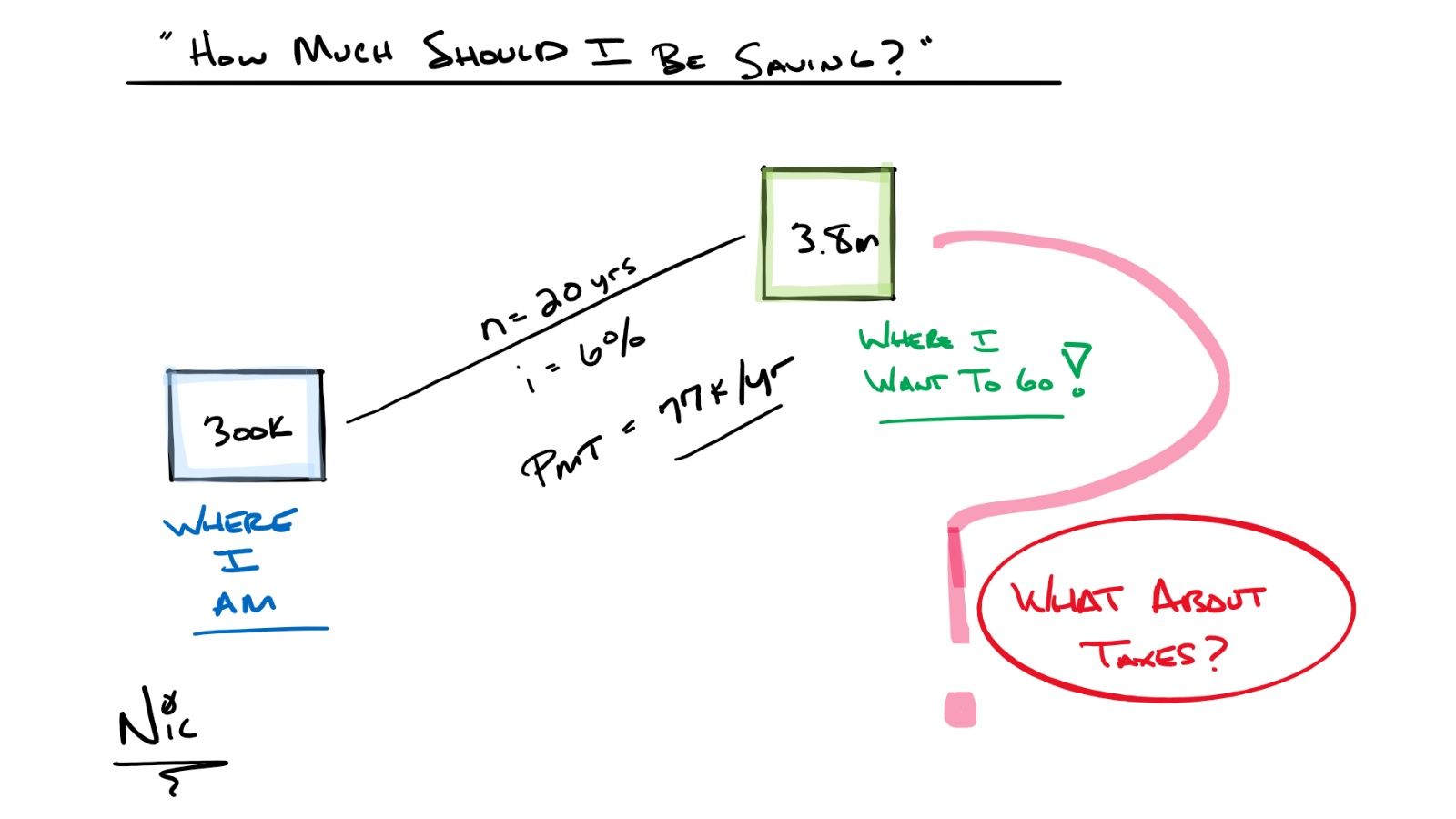

In Step 3, we calculated that we would need to build a “nest egg” of $3.8 million. Let us now calculate how much we need to save every year to go from where you are to where you want to go.

For example, let us assume:

- $300k currently saved

- 20-year time horizon to become “financially independent”

- 6% rate of return

The answer is: $77,000 per year

NIC NOTE: Please note that I did not include the impact of taxes for these calculations. The key in this calculation is getting your nest egg to $3.8 million “net” of taxes. If all your savings is in Roth, Health Savings Accounts, and Cash Value Life Insurance this is a straightforward calculation. If you have funds in pre-tax retirement accounts or after-tax investment accounts that pay interest & dividends, more calculations would be necessary.

IMPORTANT DISCLOSURES

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

This is a hypothetical example and is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing.

LPL Tracking #1-05134999