After you are comfortable with the assumptions of the variables (tax, inflation, rate of return), we will turn our attention to calculating how much money we will need to be withdrawing from our portfolio.

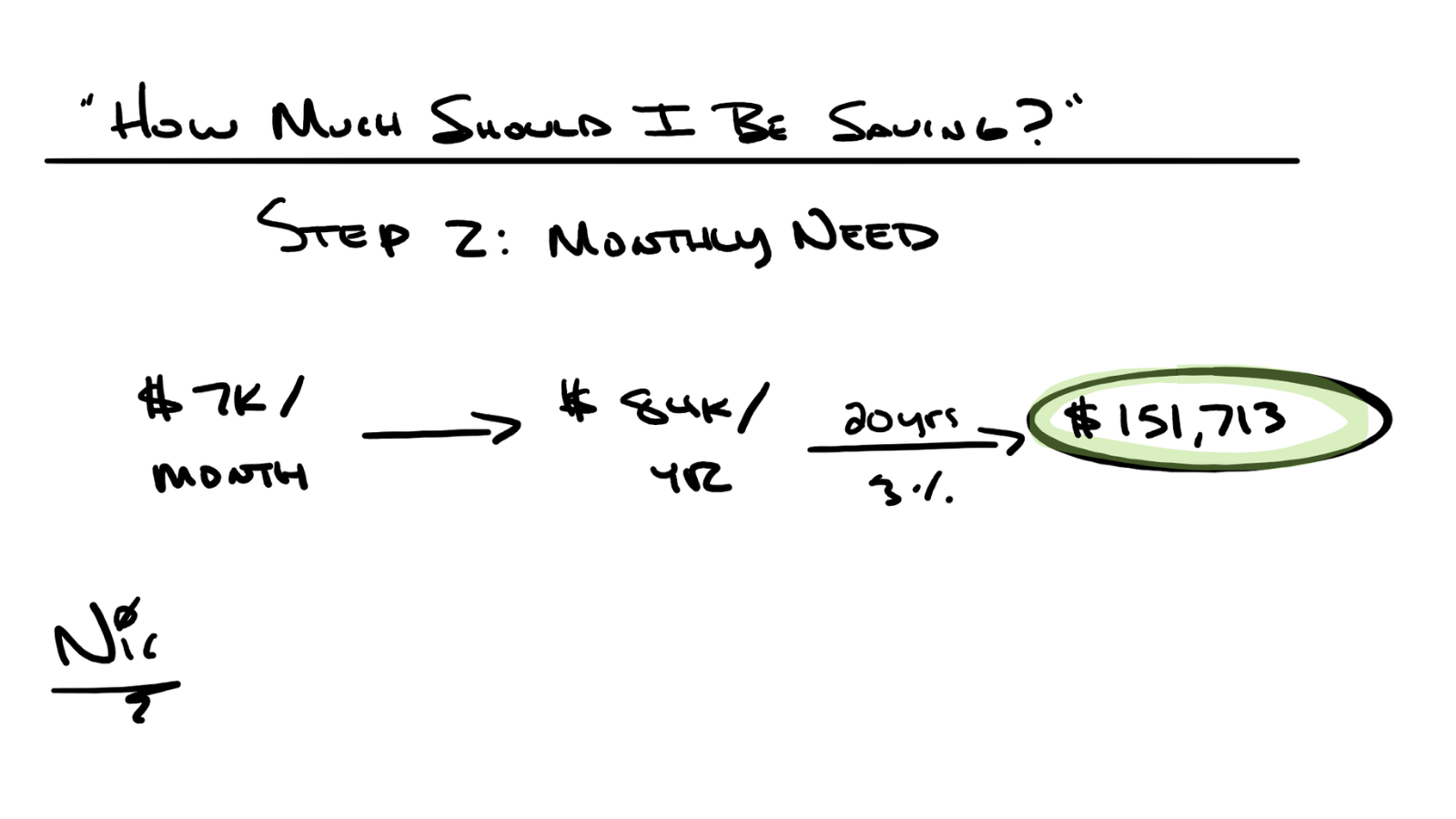

For example, if somebody needs $7k/month or $84k/year to feel financially secure to maintain their lifestyle, that number turns into almost $152k/year over 20 years with 3% inflation.

The impact of inflation cannot be understated and must be prepared for accordingly.

IMPORTANT DISCLOSURES

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

LPL Tracking #1-05134993