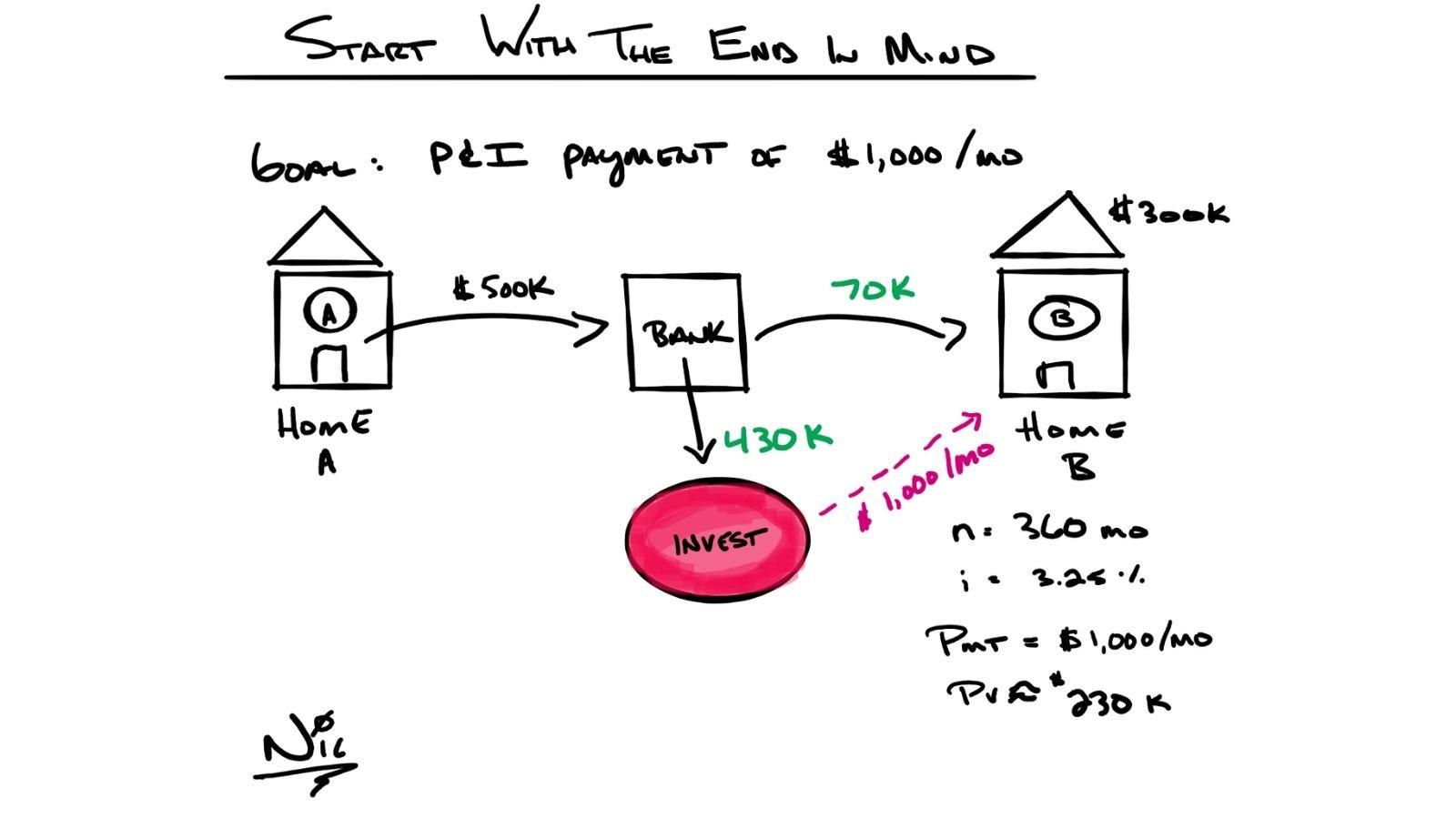

Consider the individual who just sold their home and has a check in hand for $500k. The goal is to have a principal & interest payment of $1,000 per month.

In starting with the end in mind, we can back into the fact that he would start with an outstanding mortgage balance of $230,000 (30yr mortgage at 3.25%).

If you bought a $300k home, you would need to put $70k down. That would free up the remaining $430k to invest.

If the investment made the $1,000/mo payment, that would be a withdrawal rate of 2.79%. Of course, you could be debt-free and just pay cash for the $300k home and have $200k to invest.

Understand the concept and power of starting with the end in mind.

IMPORTANT INFORMATION

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.