Investing is tricky, and so is a risk. Sometimes silver-linings exist where you might not think. Even when stocks go down, there may be cause to stay positive or even celebrate.

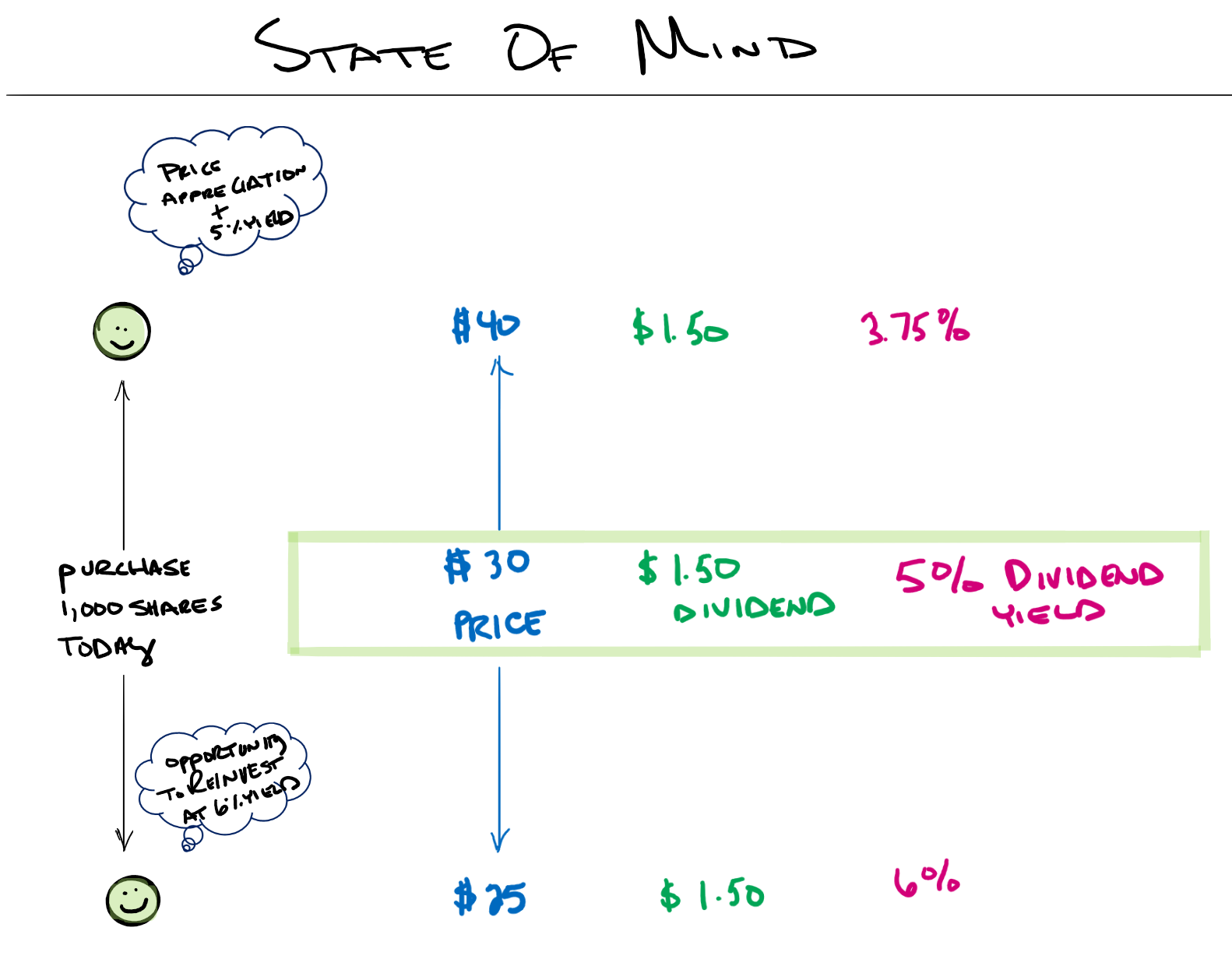

You’ve done your research. You’ve identified a great company. You decide to purchase 1,000 shares of a company currently trading at $30/share, paying a $1.50 dividend (5% dividend yield).

3 Possible Outcomes:

???? The stock appreciates to $40/share. You have substantial price appreciation, and you continue to receive your $1.50 dividend/share or $1,500/year of dividends.

↔ The stock moves sideways. You do not have any price appreciation, but you continue to receive a 5% dividend.

⬇ The stock price drops. It can be discouraging; (however, this is where I get excited). You have done the research and identified a great company. You can reinvest your dividend and get a 6% dividend by purchasing new shares. Safe to say, that can be a win.

Pay me when I’m down

Hopefully, over time, price appreciation will happen. Investing is a long-term play, so we are not usually too worried about a short-term dip. If we invest in a company, we are reasonably confident based on several factors, including a history of success. Again, it can go down, but a buying opportunity exists if it does. We can choose to allocate more capital if we believe the company will continue to do well over time.

Stocks and investments, in general, can be one of the best things to buy when they go “on sale.” Sometimes a sale can be challenging to identify, and people get scared.

The above example is just that, an example. It plays out all the time, though across numerous stocks and hundreds if not thousands of times inside mutual funds.

Owning individual stocks is fine, but if the timing and volatility give you anxiety, perhaps a group of mutual funds is more your speed. Plenty of funds have an annual dividend, and the rules apply here also. Add in an automatic contribution, and you can be buying the dip on autopilot in no time.