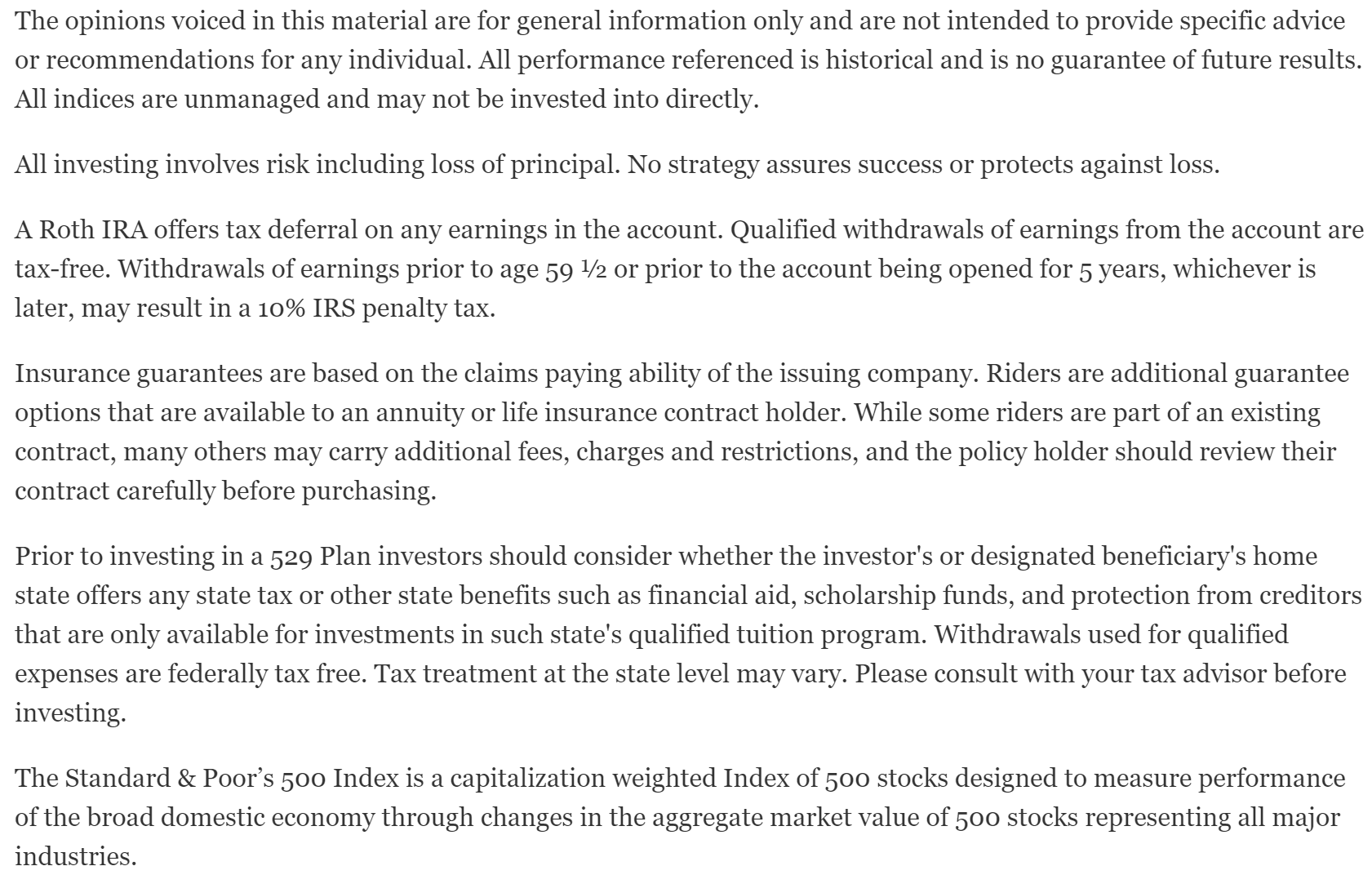

What is the Sandwich Generation?

The sandwich generation is defined not by age but by responsibility. Being a member of the sandwich generation means caring for both a parent and a child—many families in their 30s, 40s, and 50’s are members of the sandwich generation.

Put On Your Safety Mask

On an airplane, you put on your oxygen mask during an emergency before helping others. The caregiver’s role is of prime importance.

