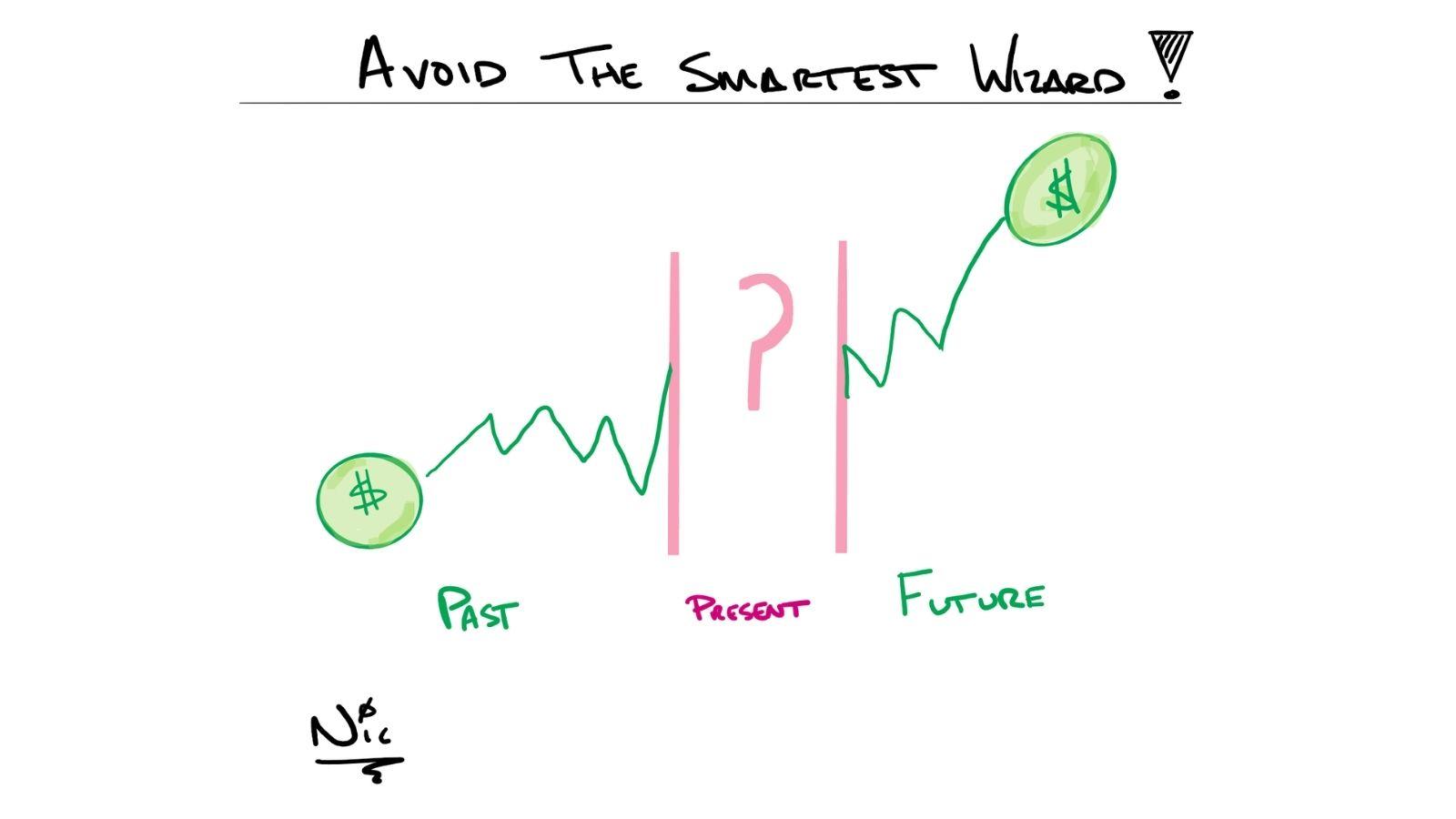

One of the most common questions I receive is something like, “if you had a crystal ball, what do you think is going to happen over the next year?”

No one has a crystal ball

There are plenty of people that would love to give you their prediction, or worse, sell it to you. Turn on any financial TV and wait long enough, and you are sure to be inundated with a variety of conflicting talking points and analyses that all seem valid in one way or another. Similarly, it is important to remember that financial TV is just entertainment. Worse yet, selling fear gets better ratings. Unfortunately, that will be unlikely to have a positive impact on your portfolio’s performance.

Back to the question at hand. The answer, at any given year, is the same:

I do not know, and nobody else does either.

No crystal ball, no problem

Trying to make short-term predictions is a fool’s game. You might correctly guess a few times. However, getting it wrong just one time could derail your financial plan forever.

Do you believe the markets will not only be higher but substantially higher a decade from now? If so, stay invested for the long term!

There are various ways to increase your ability to hang on through the ups and downs of the market. For instance, heeding the advice below can give you the cushion you need as you prepare for retirement.

- Make sure you have an emergency fund (6 months of expenses). Never invest your emergency fund.

- Keep five years’ worth of portfolio income needs in fixed-income investments. For example, if you need $1,000/month from your portfolio, keep at least $60,000 in fixed-income investments.

Each person’s risk tolerance is different, so this is just general information. Everyone’s plan will be different, just like each person’s goals are different. All that to say, investing in equities will not be for everyone, and that’s ok. Adhering to the above rules can increase your chances of a positive outcome for those who do.

IMPORTANT INFORMATION

Information in this material is for general information only and not intended as investment, tax or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.