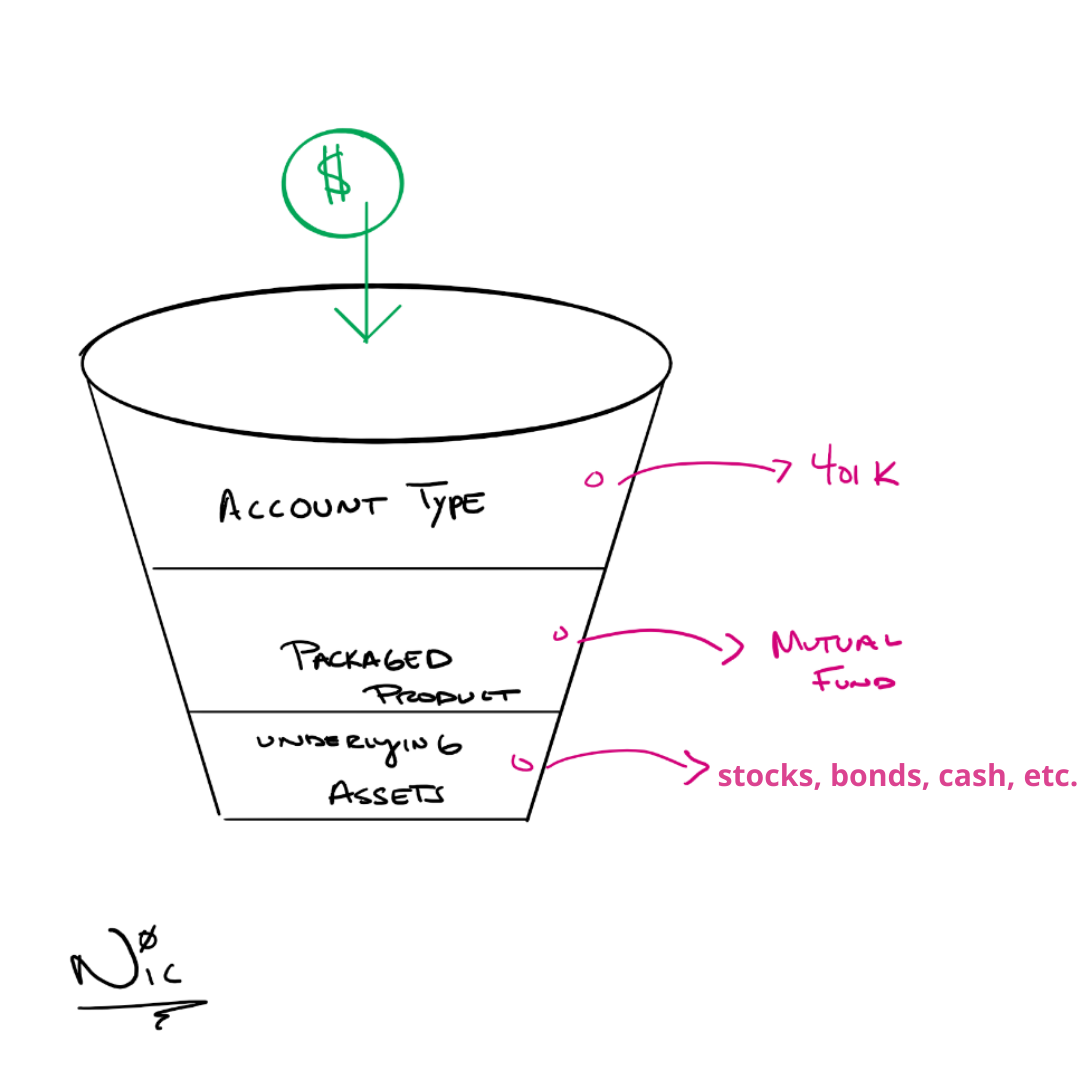

I recently saw “What is better a 401K or <INSERT RANDOM INVESTMENT>?” on a message board that I follow. Over the past 15 years in the financial industry, I have heard similar questions asked from new and experienced investors.

✅Step 1: Account Type

⭐ 401k, 403b, Roth 401k, Roth IRA, SEP, SIMPLE, Individual, Joint, etc…

⏰ NOTE: This is ASSET LOCATION. The account type largely determines that tax treatment of the underlying investments.

✅Step 2: What “Packaged Product” Am I Invested In?

⭐ Mutual Funds, Exchange Traded Funds, Unit Investment Trusts, Variables Annuities, Indexed Annuities, Fixed Annuities, Structured Products

⏰ NOTE: You may not be invested in a “packaged product.” If that is the case, proceed to Step 3.

✅Step 3: What Are The “Underlying Investments?”

⭐ Stocks, Bonds, Cash, Real Estate, Derivitives

⏰ NOTE: This is ASSET ALLOCATION. How your money is split between various asset classes.

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.