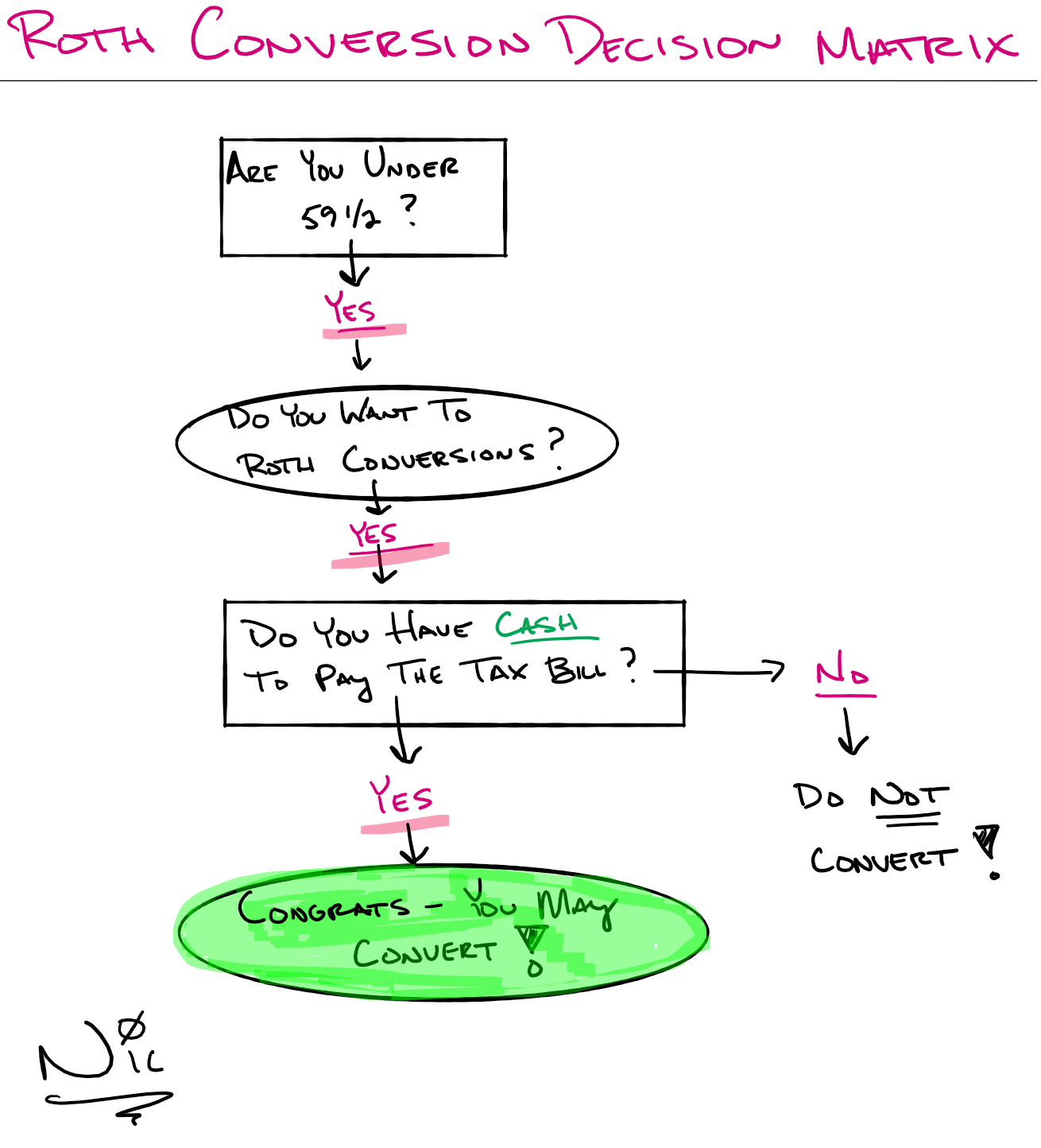

If you are under 59 ½, you need to be able to answer “YES” to all 3 questions.

If you can’t answer “YES” to ALL 3 questions, it is not the right time for you to do Roth conversions (even if you really want to).

Don’t feel defeated. Start building your cash. Cash is your conversion fuel.

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion.