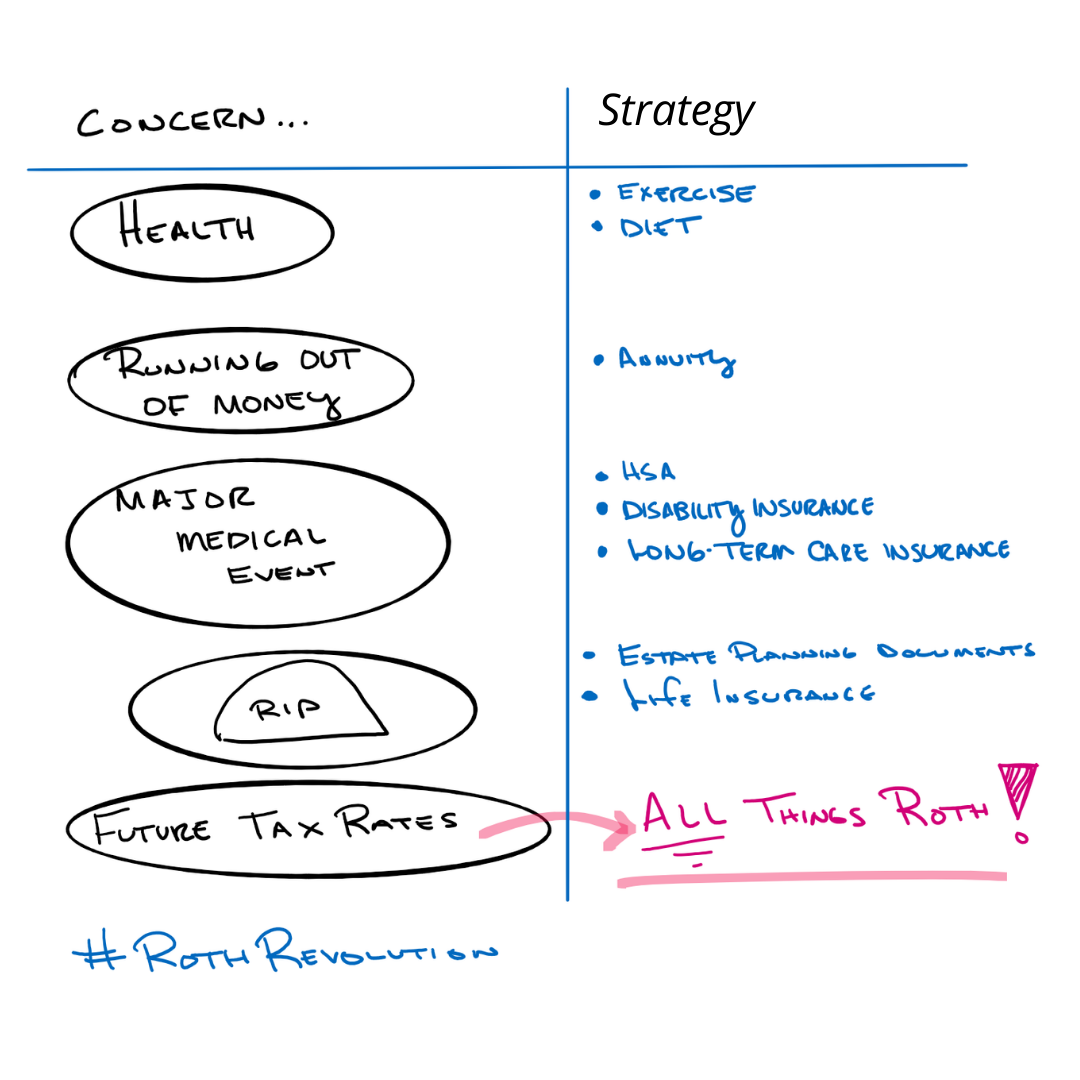

If you are concerned about your health, you can evaluate your diet and exercise program. If you are concerned about running out of money in retirement, you can consider transferring a portion of that risk by purchasing an annuity from an insurance company.

When it comes to financial planning, one of the hardest variables to plan for is future task rates. Historically, tax rates have varied drastically.

How do you hedge against future tax rates? Consider a Roth. With Roth accounts, you are paying taxes on your contributions today (foregoing a tax break today) with the ability to take distributions tax free in retirement (as long as you play by the rules).

You do not need to have all your money in Roth accounts, but it is imperative to have money in different account types (asset location) to have tax diversification.

Ignore the Roth revolution at your own peril.

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

Fixed and Variable annuities are suitable for long-term investing, such as retirement investing. Gains from tax deferred investments are taxable as ordinary income upon withdrawal. Guarantees are based on the claims paying ability of the issuing company. Withdrawals made prior to age 59 ½ are subject to a 10% IRS penalty tax and surrender charges may apply. Variable annuities are subject to market risk and may lose value.

A Roth IRA offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax. Limitations and restrictions may apply.

No strategy assures success or protects against loss. Investing involves risk including loss of principal. There is no guarantee that diversification or asset allocation will enhance overall returns or outperform a non-diversified portfolio. Diversification and Asset Allocation do not protect against market risk.