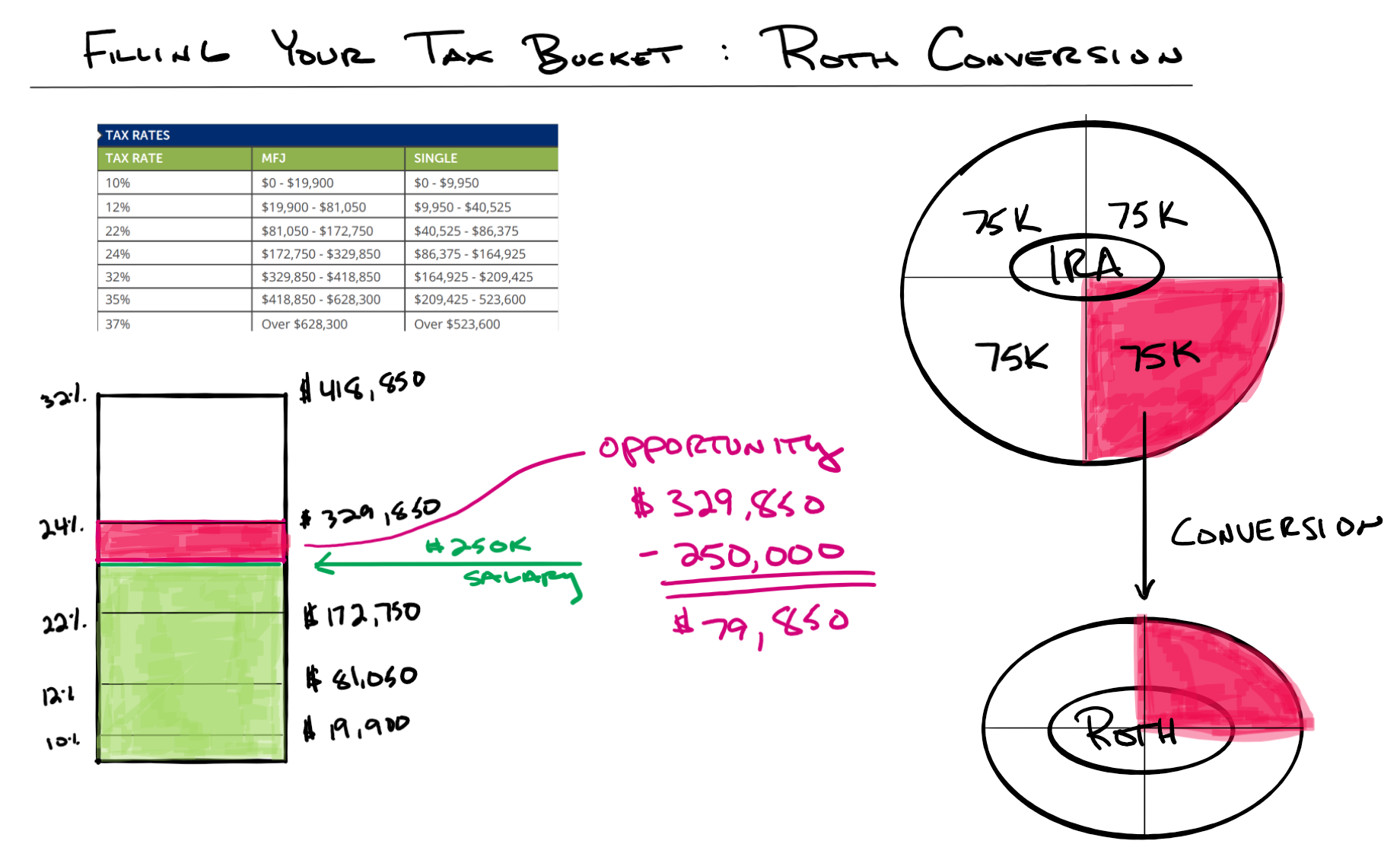

Let’s assume that you have a $300k IRA and that you would like to convert to a Roth.

The number one question that I hear is, “How much do I convert?”

I think a great starting place is to fill your current tax bracket.

Let’s assume that you have a salary of $250k. Currently, you are in the 24% tax bracket. The 24% tax bracket goes all the way to $328,850.

The opportunity would be to convert up to $79,850 ($329,850-$250,000).

For our example, let us convert $75,000. If everything stays constant, you could have your entire IRA converted over 4 years in a flat market.

Key Notes:

???? Evaluate tax brackets every year

???? Evaluate your income every year

???? Make sure you have money in non-qualified accounts (after-tax money) every year to pay for the tax consequences. You do not want to withhold from the IRA.

???? Check with your financial planner & tax planner every year

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

Traditional IRA account owners have considerations to make before performing a Roth IRA conversion. These primarily include income tax consequences on the converted amount in the year of conversion, withdrawal limitations from a Roth IRA, and income limitations for future contributions to a Roth IRA. In addition, if you are required to take a required minimum distribution (RMD) in the year you convert, you must do so before converting to a Roth IRA