Financial planning can take on new obstacles and opportunities for those looking to retire younger.

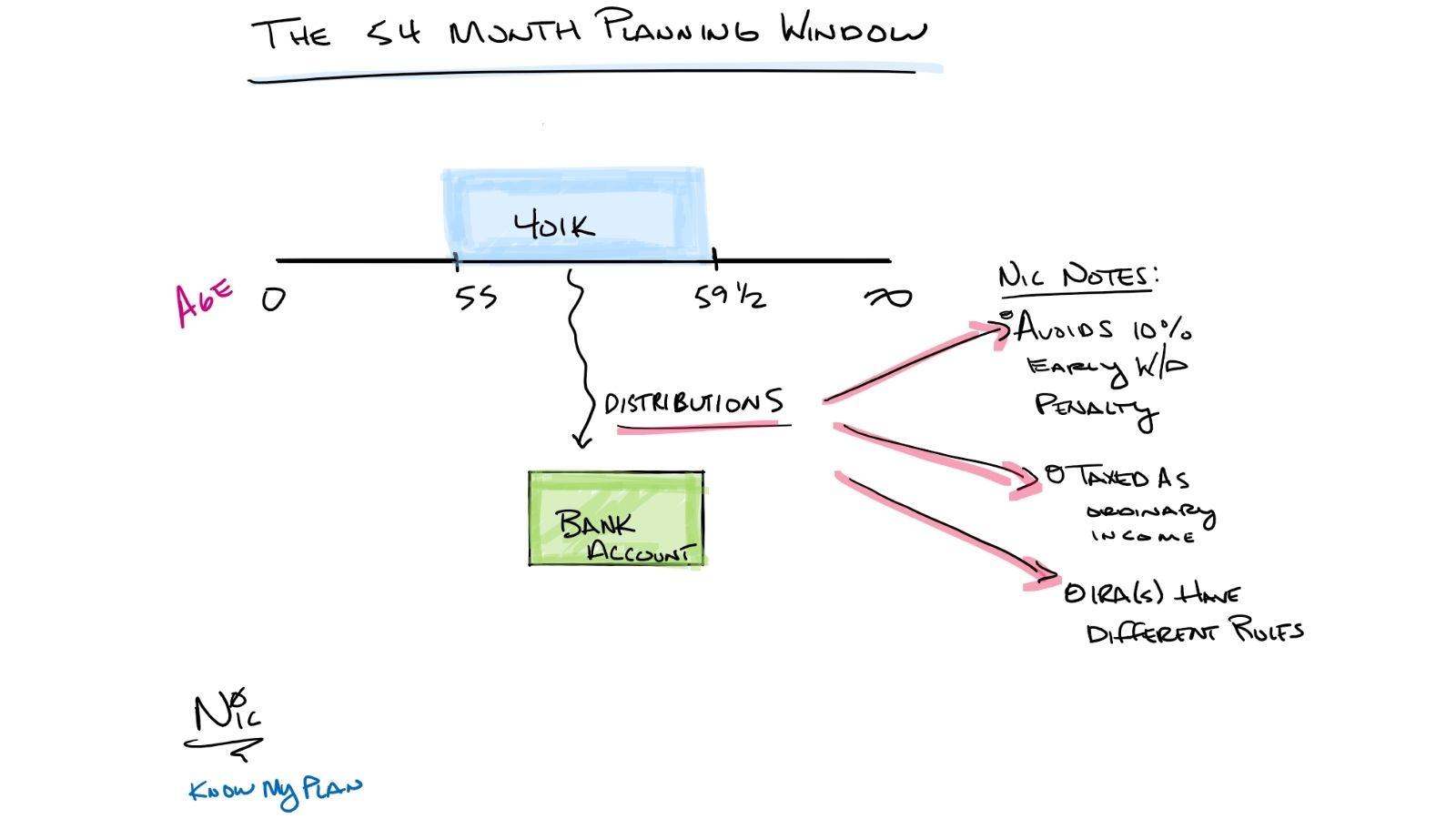

401k’s and IRA’s have different rules for taking penalty-free withdrawals. The common rule is that you must obtain age 59 ½ to avoid the 10% early withdrawal penalty of IRAs. Most think of the 59 ½ age as the earliest opportunity to withdraw funds penalty-free.

Advanced penalty avoidance

However, another often overlooked loophole doesn’t garner as much attention. You must only obtain age 55 to withdrawal funds from your 401k without the early withdrawal penalty. If you separate from an employer before age 55, the 10% penalty is applicable even if funds remain in the 401k past age 55.

If your plan involves stepping away from employment before age 59 ½, consider leaving some funds in your 401k to take withdrawals from during this magical 54-month window (the gap between age 55 and age 59 ½).

For example, if you might need a $5,000/month gross if you stopped working, consider leaving $270,000 ($5k * 54 months) in your 401k before consolidating into your IRA. This 55 early withdraw rule is just one tool to help you retire a little early should you care to do so. This example illustrates the need to “begin with the end in mind.”

Give yourself options

On the flip side, relying solely on your 401k or IRA would make things like retiring earlier much more challenging. If all funds were in the IRA and you wanted to retire at 55, you’d be getting hit with the 10% penalty.

However, having all of your retirement nest egg in the 401k presents some challenges. Often the fund selection is lackluster. The allocation may need adjusting. Do you know the average fund fee?

Sometimes a tip may inspire us to dig deeper and consider new possibilities like retiring early! However, the most dangerous thing for an investor is what they do not know.

If it is time to reevaluate your retirement plan, we would love to hear from you.

IMPORTANT INFORMAITON

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

LPL Tracking # 1-05140256