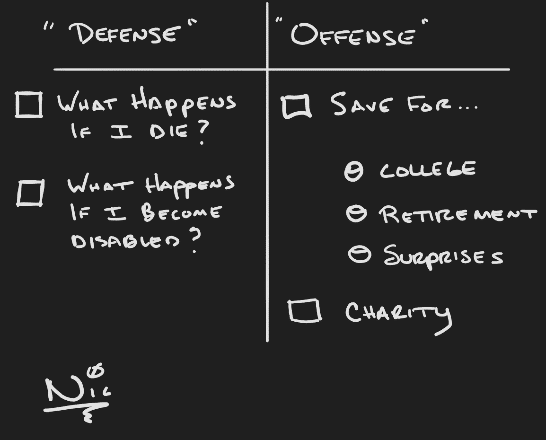

The planning process begins with identifying our goals. I personally like creating t-charts (see example above). On the left column, I create a list of reasons why I wouldn’t be able to accomplish my goals. In my example, those are risks that can be transferred to an insurance company. We hopefully addressed those two questions in my previous blog (“Non-Negotiables”).

Now on the right-hand column, this is where we play “offense” and make a list of goals that we need to be actively saving toward.

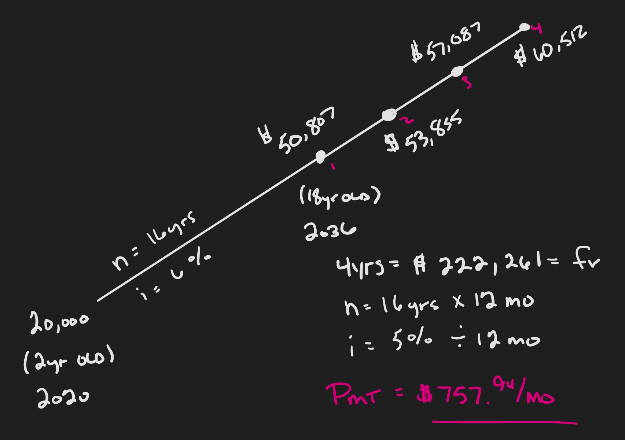

Let’s say your number one priority is to pay for 100% of college for your two-year-old child. Hypothetically, let’s assume that currently tuition and room and board cost $20,000 per year. Let’s assume that the cost of college will increase at 6% per year. How much will college even cost in 16 years? With our assumptions, we can see that college is projected to cost about $222,000 for our child. If we assume a 5% rate of return on investments, we need to save $758 per month to reach that goal.

You simply repeat this process for every goal that you have. As long as you have enough income to support your goals, you are in great shape.

However, many times people have $5,000 worth of goals and only $4,000 worth of income to allocate toward those goals. At this point, you have to start juggling your financial priorities. I believe this is an area where a financial planner can be of great value by helping you weigh the pro’s and con’s of prioritizing your goals. For example, you might have college planning for your children as your most important goal and saving for retirement as your second goal. A financial planner might help you realize that you can borrow money to pay for college, but you cannot borrow money to pay for retirement. You might still decide that college planning is your number one goal, but you realize that you might have to now work a few years longer than previously anticipated.

In conclusion, get out a piece of paper, create your T chart, and dream big about living your best adventurous life.

The hypothetical example provided is not representative of any specific situation. Your results will vary. The hypothetical rates of return used do not reflect the deduction of fees and charges inherent to investing.

Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. No strategy assures success or protects against loss. Investing involves risk including loss of principal.