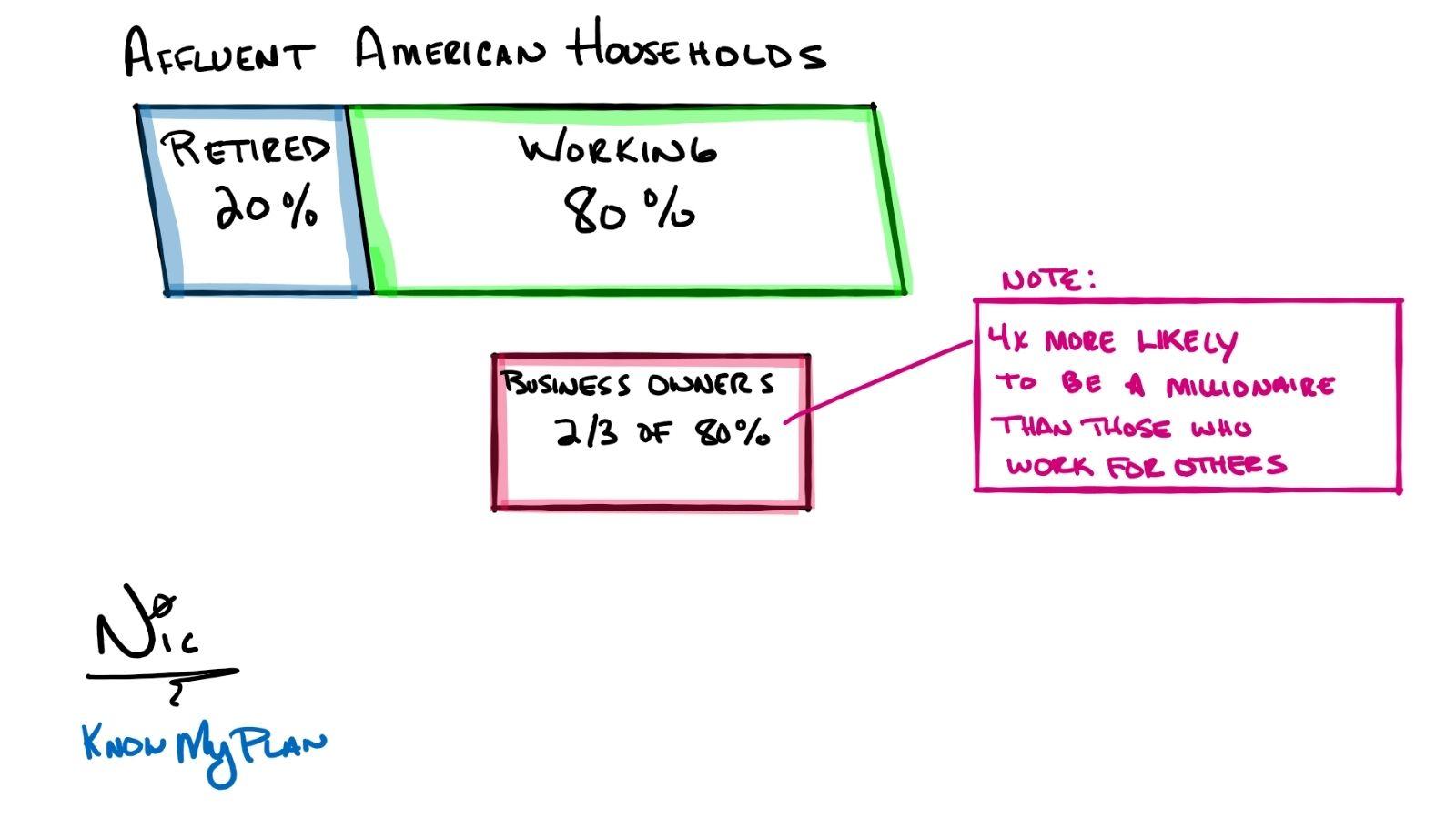

A quote from the book The Millionaire Next Door:

“Twenty percent of the affluent households in America are headed by retirees. Of the remaining 80 percent, more than two-thirds are headed by self-employed owners of businesses. In America, fewer than one in five households, or about 18 percent, is headed by a self-employed business owner or professional. But these self-employed people are four times more likely to be millionaires than those who work for others.”

Bet on yourself

Betting on yourself has its rewards. Never before in the history of the world has it ever been easier to start a business? So many companies today have just one employee, the owner.

Considering the ‘gig economy,’ there are a million ways to stitch together an income that often provides significant tax benefits, more flexibility, and higher earning potential than in your day job.

Don’t be so quick to hit me with the, ‘Hey, starting a business is risky.’ Everything has risks. There is a risk of leaving your money in a savings account that doesn’t keep pace with inflation. Staying at a job you hate is a similar fate. It’s a slow burn—death by a thousand boring meetings.

I agree that not everyone’s cut out to start a business, and that is ok. However, if you are reading these words, there is a chance that you like to learn. You want to better yourself and do better than you did yesterday. That is the makeup of an entrepreneur.

Just start The Business

At the risk of beating a dead horse, it is easier than you think because there is a service for everything that you do not know how to do. Don’t know how to build a website? Some people would love to make it for you! Not sure about bookkeeping? There are services to handle that for you! There is a service for everything!

If you have a skill that people will pay for, it is worth considering what it might look like to raise your hand and take on something on the side.

If you have a great business idea, bet on yourself. Go out on a limb and take a risk.

— Nic & Jeff

We are a full-service financial advisory company that allows you to make a one-page plan for your money and prepare for your future. Learn more about what we do and how we can help you here.

____________________________

Source: https://www.theladders.com/career-advice/4-things-millionaires-have-in-common-backed-by-research