It is great to have passive income.

Even better, it is great to have increasing passive income. Stocks with dividend growth potential can help to provide just that.

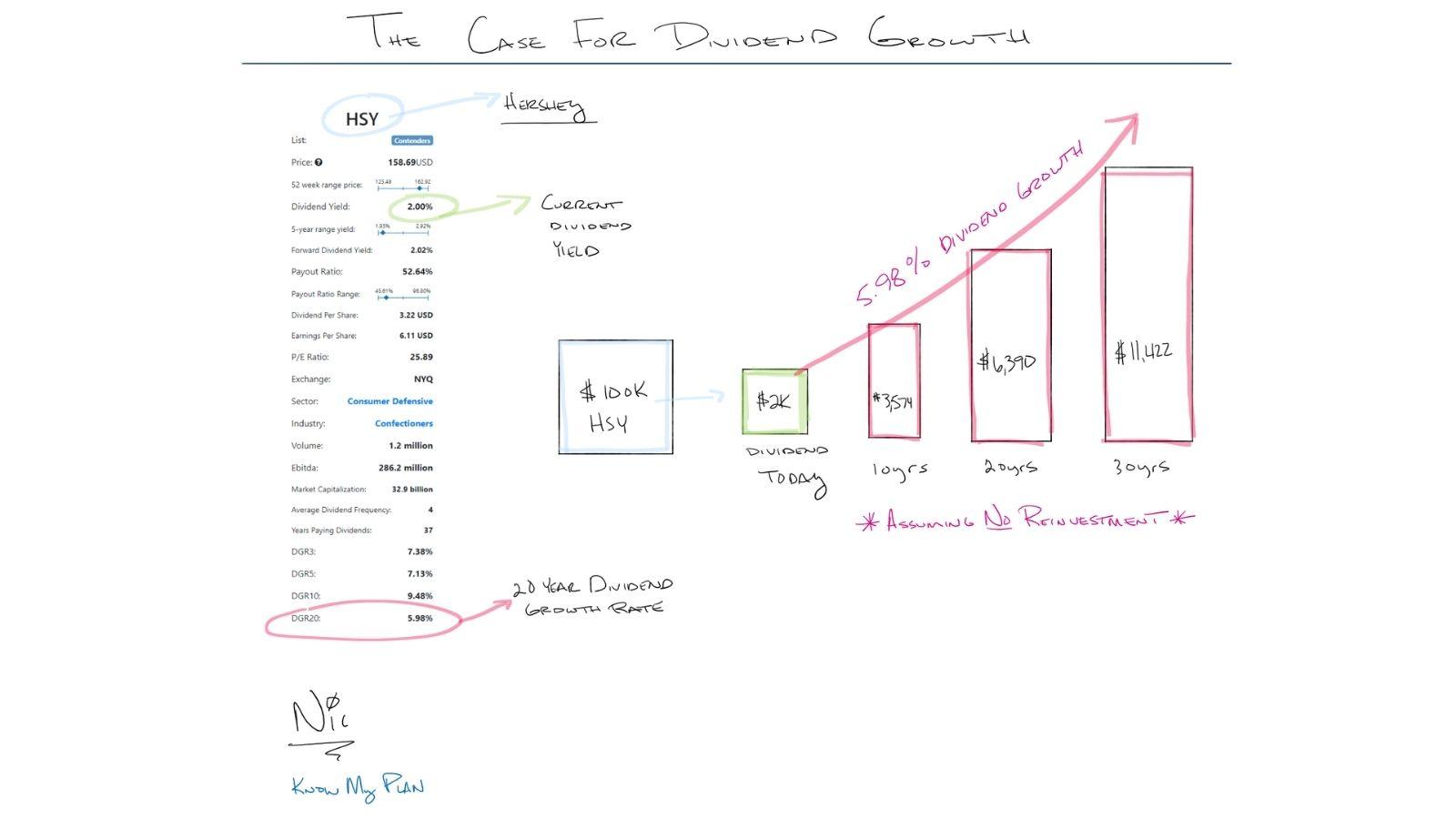

For illustrative purposes, I share with you the example of Hershey.

Currently, Hershey has a 2% dividend. Over the past 10 years, they have grown their dividend by 9.48% per year. Absolutely incredible! However, over the past 20 years, the dividend growth has been a solid 5.98%.

Assuming an individual owned $100k of Hershey today, an individual would receive approximately $2,000 per year in dividends.

Over 30 years (assuming no reinvestment of dividends), a 5.98% dividend growth rate would turn $2,000 in dividends today into $11,422 in dividends in the future.

As always, do not put all your eggs in one basket. Stay diversified. Please note: dividend payments are not guaranteed and may be reduced or eliminated at any time by the company.

IMPORTANT INFORMATION

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

All company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services. Historical performance is no guarantee of future results. All investing involves risk including loss of principal.

LPL Tracking #1-05140253