It is hugely important to the way the entire family operates.

Before discussing the financial planning implications of being in the sandwich generation, we must consider investing in our health.

Being in the sandwich generation can be an incredibly stressful period that can manifest in multiple ways.

If the primary caregiver can not function, a cascade of unintended consequences can unfold without proper planning.

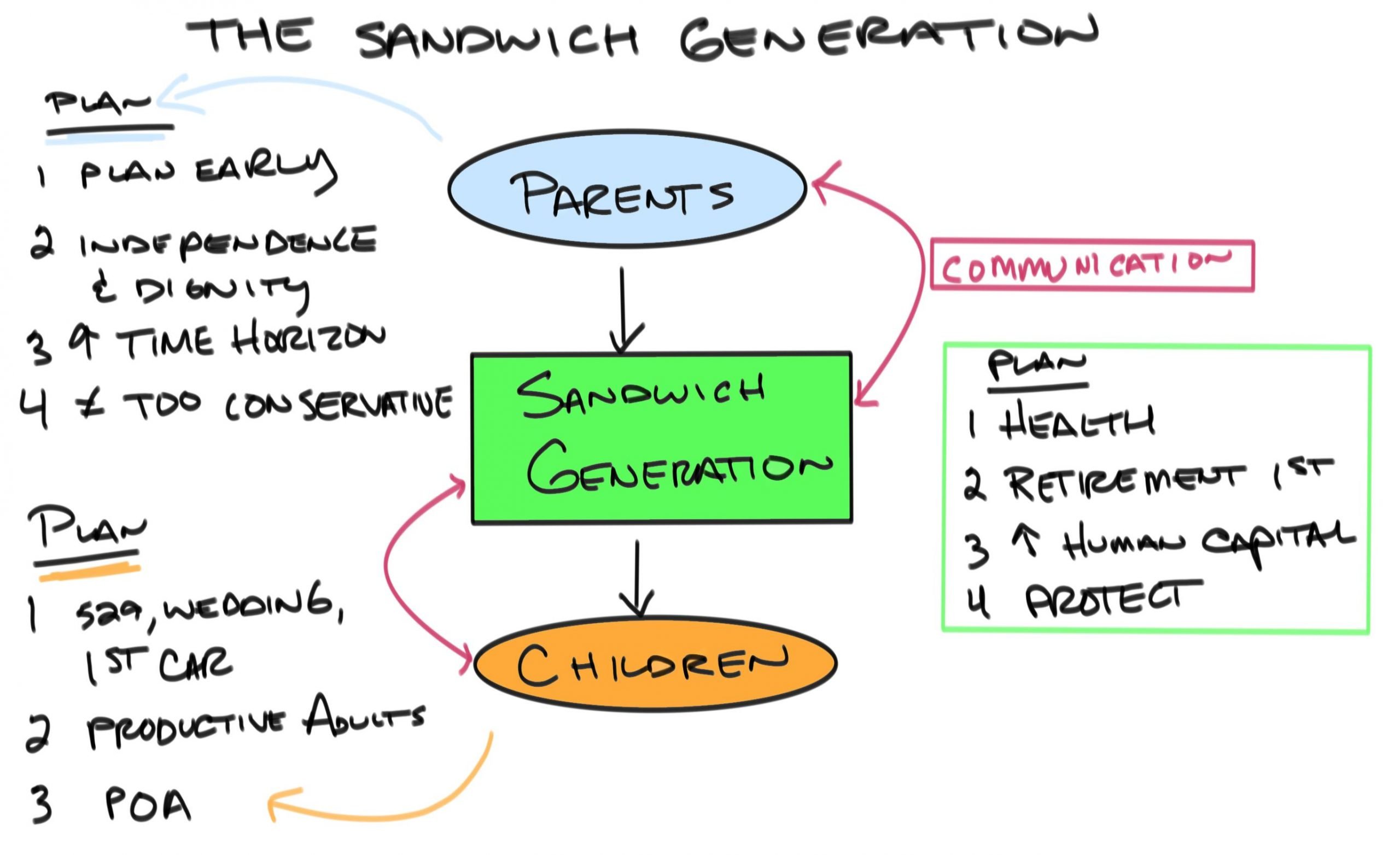

Helpful Ways to Manage Stress

One of the keys to successfully navigating your role in the sandwich generation is to manage stress. We can manage our stress with physical activities, such as walking, exercising, meditating, or finding a favorite sport. We should also balance physical activities with social activities like talking with friends and family.

