Financial planning is sometimes counterintuitive.

It’s about getting the best rate of return for bragging rights amongst your peers. Right?

Wrong.

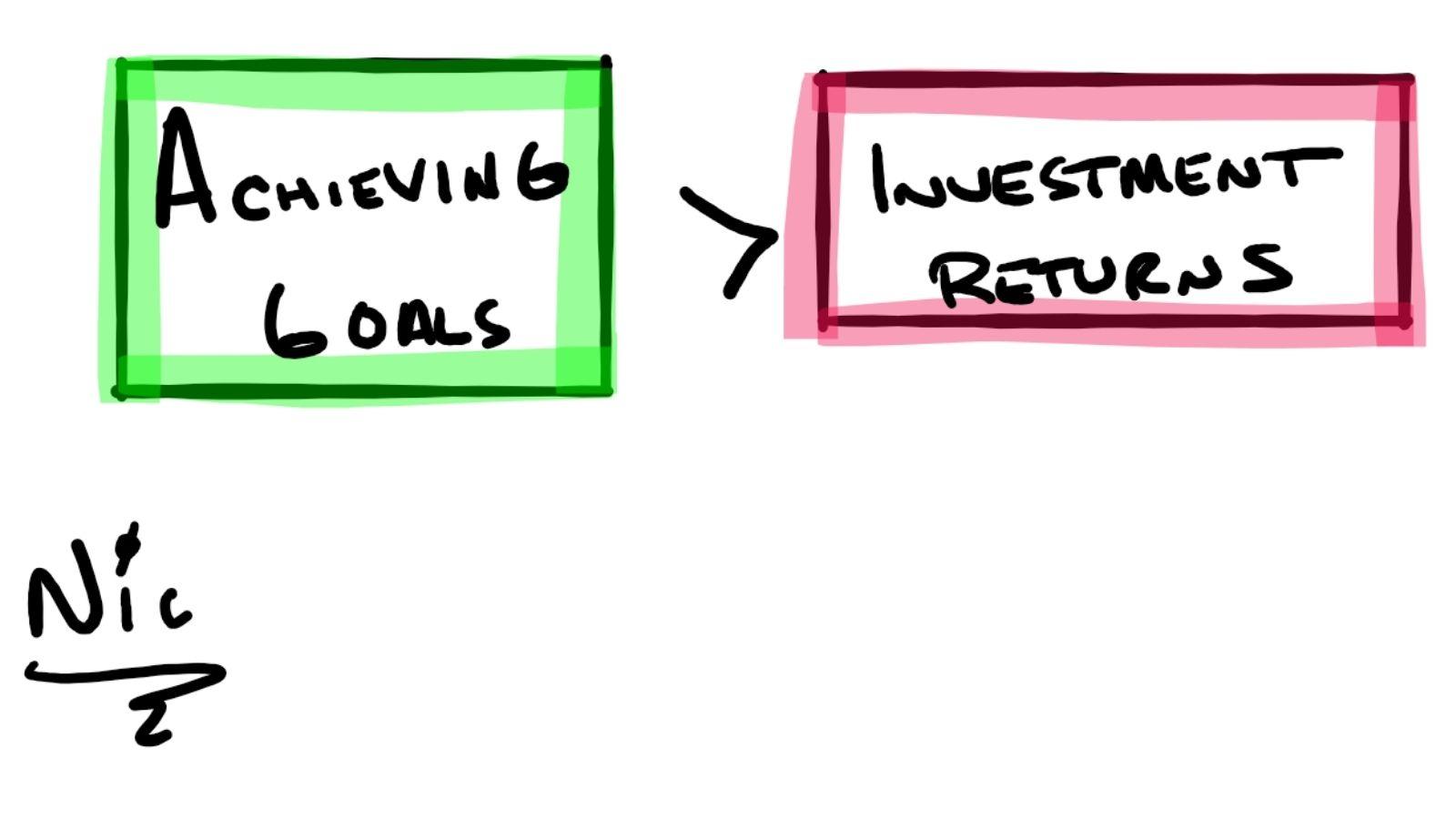

If you achieve your goals (getting kids through college, becoming financially independent, retiring, etc.), do you care how your investment returns compare to some arbitrary index?

I would certainly hope not.

Maybe your investment returns beat an investment benchmark, but you didn’t meet your goals.

How could that happen?

Perhaps you didn’t save enough money or keep it in optimal places.

How do you evaluate your financial plan?

Ask yourself these two questions:

- Do I understand my plan?

- Am I making progress towards my goals?

A rookie mistake in your finances is putting rate of return on a pedestal. Sure it’s a crucial piece of the puzzle though it is not the first step.

Professionals often view this as one of the later steps, if not the last step. You assess your goals first and ultimately back into the numbers you need to make the overall plan come together.

Money is a tool and, when used appropriately, can lead to a beautiful and fulfilling life.

This is the beauty of financial planning: The goal is to make your money work for your goals and not the other way around. So often, we get it backward. We get anxiety about a portfolio’s rate of return or some other arbitrary metric while missing the forest for the trees.

In other words, financial planning appropriately used is all about you. Your goals. Your dreams. Not what Dave Ramsey thinks is best or some other personality that you will never meet and have no direct involvement in your actual life.

It can be one of the most clarifying and liberating exercises in your life. For example, you should be unpacking your hopes and dreams, intending to build a plan to achieve them. It’s ok if there are tears involved. It should not be a dull exercise!

This is your chance to lay it all out. To say the things you may not have told anyone else. In summary, let us help you map out a plan to go out and get the life you want. Click here to set up a complimentary call to discuss what’s important to you.

IMPORTANT INFORMATION

All investing involves risk including loss of principal. No strategy assures success or protects against loss.

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

LPL Tracking #1-05124538