The previous article outlined some practical tips to bring some sanity and clarity to your variable income life. In this part 2, we want to talk about what’s next.

So, you are rocking with your monthly variable budget, the pressure is down, and it feels like you have achieved some financial stability. Congratulations! It’s hard work to get this far with all the ups and downs!

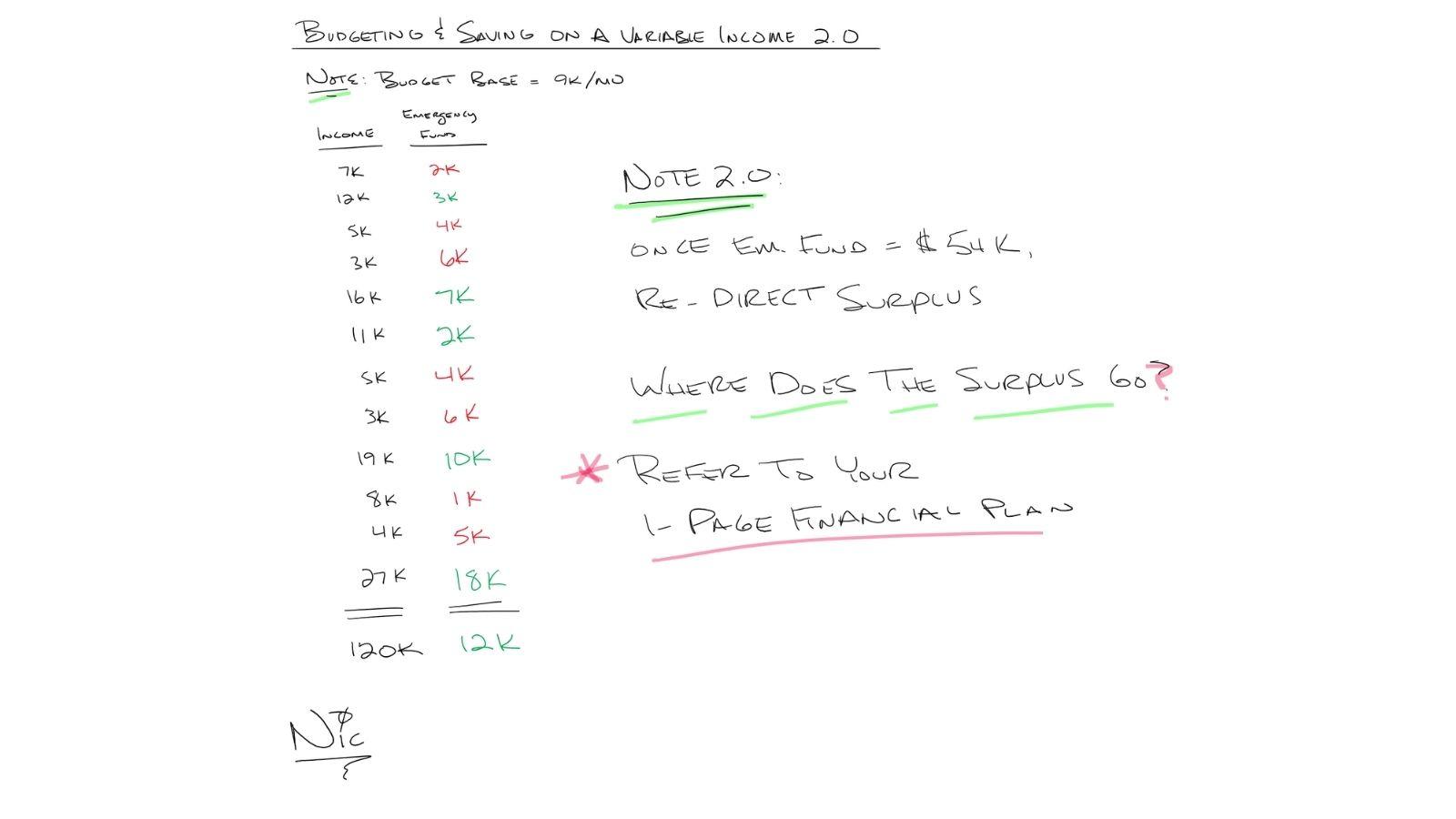

Note that the “base budget” for this family is $9k. Above I provide a practical example of the ebbs & flows of income and how to use your emergency fund to supplement during the down months. For instance, in the first month, we have an income of $7k. We would take $2k from our emergency fund to supplement our income.

In the surplus months, we build up the emergency fund until we reach the goal of having six months of your budgeted average income or $54,000 in this example.

Now what? Where does the surplus go?

If you are a client, you should know this answer! Consult your one-page plan! That will give you the roadmap for next steps to keep making progress towards your goals.

For anyone else reading this, it’s time to get to the fun stuff. Each person’s goals will shape things differently, though there are some suitable places to consider.

Do you have a 401k at work? That can be a great place to start if you can do more to max it out. In addition, maxing out a Roth IRA can be a great next step.

Depending on how you move money around in this variable framework, now can be a great time to introduce automation if you have not already.

A Brokerage account can be a fitting hub for the pieces to come together. You can direct your income to a money market account, pay yourself a biweekly, weekly, or monthly “paycheck.”

From there, the surplus continues to accumulate in the background. Any extra that you want to invest can be taken automatically from the brokerage account to enter your Roth IRA every month automatically. You can also direct funds into nonqualified accounts from here. It’s certainly not perfect, and any automation needs monitoring to ensure things are running smoothly.

It can be a great feeling to get this framework lined up to know you are saving and investing, potentially on autopilot!

IMPORTANT DISCLOSURES

Information in this material is for general information only and not intended as investment, tax, or legal advice. Please consult the appropriate professionals for specific information regarding your individual situation prior to making any financial decision.

Note: Continue to track your trailing 12 months income and make adjustments as needed to prevent a long-term deficit from occurring.

LPL Tracking #1-05132413