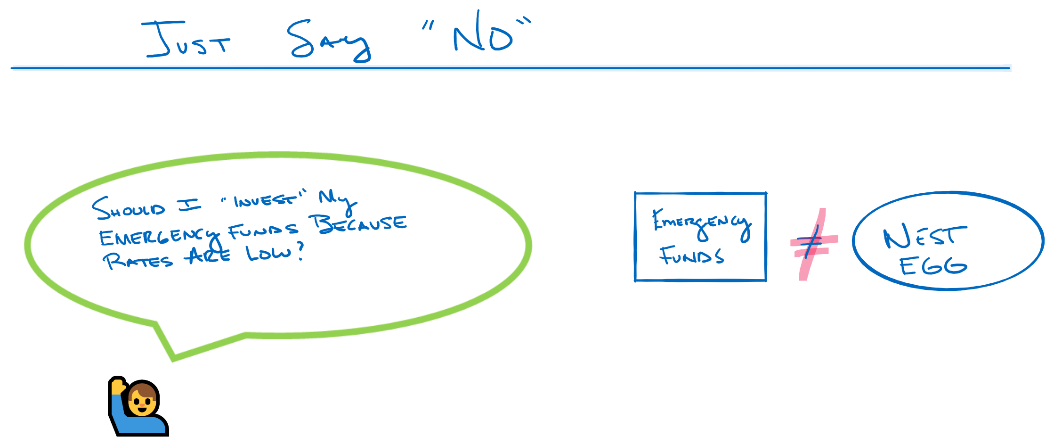

Recently, I have heard various of the question, “Should I invest my emergency funds because rates are low?” The answer is “No.”

Always “NO.”

First, what are emergency funds and how much do I need? Emergency funds are money that you set aside for if you were to lose a job or have a major unplanned purchase occur. I recommend having 6 months of emergency funds.

As long as your bank or credit union does not charge you interest to keep your funds in a savings account, put them in the savings account.

Variation #2: “Should I max out my 401k BECAUSE interest rates on bank accounts are so low?” The answer is “No.”

Always “NO.”

Should you max out your 401k? Maybe. However, the reason should be because your bank savings account is paying .1%.

When you know what you own and why and where it fits into your financial picture, you make better decisions.