If I had to choose a word to summarize 2022, it would be … challenging.

The U.S. stock and bond markets were both negative for the first time since 1969.

Relentless negative headlines were like waves hitting the shore. Mortgage rates were the highest we have seen in 20 years, wars raged, prices skyrocketed, and sickness endured.

Suffice it to say, there were very few places to hide from declining asset prices, but we look forward to the future. We choose to ignore these challenges and remain positive.

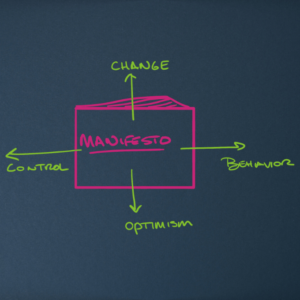

How do we prepare for 2023 & beyond?

1/ Evaluate what has changed in your financial picture.

Did a Life Event happen that adjusts that picture? There are multiple challenges and triumphs that we can face. Job change, inheritance, bonus, tax liability, the birth of a child, loved one now needing care, the list goes on. What is different for you as we turn the page from 2022 to 2023? We’ll always ask in our meetings, but this is a place to be proactive with our outbound contact with us.

2/ Evaluate your dreams and goals

We believe that your dreams determine your plan and that your plan determines your portfolio. If your dreams and goals have evolved, it is imperative to relay this information to us. We love to plan. The new information is vitally important to us as we build that plan together.

3/ Update Math & Assumptions

Within any financial plan, there are several financial calculations that take place. Together we can run the numbers to make sure that you are still on the correct trajectory.

Believe it or not, you can potentially be saving and investing too much! You may have the assets for the extra vacation or another amazing experience with loved ones.

IF you do need to invest more, it is better to know that now. Small adjustments early can be far less painful than large shifts later. Face a challenge head-on rather than waiting for it to get worse.

“Risk is measured as the probability that you won’t meet your financial goal. Investing should have the exclusive objective of minimizing this risk.”

[From Adaptive Asset Allocation by Butler, Philbrick, & Gordillo]

4/ Focus on the outcomes you control

The savings rate, investment mix, and the accounts you invest in are all examples of variables within the plan and items that you can control.

We cannot control geopolitical tensions, pandemics, war, fraud, inflation, & the media’s agenda.

Please keep in mind that the goal of media (TV, radio, YouTube, etc…) is to sell advertisements. They are not in the business of providing you with peace of mind or personalized investment guidance. The media’s goal is to keep you tuned in. They do this by creating emotions of fear or euphoria.

These emotions are generally counterproductive to achieving your dreams outlined in your financial plan.

5/ Behavior

Faith – Patience – Discipline

Acting upon your long-term financial plan is simple, but not easy.

It is not easy to stay invested through the bad times. The U.S. stock market has lost approximately 35% or more about every five years since WWII.

The best portfolio is the one that you can stay invested in when the storm comes.

The storm is always coming. We never know for certain when, how long, or how bad it will be. The good news is that with history as our guide, the storm always ends. Blue skies await us.

Focus on creating an investment portfolio that you hold for decades (not days).

It is much easier to weather the storm if you are prepared:

-Emergency Fund

-Access to a Home Equity Line of Credit [if applicable]

-If you need income from your investment portfolio, we suggest keeping five years’ worth of income in fixed-income investments.

6/ Look for cracks in the foundation. What are your challenges?

The most dangerous quadrant of knowledge is the “I don’t know what I don’t know”.

A few examples of what to look for as cracks in your foundation:

-Do you have your important estate planning documents? Are those documents up to date? (Will, Durable Power of Attorney, Medical Power of Attorney, Medical Directives, Trust, Guardianship)

-Do your beneficiary designations need updating? Death in the family, divorce, children, or establishing a trust are all good reminders to review beneficiary designations.

-Do you have the right amount and right type of life insurance?

-Have you protected your greatest asset? For most people still working, your greatest asset is your ability to earn an income. Disability insurance is an essential element in even the most basic financial plan.

-If you are 40 or older, it is time to consider how you might pay for long-term care.

Do not wait. The diagnosis does not wait until you have your ducks in a row.

When it comes to most aspects of financial planning, it pays to be proactive, and we can help you face any challenge.

7/ Don’t fall in love with a stock, the stock will never love you back.

It is possible to accumulate a significant amount of your liquid net worth in a single stock (usually your employer) through restricted stock units (RSU’s), incentive stock options (ISO’s), and employer stock purchase plans (ESPP’s) without a great deal of effort on your part.

Do your due diligence.

Never have so much of your liquid net worth tied into a single investment that it could cause irreversible harm to your plan if the investment craters.

8/ Facing Challenges: Relentless Optimism

There is always a reason not to invest [turn on the television or read the news]. However, we remain relentlessly optimistic. It is important to know that challenges and issues should not hold you back on choosing to invest.

Had you invested $10,000 in a low-cost S&P 500 Index Fund at the beginning of 1973 and reinvested dividends, you would have approximately $1,250,000.

Approximately a 10% annualized rate of return.

Over long periods of time ownership in companies (stocks) has outpaced inflation by about 7% annually.

This allows us to increase our purchasing power over time!

We believe in humanity’s ability to innovate and solve tough problems.

We believe in companies’ ability to steward capital.

This is an astonishing testimony to the resilience of America’s economy and our successful businesses.

If any of your friends or family have financial questions or need help with their challenges, we are happy to be a sounding board for them. If they are important to you, they are important to us.

–Nic & Jeff

We are a full-service financial advisory company that allows you to make a one-page plan for your money and prepare for your future. Learn more about what we do and how we can help you here.