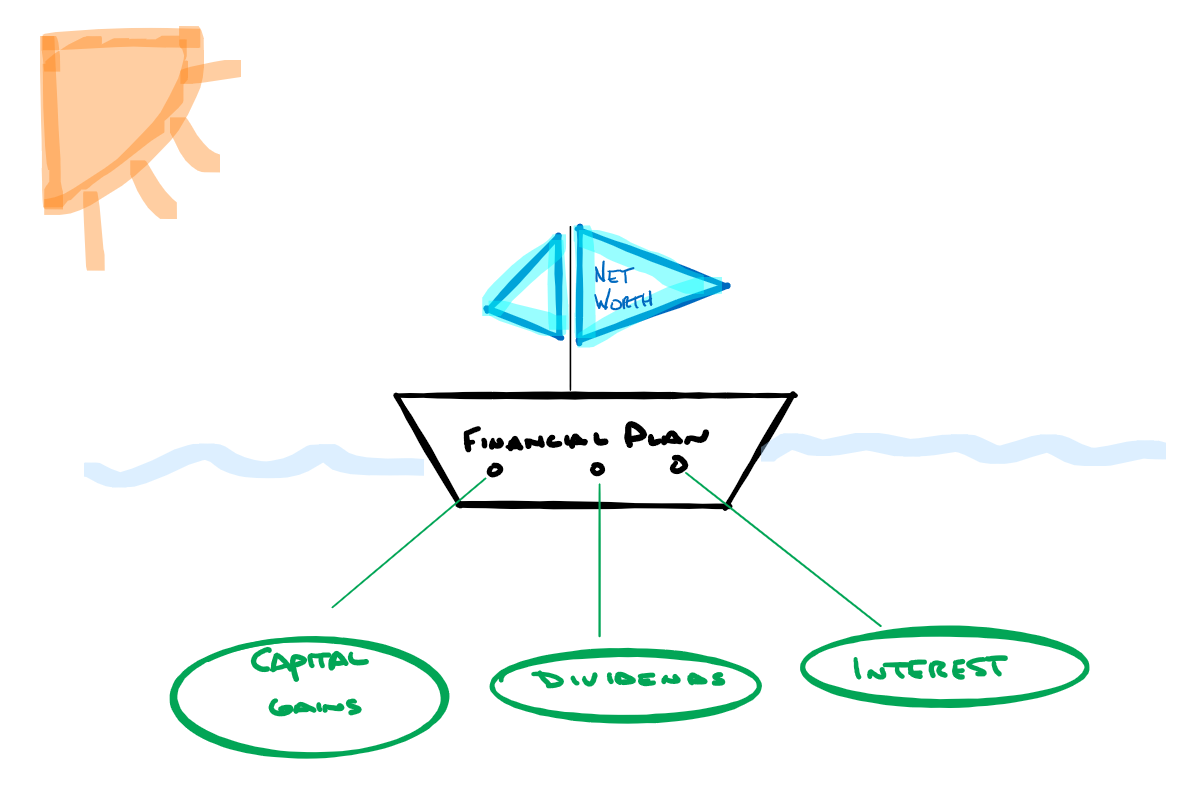

❌Would you ever choose to get onto a boat that you knew had holes in it? I would certainly hope not.

????Do you hold your own financial plan to the same standard?

A common theme I see with high earners is their non-qualified (or after-tax) investment accounts. These are accounts that are titled in individual or joint name (not a retirement account).

Every year these accounts will send you a 1099. This 1099 will include capital gains, dividends, and interest.

Actively managed stock (equity) mutual funds are one investment to pay close attention to. If you have a fund that you really love, maybe it makes sense for it to be in your IRA or Roth IRA? Why? Mutual funds distribute can distribute capital gains distributions regardless of whether you buy or sell the fund.

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.