When I think of August, I think of a renewal of hope and spirit. Kids are going back to school. Football teams are reporting to camp. No matter how bad or good last season was, we begin anew.

This year has been a particularly frustrating year for our investors. The S&P 500 reached an all-time high of 4,818 on January 4th before falling to a yearly low of 3,666 on June 16th a drop of nearly 24%.

At the time of writing this note, the S&P 500 is at 3,975. Roughly 8.4% higher than the June 16th low.

I am reminded of a quote from the famed investment manager, Peter Lynch, who said, “The real key to making money in stocks is not to get scared out of them.”

And right now, there are plenty of reasons to be scared out of them … (insert your favorite one here)

Just like the teachers at school and coaches at football camp, we are reminded to focus on getting back to the basics – control what you can control.

Tips to Stay in Control of Your Money

- Make more than what you are spending.

- Ensuring we have appropriate emergency funds. We discuss having access to six months’ worth of expenses either in cash equivalents or access to a home equity line of credit.

- If you need money from your investment portfolio, we set aside five years’ worth of portfolio income in fixed-income investments.

- The balance of your funds is allocated for growth. Know what you own and why you own it.

- We aim to protect our families from the bad stuff. Evaluation of life insurance, disability insurance, long-term care insurance, and estate planning documents are important in any market environment.

- If still in the accumulation zone, continue to invest systematically. Automate if possible.

- Splurge on your health.

Ultimately, your dreams determine your plan, and your plan determines your portfolio.

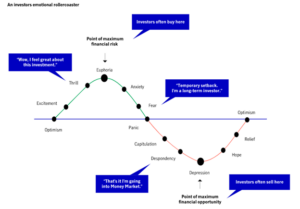

This year, as noted, has been frustrating. I remind you of the emotional rollercoaster.

We are a lot closer to Hope than we are to Thrill!

If you have questions, please don’t hesitate to contact us. We always love hearing from you.

— Nic & Jeff

We are a full-service financial advisory company that allows you to make a one-page plan for your money and prepare for your future. Learn more about what we do and how we can help you here.

_____________