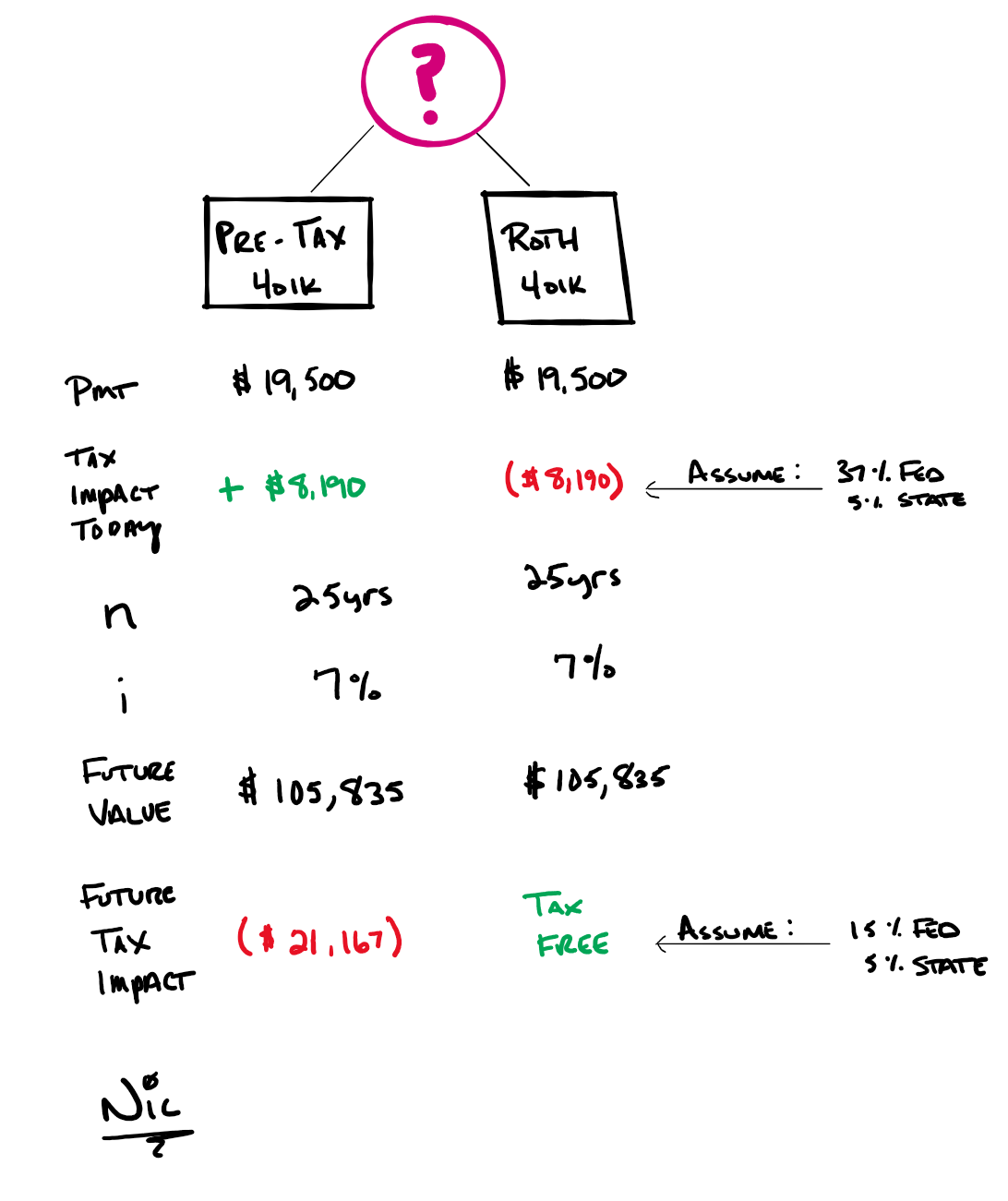

The rise of the Roth 401k presents a new choice to make. Do I pay the tax now, or stay in the (traditional or pretax) 401k and pay it later?

???? The pretax 401k will lower your taxable income. If you are in the top tax bracket today (37%) and pay 5% in state taxes, putting in the total contribution of $19,500 will save you $8,190 in taxes today in the current tax year.

???? That $19,500 contribution will be worth approximately $106k in 25 years at a 7% return. Let’s assume you are in a lower combined tax bracket in retirement (20%). Withdrawing that money will cause a tax impact of ($21,167).

???? The Roth 401k will NOT provide a tax break when you contribute because you are investing after-tax funds. You will pay $8,190 in tax today.

???? However, in 25 years, you will be able to withdraw all of your qualified funds tax-free!

Haters gonna hate

The Roth haters will say that you should contribute to a Pretax 401k and invest the tax savings. If you did that, your $8,190 in tax savings would have grown to $44,450.67, assuming a 7% annual return over the 25 years. However, this money has probably leaked taxes along the way. The likelihood of someone painstakingly doing this is also slim.

???? Do you think taxes will be higher in the future? Would it benefit you to pre-pay your taxes? There are many factors to consider, like the previous tax environment, the national debt, social security, etc.

While the future is always uncertain, we are at very low historical tax rates, and rates seemingly have nowhere to go but up. Another consideration that most people miss is your 401k match is always pretax. So even if you max out your Roth 401k, you will still have employer match money in a pretax bucket of your 401k.

The Roth 401k can be an excellent tool for most clients to build wealth, though each situation is different. If you are ready to take the next step or have questions about your 401k situation, click here for your free Financial Fortress Blueprint.

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

The examples presented are hypothetical and are not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing. A Roth 401k offers tax deferral on any earnings in the account. Qualified withdrawals of earnings from the account are tax-free. Withdrawals of earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax.