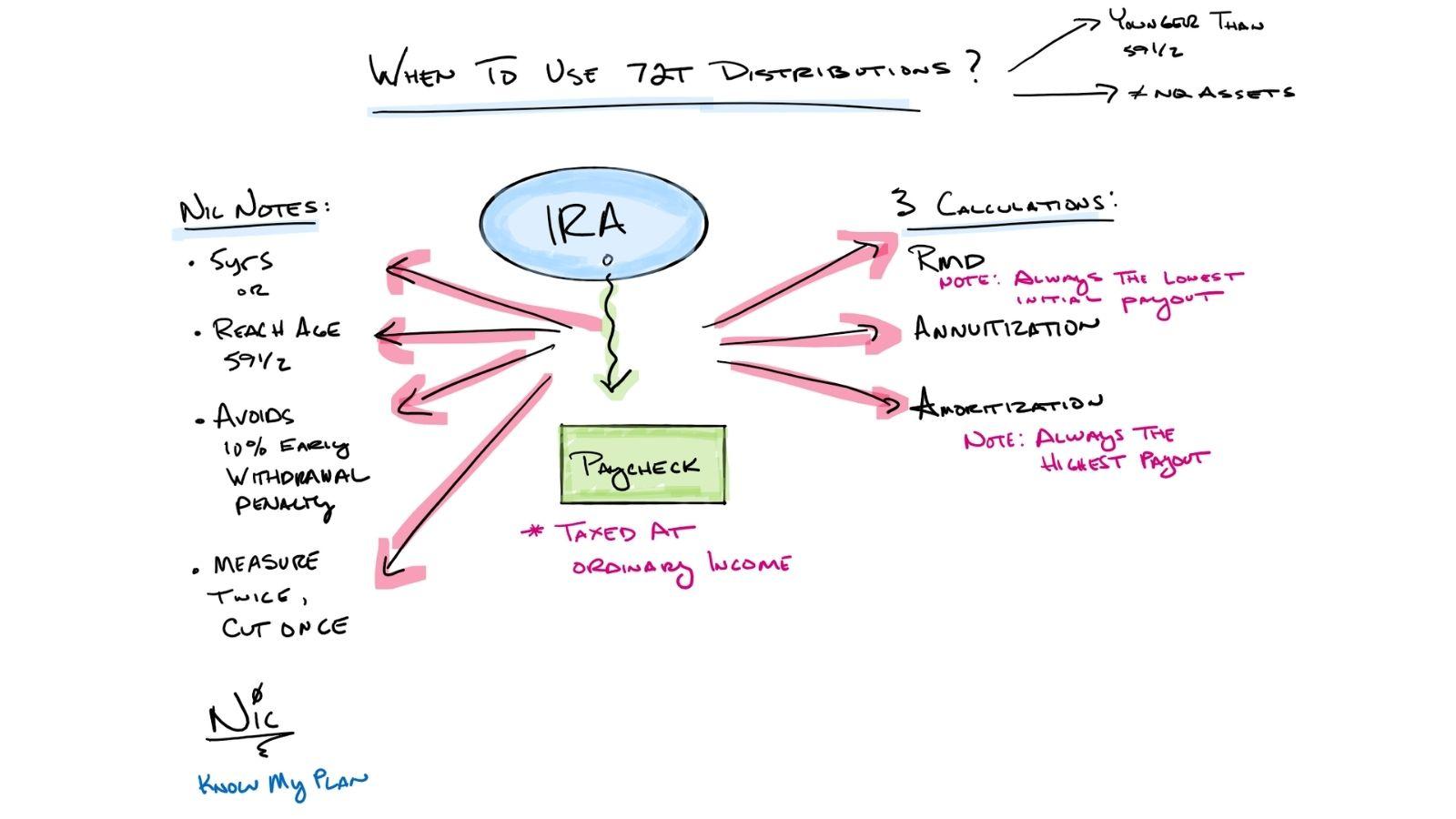

72T distributions are used to distribute funds from an IRA before you have turned 59 ½ to avoid the 10% early withdrawal rule.

These distributions must be done in a very methodical and precise way.

You must understand that there are 3 separate calculations that are run to determine how much you can withdrawal:

- Required Minimum Distribution – always the smallest initial payment.

- Annuitization

- Amortization -always the largest initial payment.

You can change your distribution method once per 5 years.

Once you begin the 72T distributions, you must do so for the longer of:

- 5 years

- Reaching Age 59 ½

Understanding this strategy could help you leave your job prior to age 55 or age 59 ½.

Due to the time frame and potential tax impact of this strategy, please always consult with a CPA and a financial planner before implementing a 72T.

IMPORTANT INFORMATION

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

LPL Tracking #1-05140249