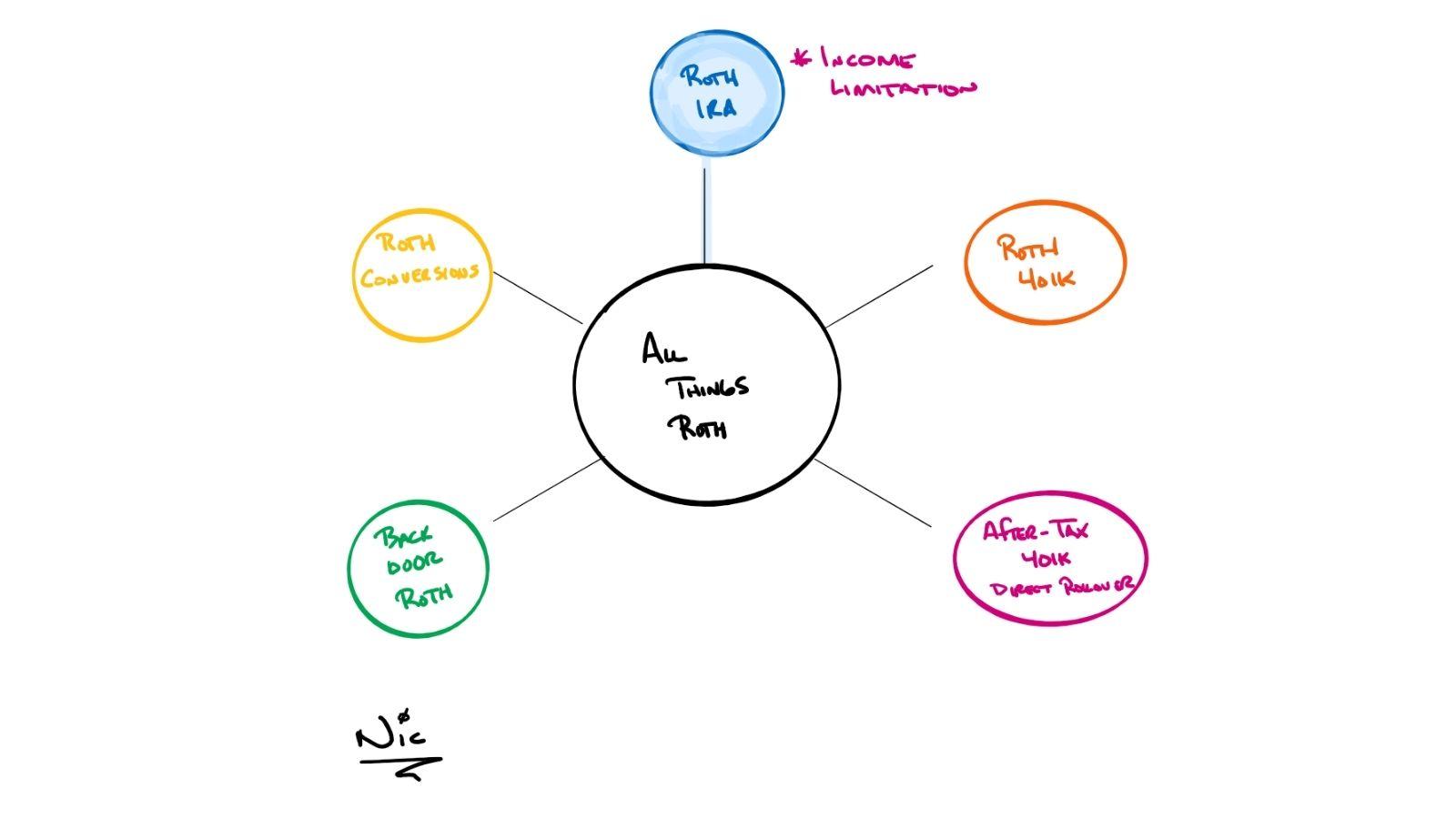

Did you know that there are 5 ways to contribute to a “Roth?” Did you know only 1 of those ways has an income limitation?

Your eligibility to contribute directly to a Roth IRA is determined by your Modified Adjusted Gross Income (“MAGI”).

- If you are single, you cannot contribute the full amount if your MAGI is above $125,000.

- If you are married, you cannot contribute the full amount if your MAGI is above $198,000.

The good news, regardless of income, you can still contribute to a “Roth” potentially up to 4 other ways!

IMPORTANT INFORMATION

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA.