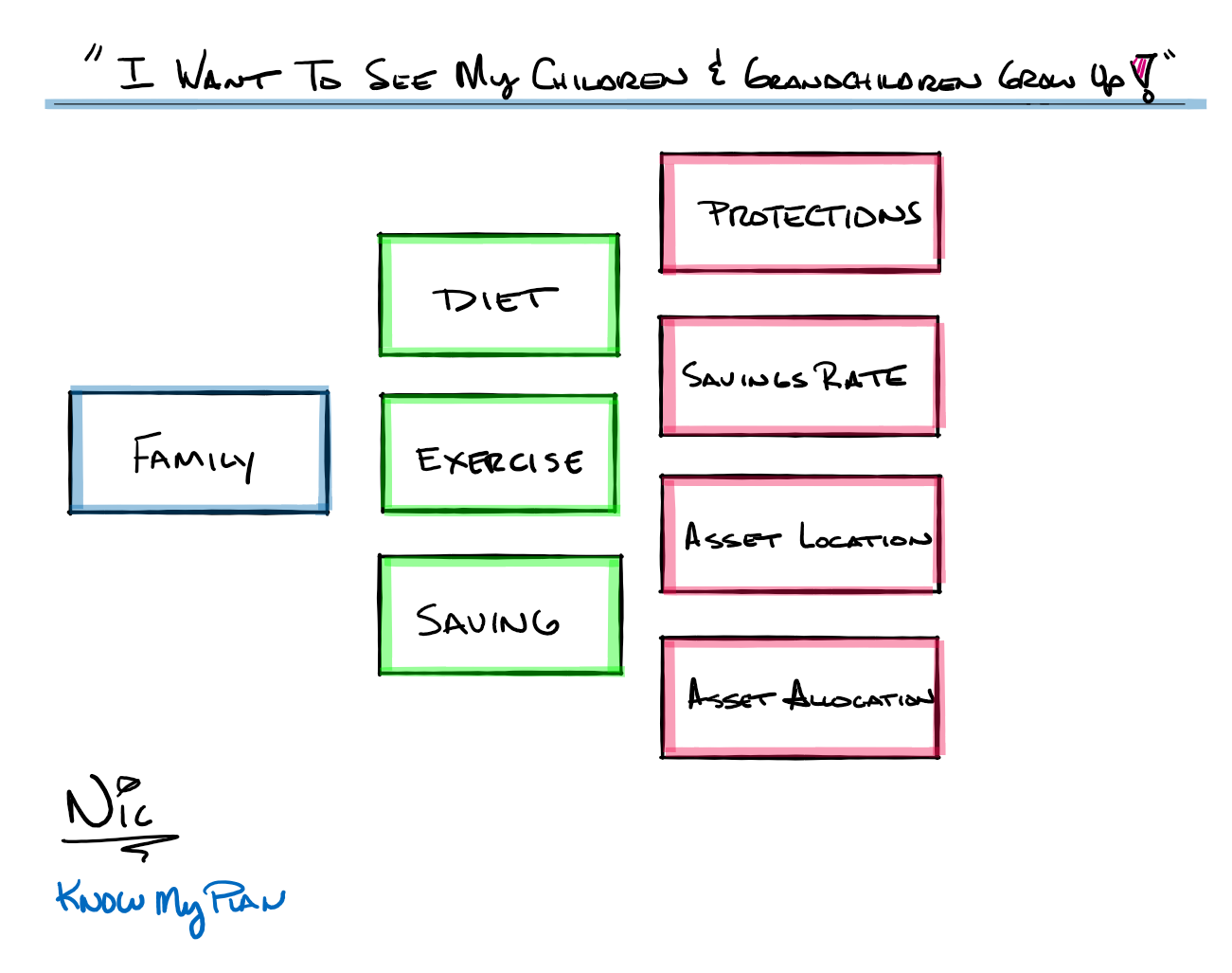

If ‘family’ is your “why,” are you willing to do the hard work to “stack the odds in your favor” to spend as much quality time with your family as possible? People are quick to say they would die for a loved one. The real question is will you live for them? Will you do what it takes to live a healthy life and stick around for the ones that need you the most?

So, I often tell people, “if there is one place where you are going to splurge, it should be on your own health and wellness.” The repercussions of not being healthy are most obvious, and it is expensive to have poor health.

Where does money fit in?

So, how do you save to be financially able to support yourself and your loved ones? Above all, I think you must focus on the controllable.

Protection Plan (the various types of insurance you need if something bad happens)

Savings Rate (how much can you consistently save for multiple years)

Asset Location (where you are saving)

Asset Allocation (the mix of stocks, bonds, real estate, and cash).

Additionally, there is no reason to focus on the things we cannot control. None of us can control what someone is willing to value a particular investment at from day to day anyways. Therefore, do what you can to save today while you can. Focus on your health and don’t be afraid to spend a little more to eat organic, or for the gym membership. Sometimes for a lot of people, the bare-bones $10 a month gym membership is a nice thought. However, you may need to spend more if you need those group classes to keep you coming back! Find ways to make your fitness and health fun!

Lastly, self-care is an important part of being healthy. People depend on you, so make sure you are taking time to care for yourself, so you can be your best when caring for others.

Content in this material is for general information only and is not intended to provide specific advice or recommendations for any individual. Insurance guarantees are based on the claims-paying ability of the issuing company. All investing involves risk including loss of principal. No strategy assures success or protects against loss.

LPL Tracking #1-05180362