After years of working with successful people, I have found that they are not merely successful because of luck. Generally, these are highly motivated and smart people.

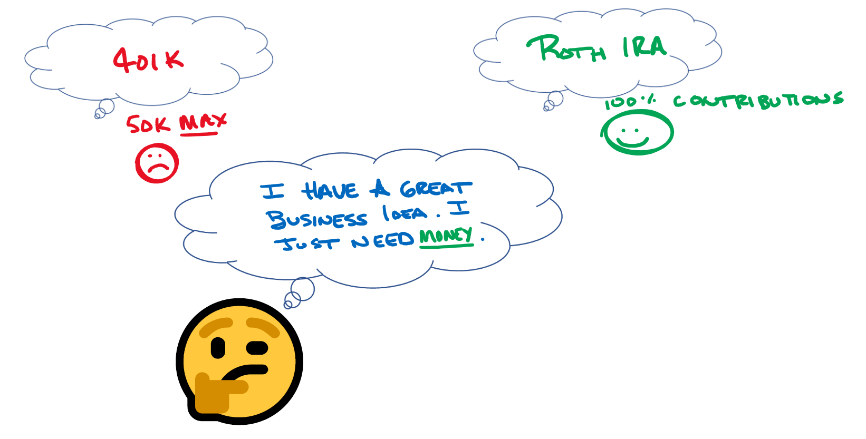

If you had a business idea today that could positively change the course for your financial future, can you access your money?

Having your money tucked away in a 401k might make you feel secure, but accessing those funds can be problematic.

❌You could take a loan (the greater of 50% of the balance or $50k) from your current employer 401k plan.

❌You could take a distribution from a Traditional IRA. If you take a distribution from a Traditional IRA this will trigger federal and state tax and potentially a 10% IRS penalty if you are younger than 59 1.2

✅Within a Roth IRA, you can access 100% of your contributions at anytime penalty free.

When opportunity knocks, you must be ready. Because if you aren’t, somebody else will be.

Fortunes favor the prepared!

The Roth Revolution is here!!

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

Withdrawals of Roth IRA earnings prior to age 59 ½ or prior to the account being opened for 5 years, whichever is later, may result in a 10% IRS penalty tax.