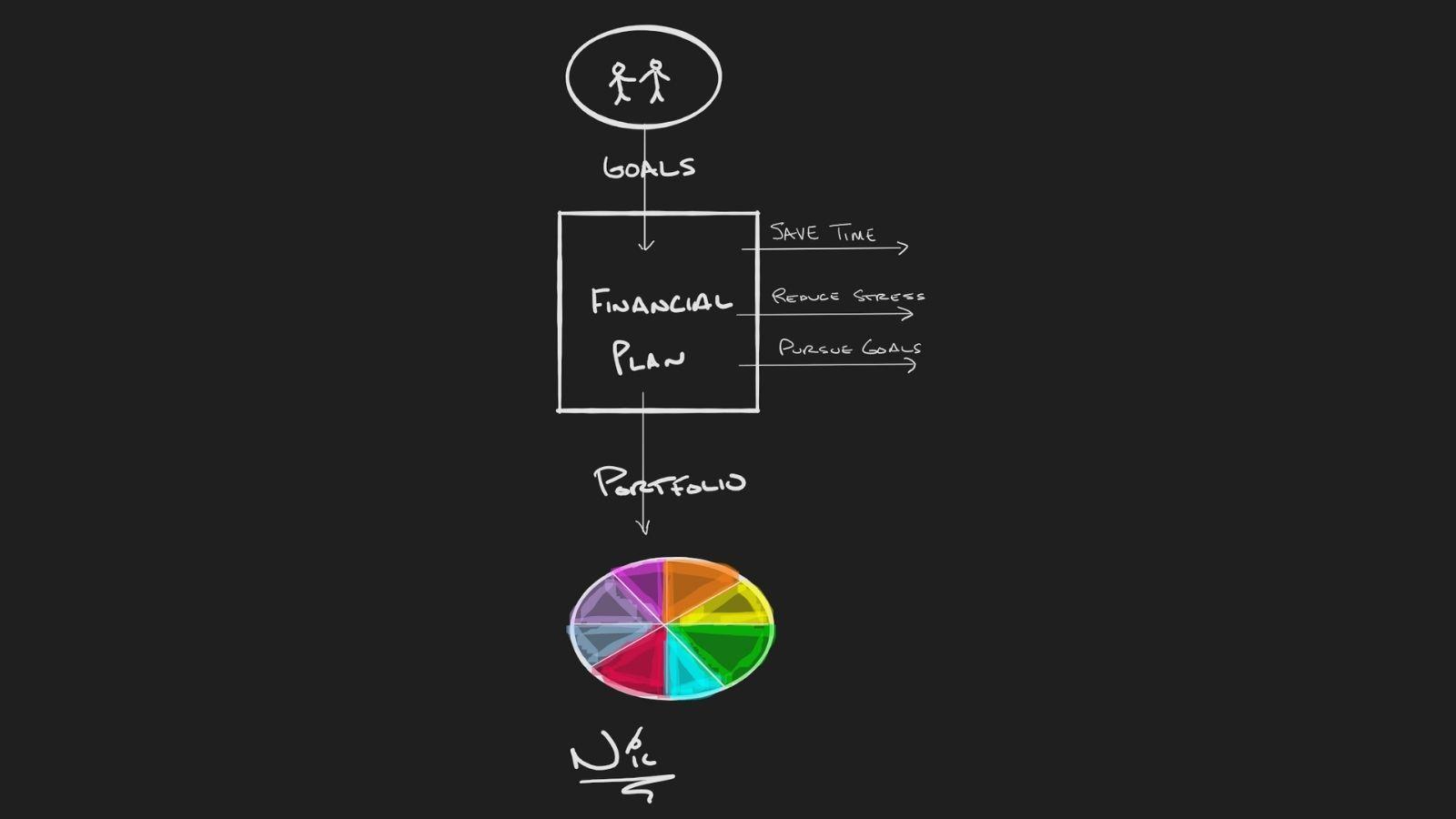

Having a financial plan might sound nebulous, like what does that even mean? It may sound like a luxury or, worse, a waste of time and money.

So, what is a one-page plan?

A typical financial plan can be pushing 100 pages or more. Often clients will pay $2,500 or more for these plans. Shortly after receiving them, they often get shoved in a drawer or filed away and are never seen again.

We are entirely against doing business like that. Are one-page plan is just that, a snapshot of your current financial picture and goals with just a few actionable next steps. We find that is much more manageable and actionable for our clients.

We feel so strongly that we center everything in our client experience around our one-page plan.

The three main reasons people enjoy having a financial plan

- Saves Time

- Reduces Stress

- Pursue Goals

A one-page plan saves time.

You get home from work after a long day at the office. You race through the Chick-fil-a drive-thru on your way to pick up dinner on the way to your kid’s baseball/basketball/soccer practice. Practice ends and you get home, get the kids in bed, and have an hour or more to yourself. Now to start Googling “DIY financial planning.” Sounds fun, right?

With hundreds of clients and decades of experience, we’ve seen it all. For instance, you can build a deck on your own, or you could save time and have better confidence by hiring a pro.

A one-page plan reduces stress.

We all have plenty to stress us out. For example, financial stress is a leading cause of divorce, and that shouldn’t come as a surprise, unfortunately. However, having a one-page plan, giving you tangible action steps, is one way to know you are making more optimal decisions around your finances, to control what you can control. Taking action reduces stress, and building your emergency buffer, and confidently pursuing your goals can go a long way to dial back the pressure in one area of your life.

A one-page plan helps you pursue goals.

We all have goals. Sometimes, however, they get swept aside in the hustle and bustle of everyday living. Having a neutral third party (that’s us) can help facilitate an environment to get everyone on the same page and provide a level of clarity you likely have never experienced. We say all the time that money is a tool. Racking up a significant balance in an IRA sounds great but is hollow without a goal to pin it on. Goals give your money meaning, thus creating satisfaction that can be difficult to quantify, let alone put a price on.

There is an upfront cost via time commitment to put the plan together. However, now you have a living document that answers time-consuming questions like:

- “What do we do with our bonus?”

- “What happens when my RSU’s or ISO’s vest?

- “How much should we be saving every month?”

We are wrestling with these questions on your behalf, saving you time, and reducing your stress. That is to say, you have a plan in place to help you pursue the goals that matter to you.

If you are ready to take the next step, click here to schedule a complimentary intro call to get your one-page plan.

ADDITIONAL INFORMATION

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.