Okay, I admit this is morbid. Let us try to move beyond that. Your parents might have the desire & capacity to gift money during their lifetime. You might have the capacity to financially support your parents.

Let us dive into this scenario.

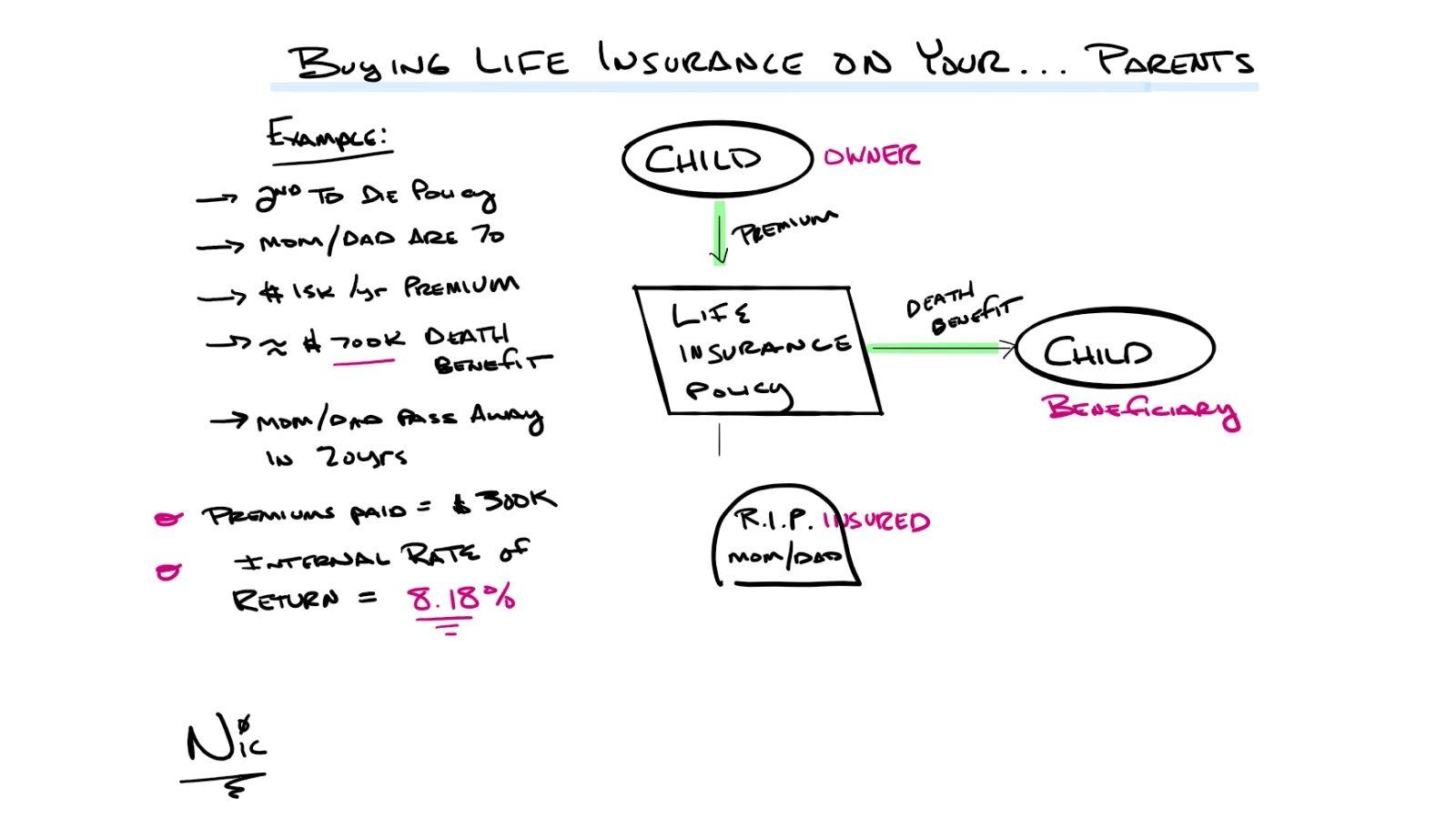

Mom & Dad are 70 and in good health (insured). The child is the owner of the life insurance policy (they pay the premium). The child is also the beneficiary.

NIC NOTE: Irrevocable Life Insurance Trusts can be super cool (another topic for another day).

In our example, the child makes annual life insurance premiums of $15k for 20 years on a 2nd to die (survivorship) insurance policy (ex: the death benefit is paid out after both parents have passed away). After 20 years, mom and dad pass away. At their passing, the life insurance company pays the death benefit to the child ($700k) federally & state tax-free (estate taxes may apply).

The internal rate of return turns out to be 8.18%.

I pose the question, what rate of return do you think you would need to net 8.18% over 20 years in a taxable investment? It is impossible to predict because we do not know future tax rates.

NIC NOTE: The longer the parents live the lower the internal rate of return (IRR).

IMPORTANT DISCLOSURES

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

This is a hypothetical example and is not representative of any specific investment. Your results may vary. Insurance guarantees are based on the claims-paying ability of the issuing company.

LPL Tracking #1-05137544