Of course, getting adequate sleep, proper nutrition, and staying hydrated will go a long way in reducing stress. According to dripdrop.com, 75% of Americans are chronically dehydrated. Being hydrated causes fatigue, foggy memory, irritability, and more. Dehydration can make you more at risk for kidney stones and heart problems (yikes).

Finally, do not forget to care for and lean on your support system. Playing your role in the sandwich generation is more than just financial. As you provide emotional support for all of your family members, remember that you need support too and people to open up to about all that’s on your plate.

Why is this Generation Feeling the Pressure?

The sandwich generation is feeling the pressure because families are increasingly smaller. There is more responsibility for fewer people. Declining birth rates in the United States have led to fewer siblings. In addition, many couples delay having children longer than previous generations. It is not uncommon for parents to be raising children into their 40’s and 50’s today.

Unfortunately, more parents may be divorced. When care is needed, the spouse is generally the first caregiver in line. Because of a higher divorce rate, there may not be a spouse to provide care. Finally, there are more single-parent families. Single-parent families, by definition, rely upon one individual for income which can lead to a smaller margin for error than a dual-income family.

If this resonates with you, click here to learn more about what we call your Financial Fortress Blueprint™!

Financial Planning Implications

The Parents in the Middle

When you are in the middle, you are the engine for the family office. Most likely, you currently have the highest human capital (i.e., the ability to make money), and you are at a younger age without cognitive decline. If planned for correctly, you have the potential to see multiple generations of your family thrive.

The Plan – Parent’s First

Hands off the next egg

- As hard as it may seem, you must never sacrifice your retirement plan. Retirement is one of the few things in life that you can not finance. Take advantage of tax-advantaged accounts such as employer-sponsored retirement accounts, health savings accounts, and Roth accounts.

- Create a plan to determine how much to save, where to save, and invest in becoming financially independent, ideally sooner than later.

Healthcare concerns

- Prepare for your future health care expenses. Besides making healthy choices in all aspects of your life, consider contributing to a Health Savings Account if you are part of a high deductible health care plan (HDHP). The IRS allows a family to contribute up to $7,300 to a Health Savings Account in 2022.

- PRO TIP: Keep track of all of your health care expenses by keeping your bills and your receipts when you paid. Currently, there is no time cap on receiving reimbursement for your health care expenses. For example, if you had a health care expense today and you paid that bill through your checking account, you could reimburse yourself in the future. Keeping track of your historical medical receipts would allow you the potential for your HSA to grow for years before disbursements. Most HSA accounts will enable you to invest your contributions. If eligible, make sure to choose appropriate investment vehicles for these dollars instead of them sitting in a cash account.

Guarding your castle

- Protect. It’s great when everything goes our way. However, we have to have a plan for when things don’t. Make sure you have your estate planning documents in place. Your will, medical directives, and power of attorney are essential documents to have executed. Your situation may include other documents like revocable or irrevocable trusts.

- PRO TIP: These documents need to be notarized. People need to be able to locate these documents in the blink of an eye. At Know My Plan, we recommend having these documents saved to the cloud and accessible via smartphone. If you have kids, go ahead and have the power of attorney documents drafted for your children. In most states, they are considered an adult at 18 years old. If they are considered an adult, you may not be able to get information if something happened to your child while they were away at college.

- Make sure that you have the right amount and right type of life insurance in place. After all, you are the engine that is driving the family office. Multiple generations of your family are dependent upon your ability to earn income. If you were to pass away without appropriate coverage, the financial impact could be widespread.

- Make sure you have the right amount of disability insurance in place. Disability insurance protects potentially your largest asset, your ability to earn an income.

- Make sure you have long-term care insurance. Long-term care insurance begins to pay out if you have a cognitive event like dementia or Alzheimer’s or you cannot perform two of the six activities of daily living (eating, bathing and hygiene, dressing, grooming, mobility, and using the restroom without assistance). Many young people believe that their disability insurance will provide coverage for long-term care needs, sadly not the case.

The Kids Are Alright

Once your plan is well on its way, you can focus on your dreams for your children. Clearly outline what you want and don’t want to happen. Do you want to pay for all of college, half, or none? Are you willing to pay for a wedding? The most important thing is that you communicate this to your children at an appropriate age. For example, you might be willing to contribute $350 per month to a 529 Savings Plan. So make sure to communicate these things with your kids as they get older.

