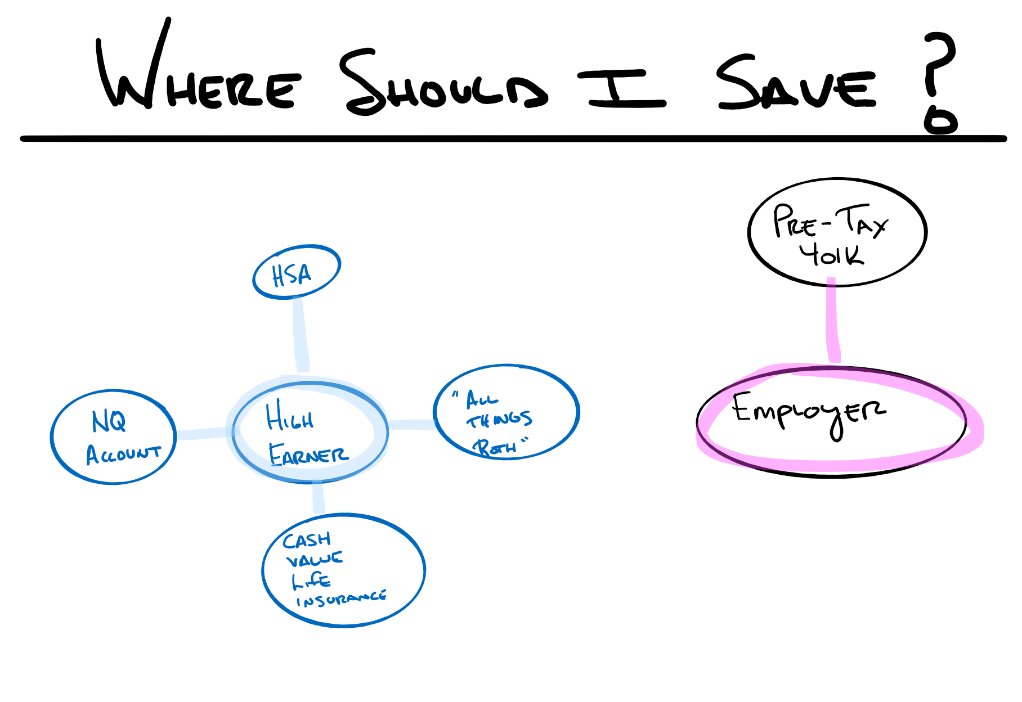

I believe that high earners need to embrace the acronym H.A.I.L.

???? HSA – Health Savings Account contributions go in tax free, tax deferred growth potential, and ultimately come out tax free when used for qualified medical expenses.

???? All Things Roth -Take advantage of whatever Roth options you have available to you. In a best case scenario, you would have the ability to get the funds to a Roth IRA. Within the Roth IRA, you will always have access to your contributions.

???? Individual Account with a Secured Line of Credit – Individual accounts can give you access to money. Focus on investments that limit income and capital gain distributions.

???? Life Insurance – properly structured cash value life insurance can be a non-correlated asset and offer diversification. In addition, you can borrow from the policy instead of triggering a taxable event.

Finally, let somebody else fund your pre-tax or traditional 401k. Employer matches always go to the pre-tax bucket. There is nothing wrong with having some of your money in pre-tax investments. I would prefer that somebody else fund it.

Everyone’s situation is different, but this is a good starting point when discussing where to allocate your hard earned money.

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.