For illustrative purposes, let’s assume you are forty-two and your spouse is thirty-eight, married with 3 kids, and in the 24% tax bracket.

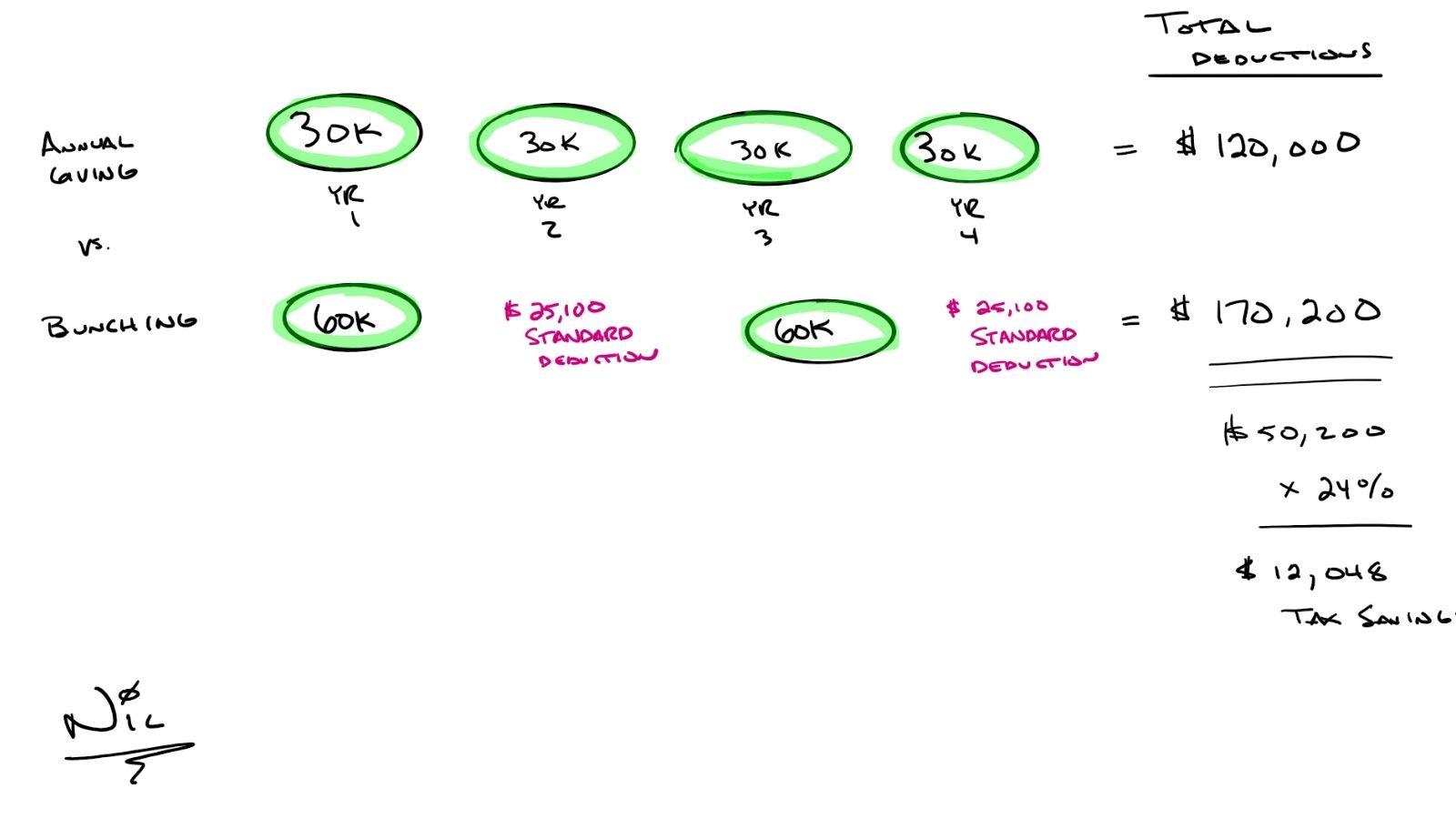

You are philanthropic! You like to give $30k annually to a charitable cause. That is fantastic.

The strategy of bunching can help you enhance tax savings. Instead of giving $30k every year, consider giving $60k every other year. By bunching, you can take advantage of the current standard deduction of $25,100.

IMPORTANT INFROMATION

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.