The infamous story about David and Goliath can easily be compared to the everchanging inflation rate.

The Consumer Price Index (CPI) was at 38 in December 1969.

Currently, the CPI is at 297.

Over the past 52 years, the cost of living has gone up 8x.

Yikes!

Let that pain set in.

Looking at Inflation

The $1 combo meal at Mcdonald’s in January of 1970 would now cost roughly $8.

Inflation is Goliath. It is big, strong, intimidating, and can scare many.

What can David [you-the individual investor] do?

The good news is that you have a rock and a slingshot.

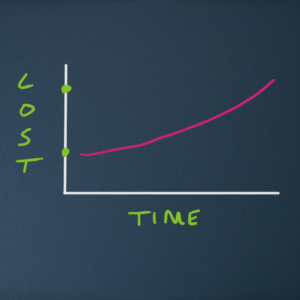

The reason that we invest is to maintain and increase our purchasing power over time.

Our goal is to create a rate of return on our investments that outpaces inflation over a meaningful period.

We begin to define a meaningful period of time as a minimum of ten years.

We do not invest or speculate about the direction of markets for short-term periods.

Consider the S&P 500 traded at 92.06 at the beginning of 1970.

Currently 3,683. Roughly 40x higher.

At the end of 1969, the S&P 500 had a dividend of $3.24.

The consensus full-year 2022 estimate is $65.

The Good News

The dividend grew 20x!

Let’s revisit the Mcdonald’s combo meal in 1970 that was $1.

Today, that combo meal is $8 (CPI 8x).

A dollar in dividends in 1970 in the S&P 500, would now be $20.

You can now buy 2 combo meals and dessert through the growth of dividends.

In its purest essence, we want to increase our purchasing power over time.

What can an investor do today?

- Own a diversified basket of companies that will innovate, lead, and prosper in the decades to come.

- Make a plan. Review it often. Make changes when necessary. Remember that your dreams determine your plan. Your plan determines your portfolio.

Invest confidently,

Nic & Jeff

We are a full-service financial advisory company that allows you to make a one-page plan for your money and prepare for your future. Learn more about what we do and how we can help you here.

_______________________