Whether you are purchasing individual bonds, brokered CDs, or Structured CDs, you want to know what happens if you pass away prior to maturity.

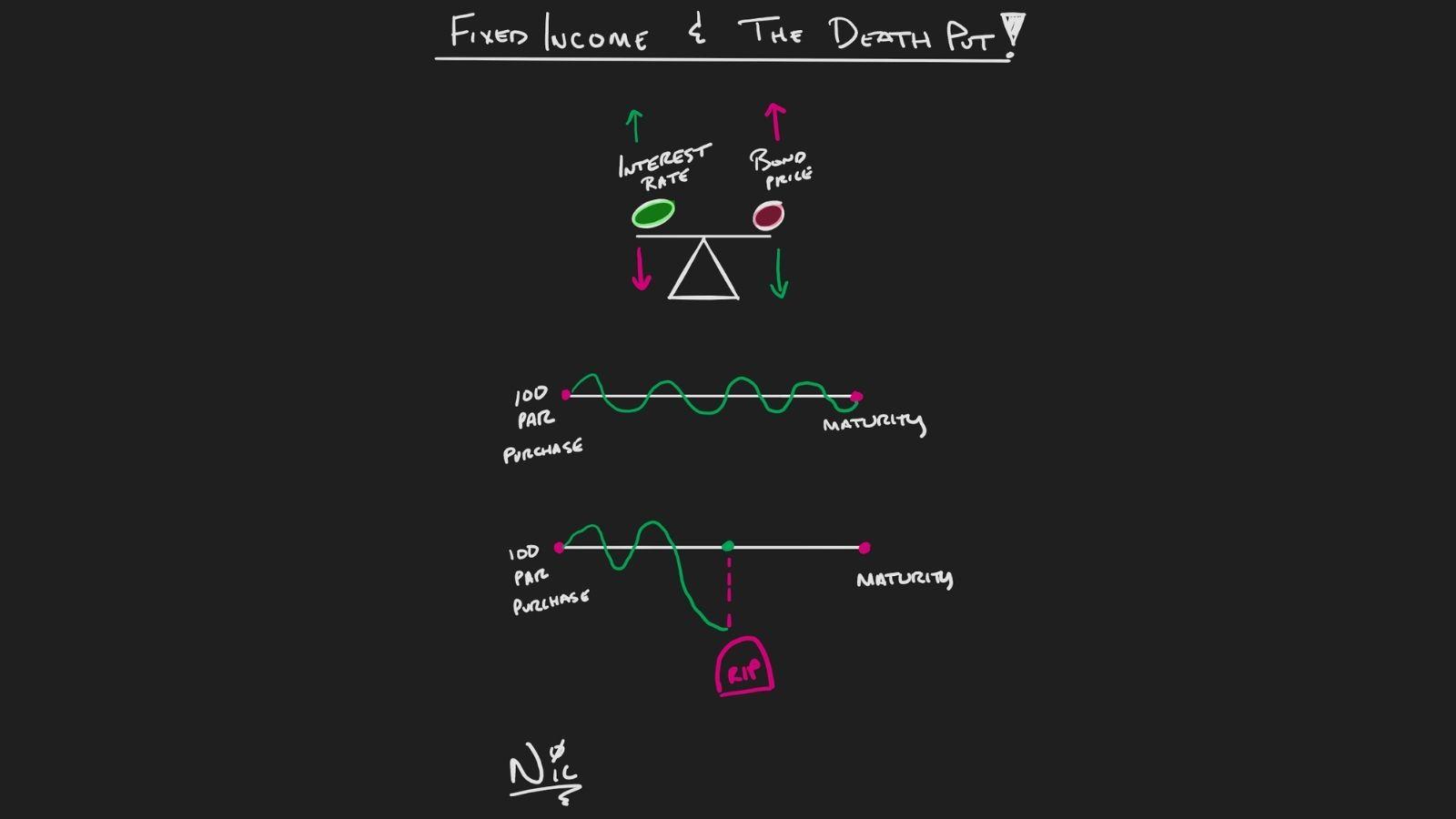

With most fixed income securities there is a direct correlation between the “Interest Rate” and the “Price of the Bond (or other investment). For example, if interest rates go up most bonds will go down. If interest rates go down, the value of the bond will go up.

When you purchase a “bond” at the initial offering at “par” or at a price of 100. If you hold that bond to maturity, it will mature at “par.” The goal is to get the coupon payment until maturity.

But what happens if you die?

On paper, the “bond” could be worth less than par. For example, maybe you invested $100k in a “bond” that is now worth $85k on the open market. Many new issue securities will allow you to “put” this “bond” back to the issuer at par (The Death Put).

The Death Put allows your beneficiaries the ability to receive $100k immediately and not have to wait until maturity to receive par or to have to sell the “bond” at a loss.

ADDITIONAL INFORMATION

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.