Saving for college

The 529 Savings Plan is a terrific vehicle to save for future college expenses. Your contributions have tax-deferred growth potential and qualified distributions come out tax-free. Contributions can be invested similarly to your retirement plan for growth potential.

The 529 offers a great deal of flexibility in that you can transfer funds between multiple beneficiaries. In addition, you’re not penalized if your child gets a scholarship. If the funds aren’t used for qualified educational expenses, there is a 10% penalty on the gains.

I have seen great examples where families communicated in middle school to their children what they would contribute to the cost of a college education. It incentivized the children to get good grades and talk openly with their guidance counselors about college scholarships.

Once they realized they would have some skin in the game, they worked a little harder to minimize potential student loans. Again, do not wait until middle school to talk about money in general. Start a piggy bank, teach them to invest early. Don’t feel like you have to wait until they are 16 to have any conversations around money.

Grandparents

Just as like setting expectations with your children, speaking to the grandparents is no different. Communication and being empathetic are paramount to navigating this conversation. No parent wants to be a burden on their child. Try to explain that you want to understand their plan, wishes, and how you can best help them fulfill their vision. Your parents very well need your help because they statistically are living longer.

- For a 65-year old couple, there is a 50% that at least one spouse will reach 92. ¹

- 2/3 of people currently 65 years old will need long-term care support at some point.²

At this point, the goal is to create a financial plan for your parents the same way that you did for yourself. Your financial plan focused on how much to save, where to save, and how to invest. If your parents are still working, the process is the same. However, if your parents are retired, the focus should be on investing and distributing the investments in the most tax-efficient manner. After all, it is not how much you have, but how much you keep after paying taxes.

The most common mistake retirees make is grossly underestimating their life expectancy and becoming too conservative too early. We often hear phrases like, “I don’t even buy green bananas.” As previously referenced, we have to plan for a minimum 30-year retirement.

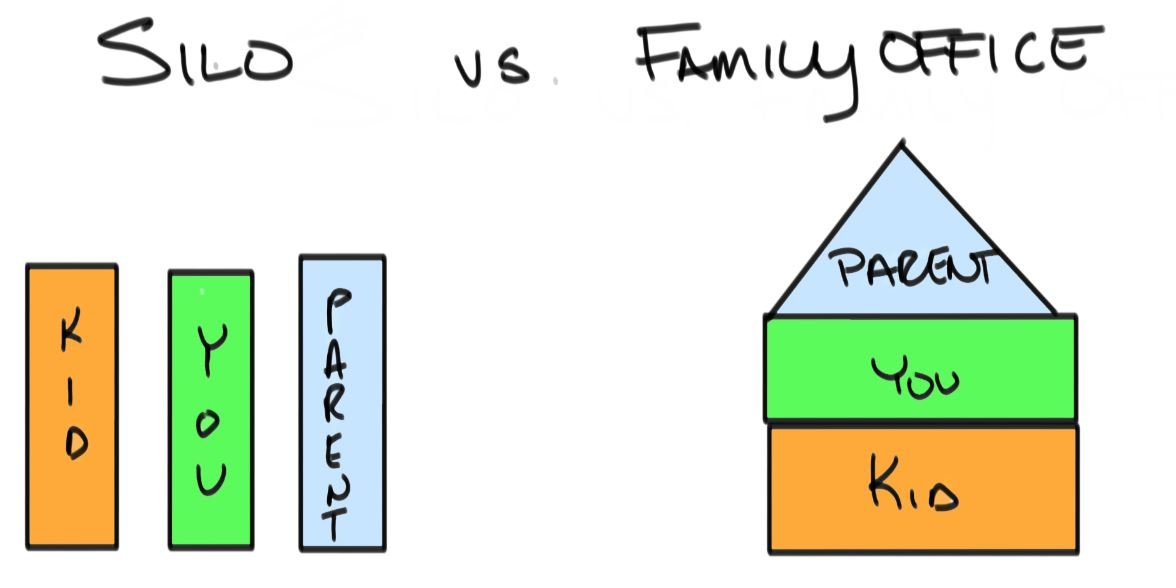

The Retirement Investment Framework

Cash is king?

