Mutual funds are one of those terms we hear frequently but no one stops to explain what they mean. You likely have a general understanding, though this article will hopefully clarify some things to give a basic understanding of what a mutual fund is. We will also touch on the kissing cousin of the mutual fund: the ETF.

Before mutual funds existed, a Financial Advisor, or a Stockbroker would construct a portfolio with individual stocks. One of the biggest drawbacks of this model is that to achieve any amount of diversification, you had to have a lot of money to invest. Each stock trades at a certain price, and you need multiple shares of many different stocks to build out a portfolio. To give an extreme example, if you wanted to invest in Berkshire Hathaway stock, (at the time of this writing at least) you would have to pony up $428,101 to purchase a single share of their stock. What’s that? You only have $428,000? So sorry you must take your money elsewhere.

Again the above example is extreme but the reality is the same. If you do not have enough for a single share then you must do something else. You can see that even if a stock is trading at $100 per share, having multiple shares in multiple companies add up every quickly.

Enter: The mutual fund

With the advent of the mutual fund, the average investor can have access to hundreds of stocks in one prebuilt portfolio managed by professional money managers for as little as $50 per month! This alone is one of the biggest wins for average investors!

Similarly, ETFs or Exchange Traded Funds are very similar. Both are available in a pre-packaged portfolio. ETFs are largely invested in stocks or bonds. EFTs have a few differences. Most notably, ETFs are traded during market hours like a stock would be. Unlike mutual funds whose prices are locked in at the end of the trading day. One benefit for beginners is that with an ETF, you can purchase a single share of an identical fund if you do not have enough capital to meet the minimum requirement of the mutual fund.

You invest $500 a month in a mutual fund. All of your money is in the market. If you did the same $500 in the ETF you would purchase 2 shares with money left over and the balance would sit in cash. Not very efficient. This happens to be an advantage of mutual funds.

What’s next?

Taking action

- Select a mutual fund or ETF that you feel best fits your investment objective.

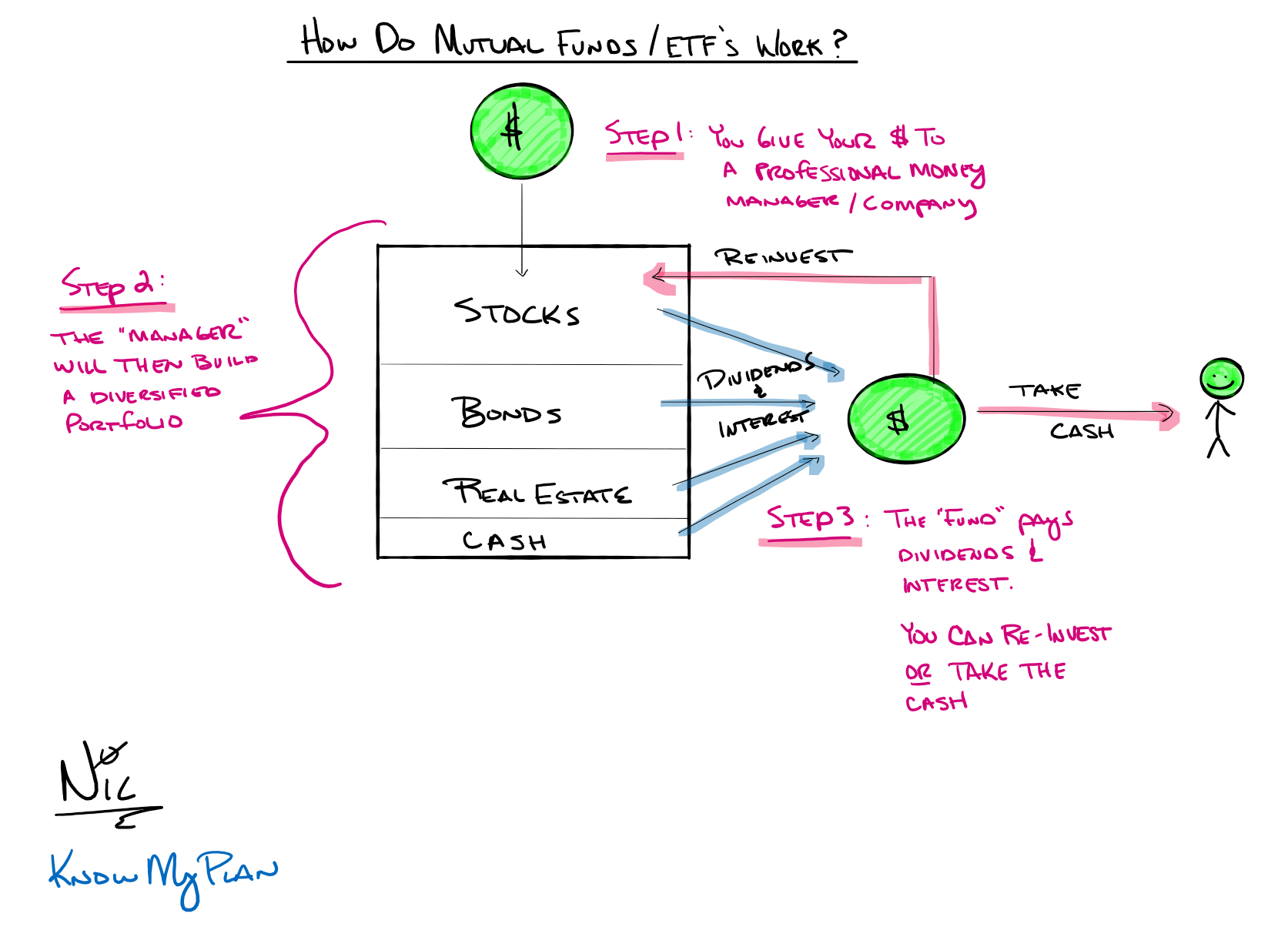

- You are giving your money to a professional money manager or company.

- Their goal is to build a broadly diversified goal.

- The objective of the “fund” is to pay income in the form of dividends and interest. You can re-invest that income, or you can take the cash and put it in your bank account.

Now that you see how this all works, you should be one step closer to getting your money working for you.