Where do you go when you need to access money? I think it is paramount in any great financial plan that you proactively think about “access.”

But, I need cash now!

This concept applies to a million-dollar business idea, as well as everyday life. When you need to replace a vehicle, pay for braces or any large of unexpected purchase, access is important.

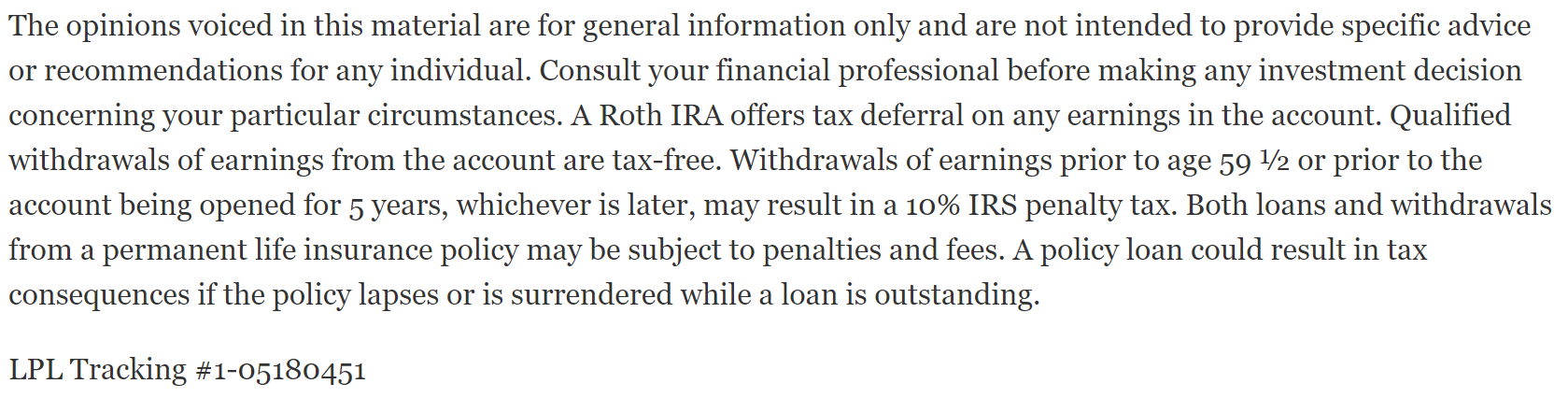

Some locations are not efficient (401k, Traditional IRA, or Annuities) because taxes or penalties may apply.

Popular locations to access funds include:

1️⃣ Roth IRA Basis

2️⃣ Cash Value Life Insurance

3️⃣ Collateralized After-Tax Investment Account

4️⃣ Your Home (Home Equity Line of Credit)

Before saving, remember the acronym T.A.G. (tax efficient, access, & growth). Always make sure you know how to access money in the most tax efficient way.

But, which tax efficient way?

Each of these options listed above have many pros and cons. Each situation that needs cash, may provide different opportunities and watch-outs for each.

Let’s review each option more closely.

Roth IRA Basis

You can touch any principle amount you invested in a Roth IRA, tax and penalty free. Missing out on decades of tax free growth potential is the price you pay, however.

Cash Value Life Insurance

One of the benefits of cash value life insurance is that you can use the cash or borrow from it. If you borrow from your cash value, it can be a smart bet, if you are using the money to purchase an asset, like starting a business. However, taking a withdrawal from a policy can reduce the death benefit if you pass unexpectedly.

Collateralized After-Tax Investment Account

Many firms allow you to use your after-tax investment account as collateral for a loan. Typically the rule of thumb is allowing you to borrow up to 50% of your account value. You don’t need a credit check and the funds can be quickly in hand. The downside is that margin cuts both ways. The leverage increases risk. If the market goes down, you are on the hook. Nobody wants to sell securities to pay off the loan.

Your Home (Home Equity Line of Credit)

Having access to home equity can add peace of mind for some homeowners. You can use it to fix up your home, consolidate debt, among other things. However, it’s like having a credit card, but your home is on the line. It can be tempting to spend, and typically has a higher variable interest rate.

It’s your money, use it when you need it

Having more options is usually better than having less. As you can see, it is a lot to think about. Having a trusted professional in your corner can reduce your stress and bring clarity when making big money decisions.