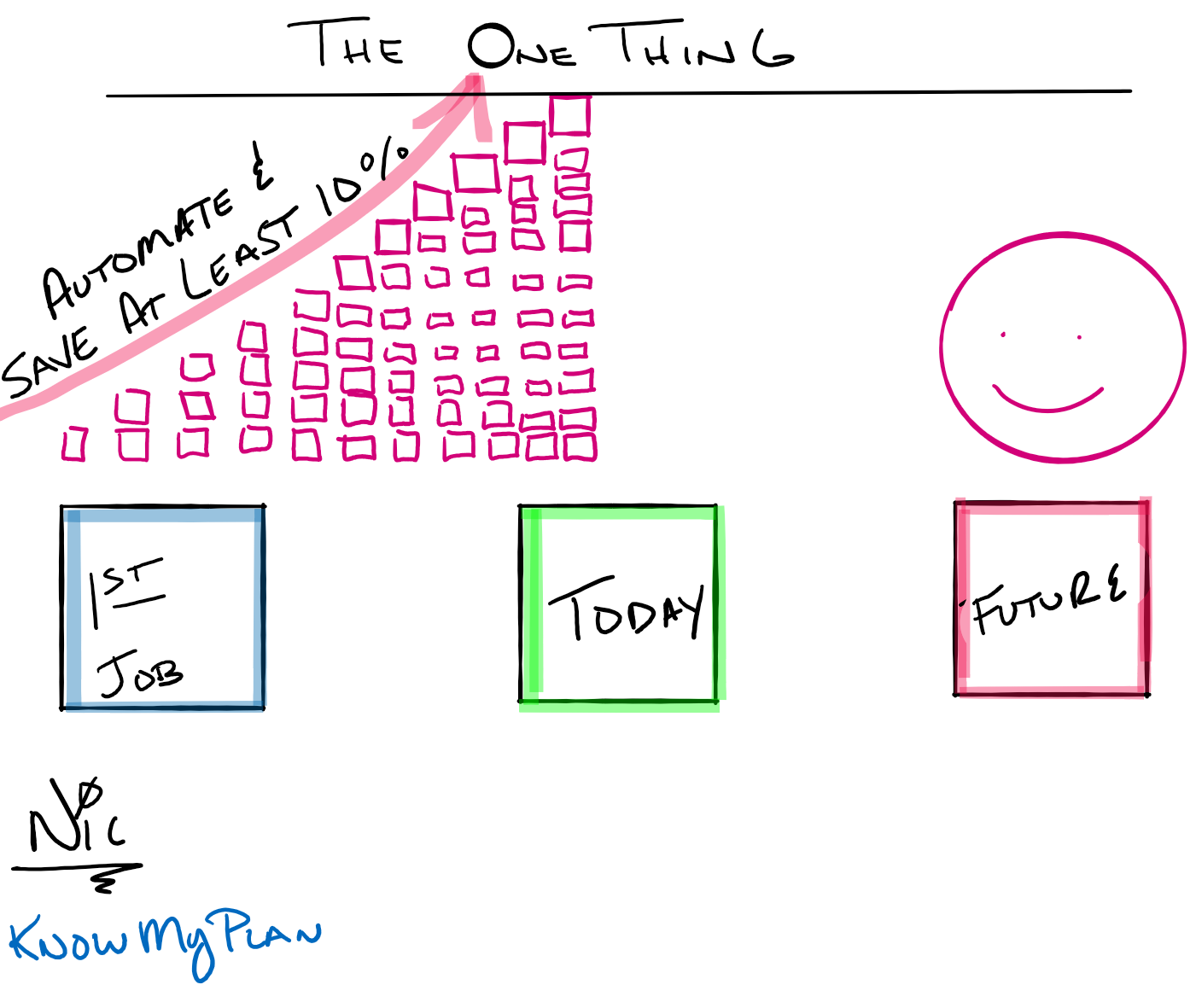

I was recently asked, “If you could go back and give yourself one piece of investment advice after graduating college, what would it be?”

My answer: Automate your savings of at least 10%.

As if that were not enough, I have 3 bonus tips:

- Adjust your savings as you begin to earn more.

- Pretend the money does not exist

- Do not check the account online or look at statements more than once per decade.

What’s a savings rate?

Let’s expand on this. Your savings rate is how much you are saving over a period of time, usually over the course of the month or a year. It is most easily thought of by looking at your take home pay and how much of it is saved, expressed as a percentage. If you receive $10,000 a month after taxes and save $1,000, that is a 10% savings rate.

If you can’t save 10% today that is ok. Save what you can even if it is 1%. From there, you can increase it over time, but saving and investing must be a priority. A simple tip is to save half of any new bonus or increase in income. This alone can have you in a great spot in no time! Don’t believe me? Think about what you are making today, compared to 5 years ago, and hopefully you will be encouraged!

Keeping these savings accounts or investment accounts out of sight and out of mind will go a long way in the growth potential of your assets. Ideally, do not have your emergency savings at the same bank as your primary checking. It is just too easy for little things to become emergencies, like a sale at your favorite store or the desire for pizza! We have all been there!

Jack Bogle the founder of Vanguard and creator of the Index Fund, was famous for advising people not to look at their statements. The idea is to stay invested and stay the course as it will pay off in the long run! He would famously tell people to just keep investing and have a cardiac specialist on hand when you finally do open your statement, approaching retirement, as the balance will likely be big enough to give you a heart attack!

Is 10% a big enough savings rate?

For most people, 10% is less than ideal. Fortunately your 401k at work is a great way to consistently increase your savings rate without feeling the burn. Most 401k’s have the option to automatically increase how much you put away every year. You can increase the amount in increments of 1%. Again, start where you are but stick with it, stay invested and invest early and often.

Your future self will thank you!