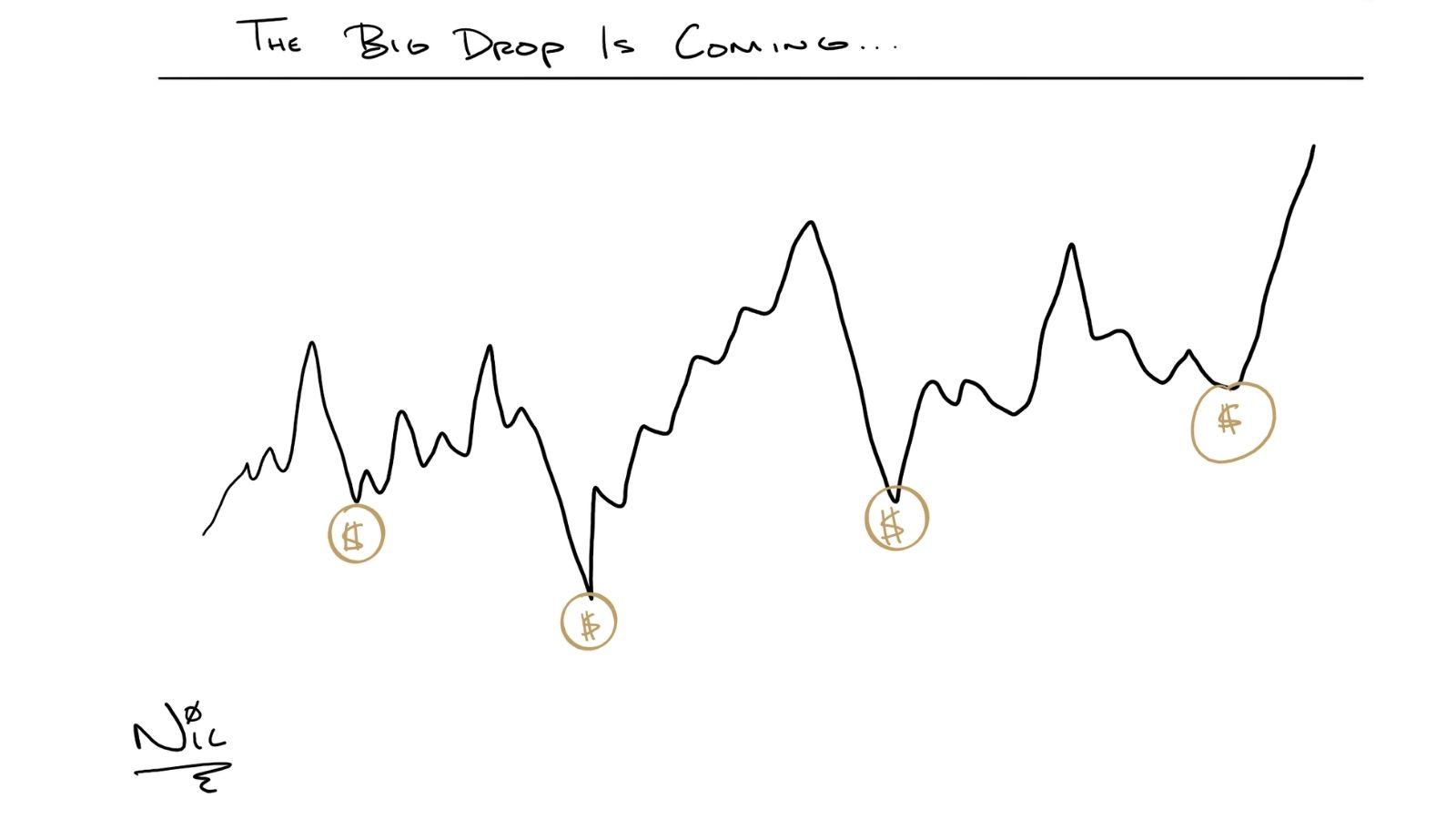

Yes, the big drop is coming, but the big drop is always coming!

There is no reason to try to guess when the big drop is coming.“More money has been lost anticipating the correction than the correction itself.” – Peter Lynch

What can I do to prepare for the “Big Drop?”

- Refer to your one-page plan

- Make sure you have an emergency fund

- Make sure the funds that you need during the next 3 years are not invested in equity-based investment vehicles or equity-type risk investments (i.e. high yield bonds).

- Continue to dollar-cost average

- Continue to invest in your retirement plan(s)

- If you can, increase contributions to buy more shares

- Look for opportunities for Roth conversions

- Put any surplus cash in your emergency fund to work.

IMPORTANT DISCLOSURES

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. All investing involves risk including loss of principal. No strategy assures success or protects against loss.

LPL Tracking #1-05132406