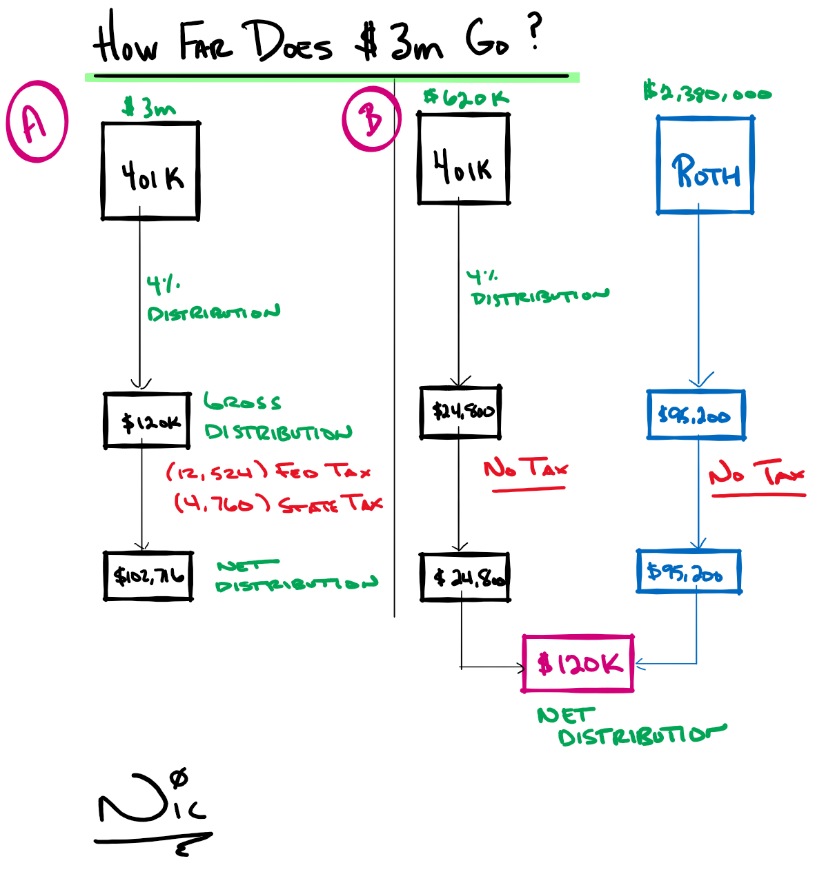

Let us assume two clients are retiring at age 60 and will take the standard deduction. Both couples have $3 million at retirement. Both couples want to take a 4% distribution rate. Both states have a 5% tax rate.

????Couple A: The Avery’s

The Avery’s retire with $3m in a 401k plan. They take a $120,000 gross distribution. After taxes, they are left with gross income of $102,716.

???? Couple B: The Bradley’s

The Bradley’s retire with $3m, but it is divided into two separate plans. They have $620,000 in a 401k and $2,380,000 in a Roth IRA.

They take $24,800 from the 401k. The 401k distribution is offset by the current standard deduction of $24,800 and will not owe any taxes on the distribution. The 401K distributions were made on a pre-tax basis.

In addition, they take a $95,200 distribution from the Roth IRA. The Roth IRA has been open for more than 5 years and the owner has reached 59 ½ so distributions are tax free.

The Bradley’s pay zero taxes on their distribution and net the entire $120,000 distribution.

Are you embracing the Roth Revolution? Are you pursuing the zero percent tax bracket?

This is a hypothetical example and is not representative of any specific investment. Your results may vary.

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.