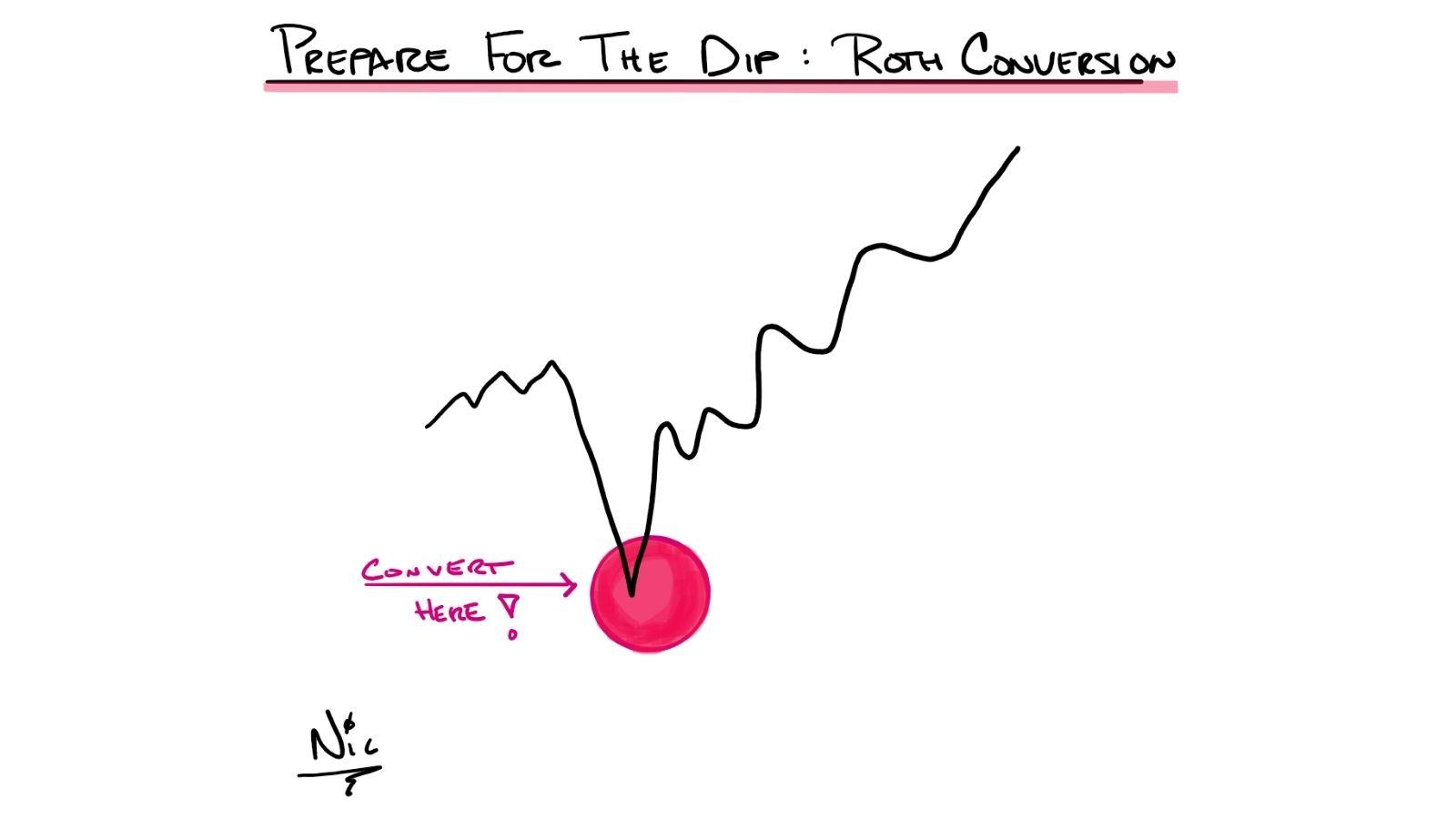

From time to time, the entire market has substantial drops. On average, since WWII, the S&P 500 has had a 40% drop from peak to trough roughly every five years. We have no idea when these drops will come, and trying to time them is futile.

I propose you have a path forward for when securities in your IRA drop in value that you believe are great long-term investments.

For example, let’s say that you own ABC stock, making up $20,000 in your $100,000 portfolio. The rest of your portfolio is going great and has appreciated to $110,000. However, ABC has fallen on hard times, and the stock has taken a dip from $20,000 to $12,000.

Not all dips are bad

The dip is an excellent opportunity to convert your ABC stock from your Traditional IRA to a Roth IRA. When doing a Roth conversion, you can pick the specific securities and shares you would like to convert.

It’s worth noting, the amount converted is taxed as ordinary income in the year of conversion. In addition to this market opportunity, you must also assess your tax situation. A conversion like this is not something that you should undertake lightly. You will want to know that you aren’t overpaying in taxes to move more money to the Roth side of the equation. To optimize, you would ideally continue to let your Roth dollars compound for years and decades, reaping more significant tax benefits.

You don’t have to do it alone

Complicated moves like this are where a Financial Planner truly shines. Yes, you can do some of these things on your own. You can invest on your own. You can fix your own car’s transmission if you really want to. The point here is opportunity cost. Could you spot an opportunity like this on your own? Could you execute in time? Are you able to weigh the tax implications while keeping an eye on long-term growth?

If you are ready to step up your game, click here for your free Financial Fortress Blueprint to get started.