We believe that a great starting point is to keep six months’ worth of cash in emergency funds. For example, if you have monthly expenses of $5,000 per month, we advise keeping $30,000 in an emergency fund. We are willing to accept defeat with these dollars and admit that they most likely not keep up with inflation. Typical emergency funds would be in bank or credit union checking or savings accounts.

Keeping up with… inflation?

Next, we would want to keep five years’ worth of portfolio expenses in fixed income. For example, if you need $2,000 per month from your portfolio, we advise keeping $120,000 in fixed income ($2,000/ month x 12 months/year x 5 years). Fixed income hopes that it can create a return equal to inflation over time. Fixed income investments could vary from bonds, fixed annuities, fixed indexed annuities, cash value life insurance, certificates of deposits, etc.

Growth mindset

Finally, we would recommend keeping the balance invested for long-term growth potential. If your parents have $1,000,000 with $5,000 monthly expenses and a need of $2,000 per month from the portfolio, we will allocate $30,000 to the emergency fund, $120,000 to fixed income, and $850,000 for long-term growth potential.

The hope of investing for long-term growth is that these dollars can create a return exceeding inflation. These are the dollars earmarked to develop independence and dignity for our later years. Growth investments could be companies (the stock market), real estate, precious metals, cryptocurrency, commodities, baseball cards, art, etc.

While past performance is not guaranteed, let’s take a look at the S&P 500 between 1950 and 2020. It is worth noting that the worst the S&P 500 has performed over any rolling 20 year period is +6%.

When your growth investments are performing well, take distributions from your growth allocation. However, when investing for growth, there will be short to intermediate-term volatility where your growth investments will decrease in value. When those dips happen, we want to transition to our fixed-income assets for distributions. We want to give time for our growth investments the opportunity to recover before taking additional distributions.

Long-Term Care Expenses

The other prevalent mistake we see the grandparents make is not preparing for long-term care expenses or health care expenses in general. You will need to evaluate if your parents have long-term care insurance. If they do, you will need to assess what it pays for and for how long. In addition, you will want to review any life insurance policies that your parents may own. Many life insurance policies have riders for long-term care or chronic illness.

If your parents are in good health, you could evaluate if a long-term care policy or a life insurance policy with a rider would benefit their financial plan. If long-term care is deemed necessary, the children could potentially pay, or help pay the premiums on the policy.

Clarity and Peace of Mind

Similar to your plan, it is paramount that your parents have their estate planning documents in place and that you have access to them. Understanding your parents’ wishes in their estate planning documents is incredibly important. It is common to make some life decisions ahead of time.

If you can get Mom and Dad to communicate their wishes in a family meeting setting, it can prevent fighting during life’s most stressful moments (i.e., “I think Mom and Dad would not have wanted us to pull the plug.”)

Often, your parents will want to stay in their home as long as possible. Independence and dignity are at the top of their wish list. Use this family discussion as an opportunity to talk about the family’s mutual bucket list.

Every conversation is an opportunity to unlock information that can provide more clarity on your family’s wishes, challenges and possibilities. Working together can increase harmony, and trust as you navigate this challenging terrain.

