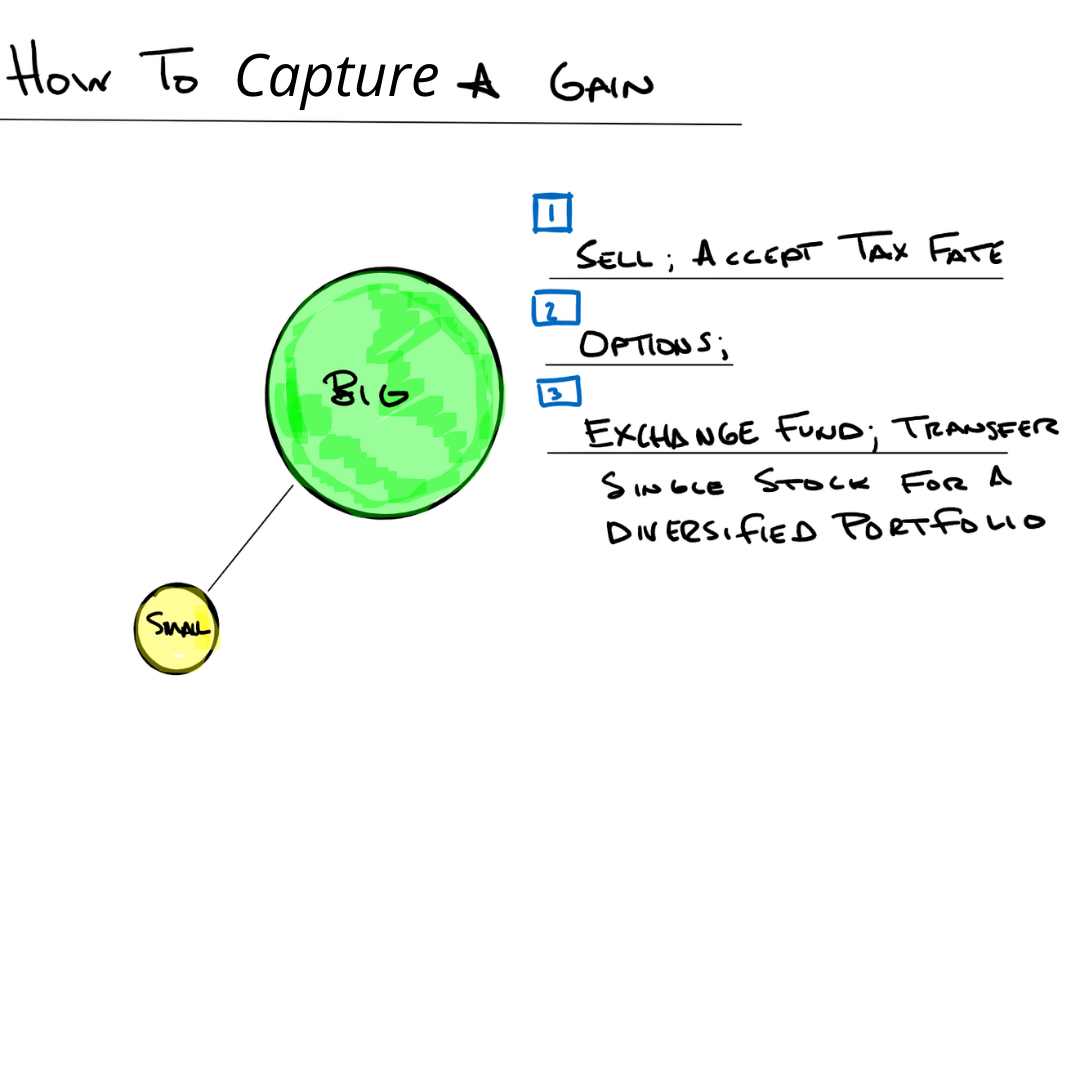

Sometimes small investments turn into big investments! That is awesome!! I love melt-up and parabolic returns. When these things do happen, it is important to capture your gains.

Do not let any security become more than 20% of your liquid net worth.

Options to consider:

1️⃣ Sell. Accept your tax fate. You won the game, and the price of admission will be your tax bill.

2️⃣ Utilize options.

3️⃣ Exchange Fund. Notice these are not Exchange Traded Funds (“ETF’s”). With an Exchange Fund you are traded a single security for a diversified equity portfolio. The benefit of this is that you instantly become diversified and eliminate single stock risk. The downside is that you generally must be considered an – accredited investor, typically $5 million in cash to contribute- and you cannot access your funds without penalty for up to seven years.

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

The Exchange Fund’s risk management process includes an effort to monitor and manage risk, but does not imply low risk. Diversification does not protect an investor from market risk and does not ensure a profit.