First, our belief is that you NEVER mix your portfolio and politics.

Elections can be contentious. Opinions are flying. Rumors and rhetoric are persuasive and hard to navigate. It makes perfect sense why you’d want to sit this out, let the dust settle, and then decide how you want to approach future investments.

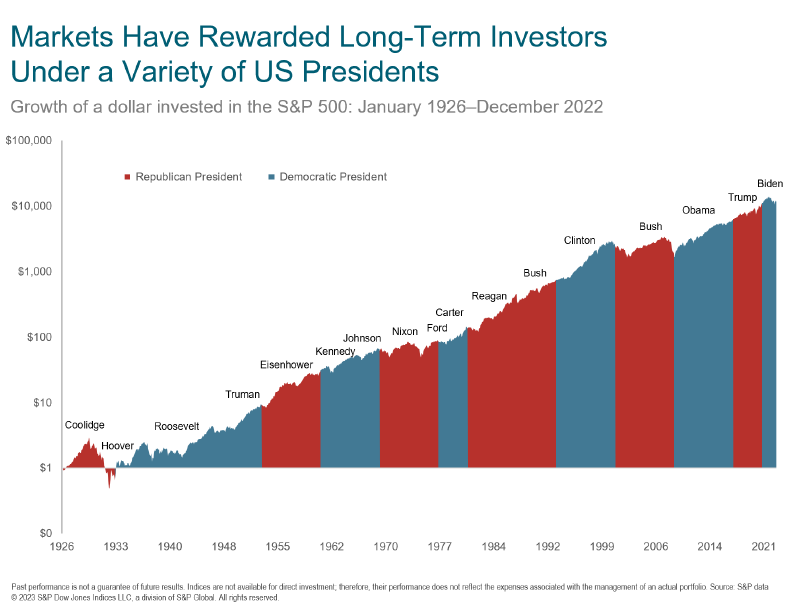

However, history tells us that regardless of who’s in the White House or what party controls Congress, the stock market has continued to climb higher over the past 100 years.

Why?

Because earnings & dividends have steadily increased over time.

Our core investment beliefs:

We do not believe the economy can be consistently forecast, nor the markets consistently timed. We do not believe it is possible to gain any advantage by dipping in and out of the markets, regardless of current conditions.

We do believe, however, that the most efficient method of capturing the full premium return of equities is by remaining fully invested all the time.

We build our portfolios and financial plans for clients that are prepared to ride out the frequent, often significant, but historically always temporary equity declines. Even during these trying moments of volatility, we believe that our reinvested dividends will be buying more lower-priced shares—and the power of equity compounding will continue to our long-term benefit.

In summary, and we can’t stress it enough: We believe that you should have a financial plan.

Your goals will determine your plan and your plan will determine your portfolio.

If you or someone you’re close to is a high-achieving professional that could use help aligning their finances and establishing a financial plan, please reach out to us, we’re accepting new clients and eager to help.

Cheers, Nic

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors or will yield positive outcomes. Investing involves risks including possible loss of principal. Any economic forecasts set forth may not develop as predicted and are subject to change.