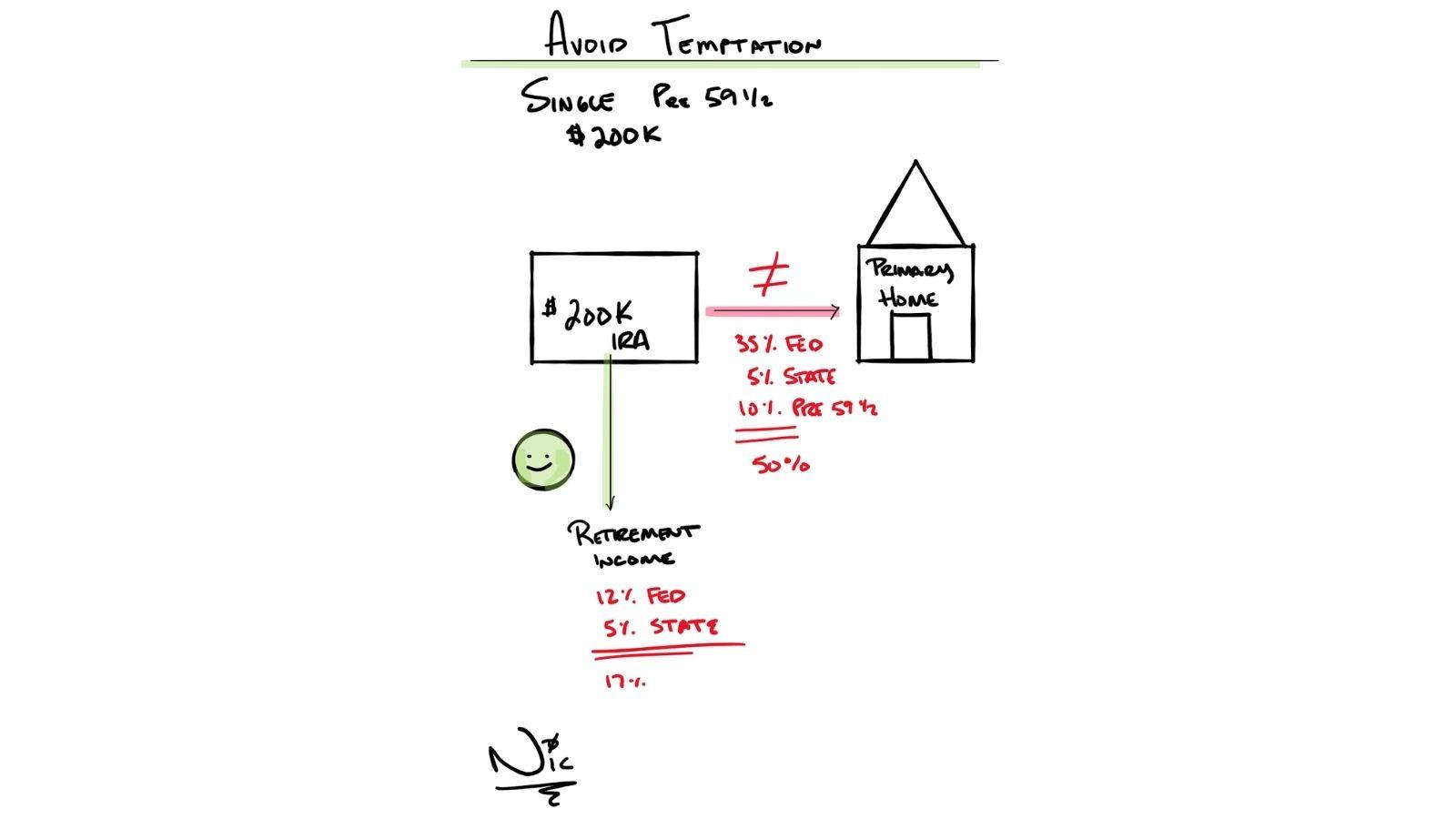

I had a conversation with a middle-aged man who had not yet reached the magical age of 59 ½ who was making about $200k per year.

He had a sound financial plan. By all accounts, he was on track.

He decided that he wanted to purchase a nice condo. He had good credit and the ability to borrow money for a mortgage at 3%. However, he decided to liquidate his IRA to purchase this condo to have a lower mortgage payment.

The single 35% tax bracket starts at $209,425 in 2021.

- $200,000 distribution

- 35% Federal Tax Bracket

- 5% State Tax

- 10% Pre 59 ½ Penalty

He will pay 50% in taxes and penalties ($100,000) – WOW! These same funds were on track to be withdrawn in retirement at no worse 12% federal and 5% state (17% total). Why pay 50% taxes & penalties when you can borrow money at 3%?

AVOID TEMPTATION!

Our biggest job as financial planners is to help people avoid big mistakes.

It can take years and years of doing things right only for your plan to fall apart with a few bad decisions.

When given the option of paying 17% in taxes or 50%, most would choose 17%. However, the total fallout is not immediately apparent in this case.

Opportunity cost is the killer in this instance. With some basic assumptions to consider, this becomes quite sobering very quickly. Assuming he planned to work another ten years, his money would have more than doubled, assuming an 8% return over that period.

So not only does he not have double his money, but he doesn’t have it at all because he liquidated it at a 50% loss to taxes.

I’m not here to kick anyone while they are down, but it will be challenging to bounce back from this one. Whenever possible, don’t pay more taxes or penalties than you have to.