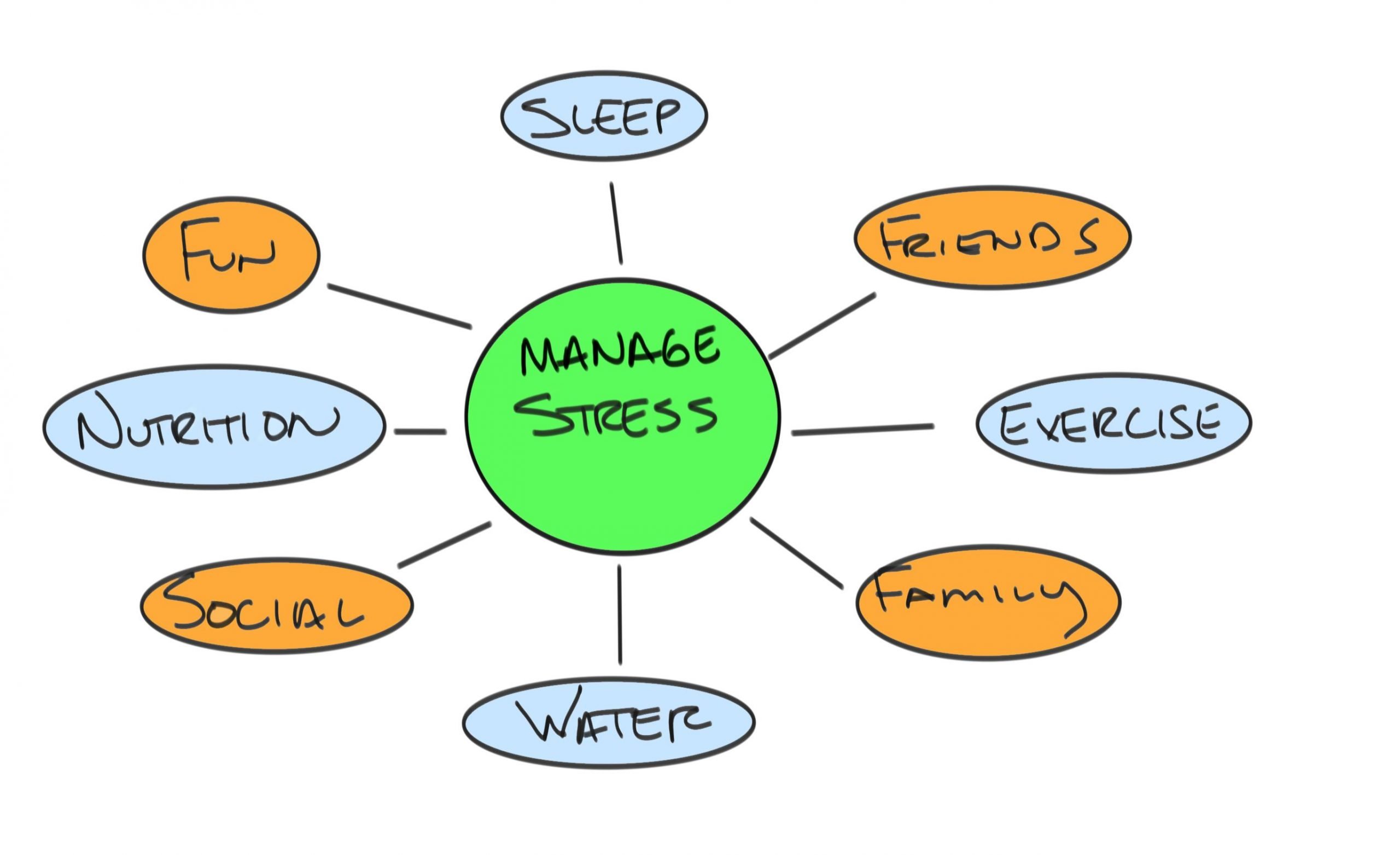

Silo vs. Family Office

This article has discussed three different generations that each have their unique planning requirements. In a silo approach, you would have three individual plans met through their assets and human capital.

A family office approach would pool the assets and human capital of all generations together to meet the needs of all members of the family. In the family office approach, you would generally have an infinite time horizon.

For instance, you want the wealth maintained for ongoing generations. It can be much easier to manage assets to meet long-term growth requirements with an infinite time horizon mindset.

Ultimately, as a family, you will need to decide which approach is right for you. The key to making a family office approach work is to have clear communication between all parties involved.

Conclusion

It is tempting to help your children or parents; you must only do so out of abundance. Never do anything to jeopardize your plan. There is nothing wrong with re-evaluating your goal if you are willing to live on less to create more margin.

However, don’t bank on working longer (your body or employer might have other ideas) or saving more in the future (life could always throw you curveballs). Communicate clearly and create boundaries with what you are and are not willing to do to help your children and grandparents.

Also, don’t feel like you have to do this alone. Reach out to a Certified Financial Planner to help keep your plan on track. Leading your family in this time will not be easy, but the confidence will be worth the time and effort invested.

Is this eerily similar to your situation? We get it. We help people just like you because we’re in the sandwich generation too.

Click here to schedule a complimentary 30 minute conversation with us.

¹ Tackling Retirement Risks, Spring 2020, Merrill. Chief Investment Office calculations based on Society of Actuaries, 2012 Individual Annuity Mortality Tables, Basic.

² The Administration for Community Living, U.S. Department of Health and Human Services. https://acl.gov/ltc/basic-needs/how-much-care-will-you-need