Death and taxes, right? Thankfully, some strategies are available to regular folks to help drastically reduce or even eliminate your income tax liability in retirement.

The easiest option is to have zero assets. Assuming that is not your aspiration, there is a 2nd option that focuses on asset location.

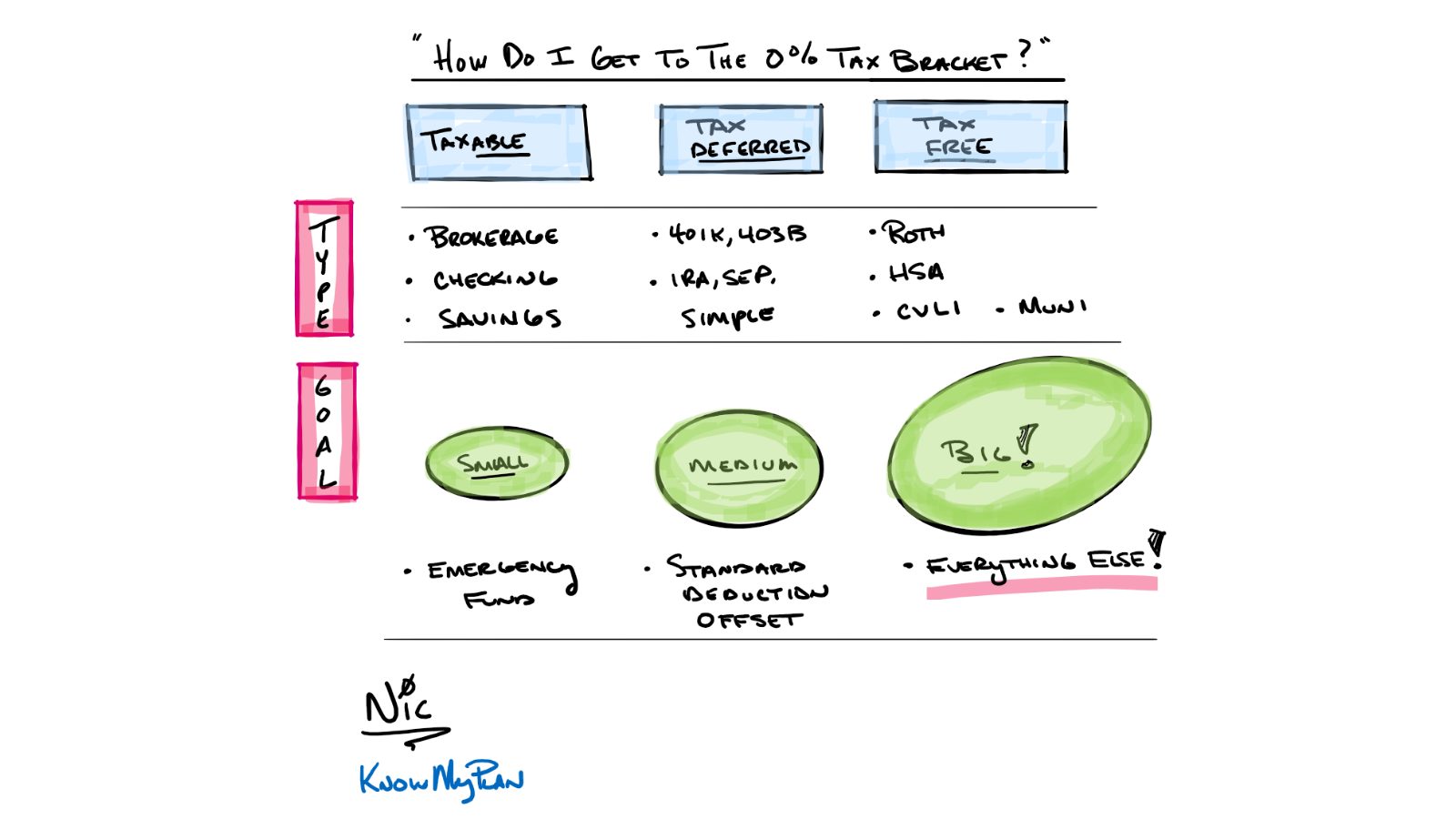

Asset location is the process by which you place assets in the three primary locations (taxable, tax-deferred, and tax-free).

The reality is you have less flexibility the closer you are to retirement. As a result, this is a prime example of the need to ‘begin with the end in mind.’

Planning ahead

A taxable account is your emergency fund checking, savings, and investments that aren’t in a qualified retirement plan. For this article, we will be spending most of our time discussing the other two main types of asset location.

Your tax-deferred account is your pre-tax retirement accounts, like a 401k or Traditional IRA. These dollars get taxed as ordinary income upon distribution. As a result, you would have enough money in this bucket to withdrawal up to the standard deduction amount and no more. You have to keep this account small enough that RMD’s (required minimum distributions) would not exceed the standard deduction.

Finally, the tax-free bucket would hold the balance of your investable savings. The tax-free bucket would typically consist of Roth accounts, Health Savings Accounts, Cash Value Life Insurance, and Municipal Bonds. Note that all 4 of those tax-free accounts have exceptions and situations where there could be taxes, so you must understand how to utilize those savings vehicles best.

No one said it would be easy

Of course, it can be easy to whip through a couple of high-level examples to make the point. That said, this can get hairy pretty quickly.

Taxes changes, most investments are not guaranteed, and there are numerous pitfalls to consider when setting a plan like this up, but in executing it over someone’s full retirement.

If you would like help in considering any or all of this, please consider looking at our financial fortress blueprint.

IMPORTANT INFORMATION

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

LPL Tracking #1-05219340