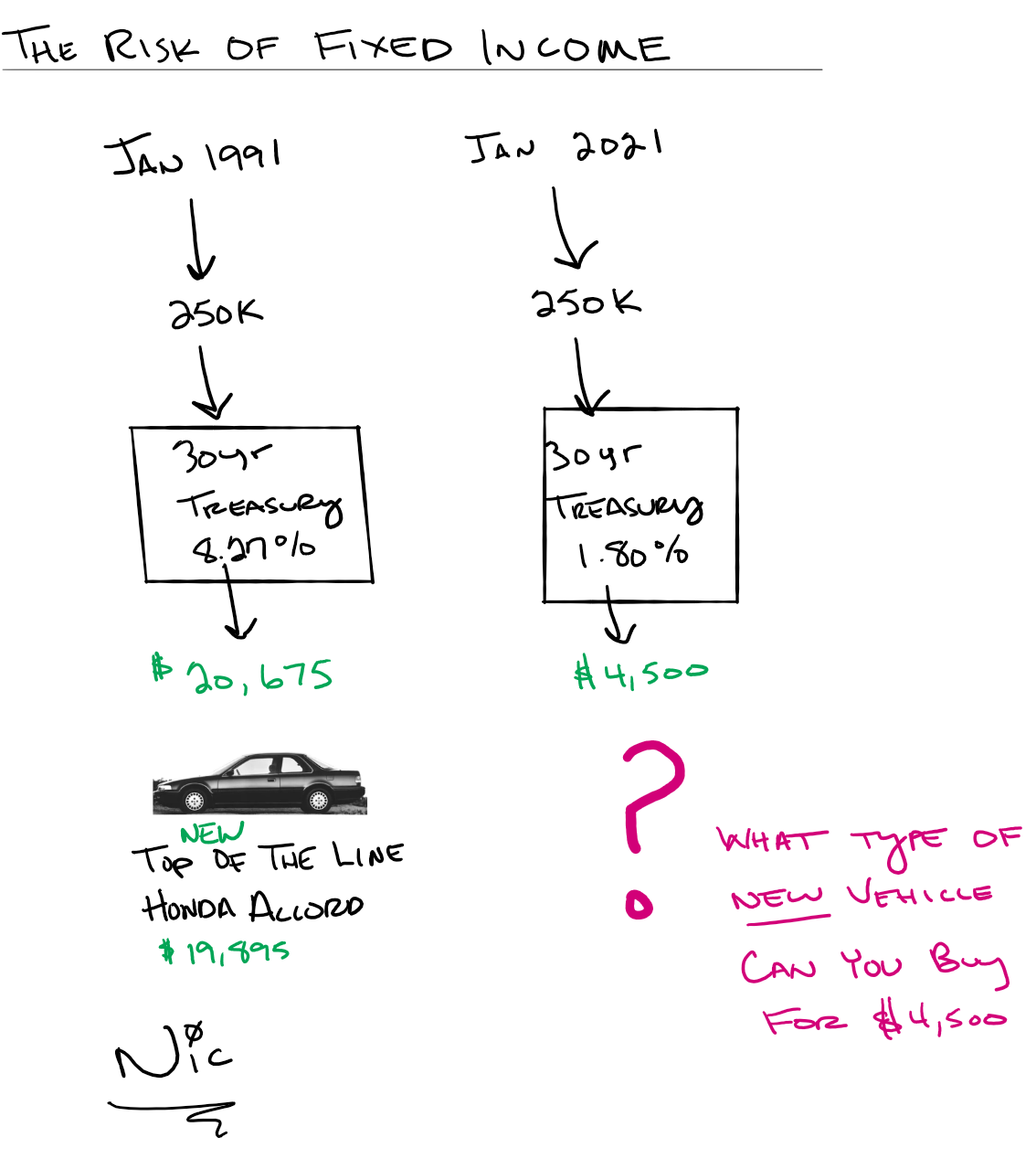

In January 1991, an individual could purchase a 30-yr U.S. Treasury Bond paying 8.27% or $20,675 per year on a $250k investment.

The value of that bond fluctuated until it ultimately matured at par. At that time, the individual received their initial $250k investment back.

Now the 30-yr U.S. Treasury Bond pays 1.80% or $4,500 per year.

In 1991, you could have purchased a brand-new fully loaded Honda Accord.

Thirty years later, you might only be able to purchase a 1991 used Honda Accord.

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.