It is never too early to begin meeting with a financial professional. It is a misnomer that you have to have a lot of money to meet with one. Often people regret not starting the process sooner. So start where you are now and begin the process. It is easy on the other hand to think you don’t need one. A common objection is, “Hey, I have a 401k.” For sure that can be a great tool, but it isn’t the only tool. In other articles we explore the topic of asset location so if you read that you probably know what I am about to say: People not only need the tax-deferred 401k, but also money in a Roth as well as a taxable account.

Bring in the big guns

Generally, people reach out to a financial planner for one of two reasons:

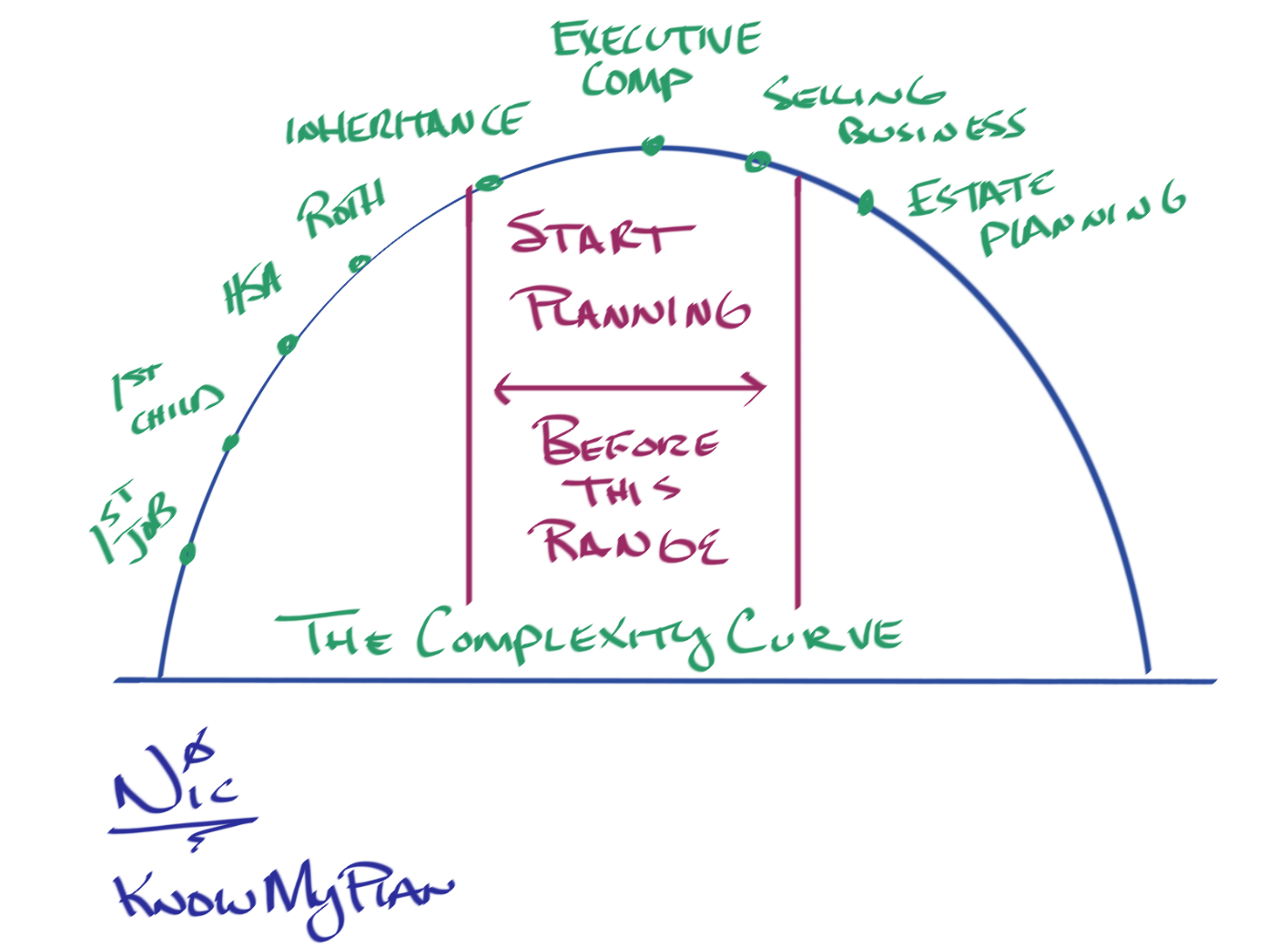

Their financial picture is growing more complex.

There is some sort of pain point that they cannot resolve.

As you age, have a few jobs, get married, have kids, have stock options, you wake up one day and realize things are more complicated than when you were younger. Ideally, it is better to have a relationship in place and a plan in place to address these concerns, in many cases, before they pop up.

When you start a job, you likely realize the desire to retire one day. Similarly, you can consider, and plan for other life goals before they materialize. Kids are a great example, and yes you cannot open a college fund for kids you do not yet have. However, you can begin your investing journey and squirrel some funds away in a taxable account so that when your bundle of joy arrives, you will be one step ahead and able to transfer some of those funds into a 529.

Been there, done that

One of the realities is that a good planner has likely seen it all and thought through hundreds of different scenarios, and pitfalls you may never consider.

You must find a good financial planner. You can never start too early. Do it, before things get complicated. Find somebody that you can trust who you feel comfortable sharing the good, the bad, and the ugly.