We (Nic & Jeff) are goal-focused, planning-driven, long-term equity investment advisors.

We are here to help you reach a specific place by the time you retire.

Then we’re guiding you through the retirement of three decades or more, during which you will strive to draw a lifestyle-sustaining income that rises to offset increases in your cost of living.

Even as your withdrawals grow, we’re working towards causing your capital to accrete as legacies to those you love.

What would make us change your plan?

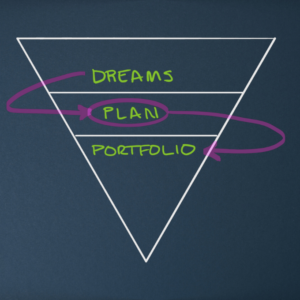

Once you have a plan in place and a portfolio that we and you believe is optimally suited to that plan, on what basis would we change either the portfolio or the plan itself?

Answer: The primary basis to change the plan is if your dreams have changed. If/when they do, please let us know as soon as possible!

Our View on Economic & Market Forecasts

- The economy cannot be consistently forecast.

- The market cannot be consistently timed.

When should I add or take money from my Nest Egg?

- The correct time to add to one’s long-term equity investment is whenever one has the money available above and beyond your emergency fund and money set aside for upcoming major purchases.

- The correct time to withdraw money from equities is when one needs the money. NOTE: When you need money, we may recommend using funds in your emergency fund or your fixed-income assets.

Closing Thoughts

We believe you can never make a good long-term investment policy out of near-term macroeconomic worries.

Let us focus on the earnings, dividends, and values of mainstream businesses over time horizons in line with your family’s lifetime financial dreams.

In 1992, the S&P 500 had earnings of $21 per share. Then in 2022 (thirty years later), the S&P 500 has estimated earnings of $220 per share.

So, in 1992, the S&P 500 was at 436. As I write this note, the S&P 500 is at 4,107.

Notice that both are approximately 10X.

Invest confidently!

–Nic & Jeff

P.S. You cannot invest directly in the S&P 500.

We are a full-service financial advisory company that allows you to make a one-page plan for your money and prepare for your future. Learn more about what we do and how we can help you here.

_______________

NOTE: Dividend payments are not guaranteed and may be reduced or eliminated at any time by the company.